Aspen Bridging has completed its first transactions under a new dual representation legal service combined with its No Valuation product, cutting completion times dramatically.

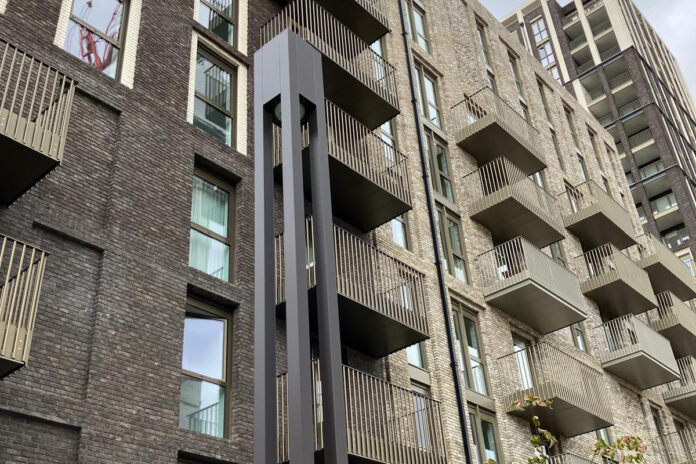

The lender’s debut case using the process was a £700,000 bridge for a foreign national buying a two-bedroom newbuild apartment near Tower Bridge. The deal was completed in just 10 days.

The Chinese applicant needed to move quickly after the developer demanded immediate completion, putting their deposit at risk. Aspen’s solution combined its dual representation legal process — developed with Lightfoots and Lawrence Stephens — with its established No Valuation offering to speed up the transaction.

The 75% loan-to-value bridge was agreed on Aspen’s stepped rate, starting at 0.55% per month over a 10-month term. The borrower plans to exit via a buy-to-let refinance.

In the same week, Aspen also completed a £250,000 auction purchase loan on a house in Stretford, Birmingham in just seven days, ensuring the buyer met the auction deadline and retained their deposit.

Richard Coombs, director of operations at Aspen Bridging, said: “Our recently launched dual representation legal service is already proving its worth to our borrowers by creating a streamlined process that reduces the time we can complete deals.

“Paired with our award-winning No Valuation product we have curated a process that is unrivalled in the industry in terms of speed, simplicity and cost.”

He added that the dual representation service is available for refinances, purchases and light refurbishment deals for both UK and foreign nationals. “It will no doubt prove to be in high demand going forwards with applicants requiring fast and effective finance solutions,” he said.