Aldermore bank has provided a £1.3 million commercial development finance loan to Cookridge Estates LLP, the West Yorkshire property developer, to fund the construction of two detached drive thru units built as part of a larger roadside and retail development.

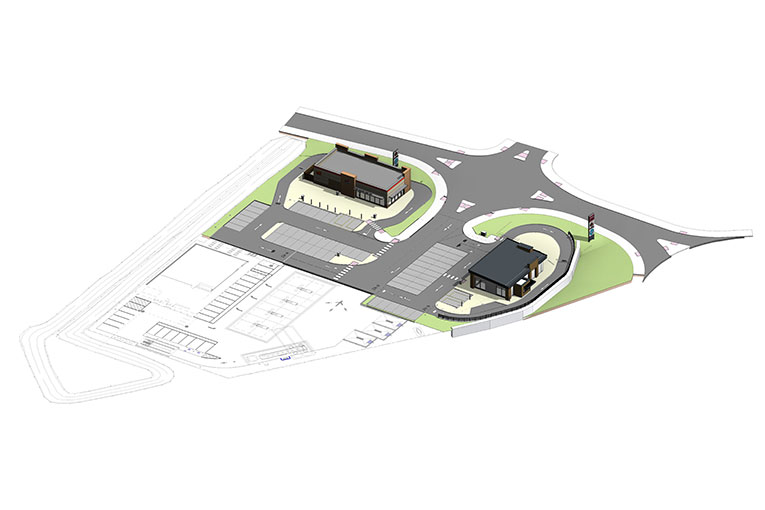

The two drive thru units have been pre-let to Costa Coffee and Burger King. The development site also includes a Lidl food store which is trading, and a plot for a petrol station and shop which is currently under construction.

The development is situated one mile to the south east of Beverley town centre at the roundabout junction of Minster Way, which forms an outer ring road for the south east quadrant of the town.

David Whitehouse, property development manager at Aldermore, said: “This deal is a fantastic example of the work we’re doing in the north of England. The two drive thru units are in a prominent location and within the wider development, there are complementary uses which will all attract customers.”

Duncan Waller, managing director of Cookridge Estates LLP, added: “We’re delighted to work with Aldermore on the final phase of the Minster Way development. Construction is underway for the Costa and the Burger King on time and budget.”