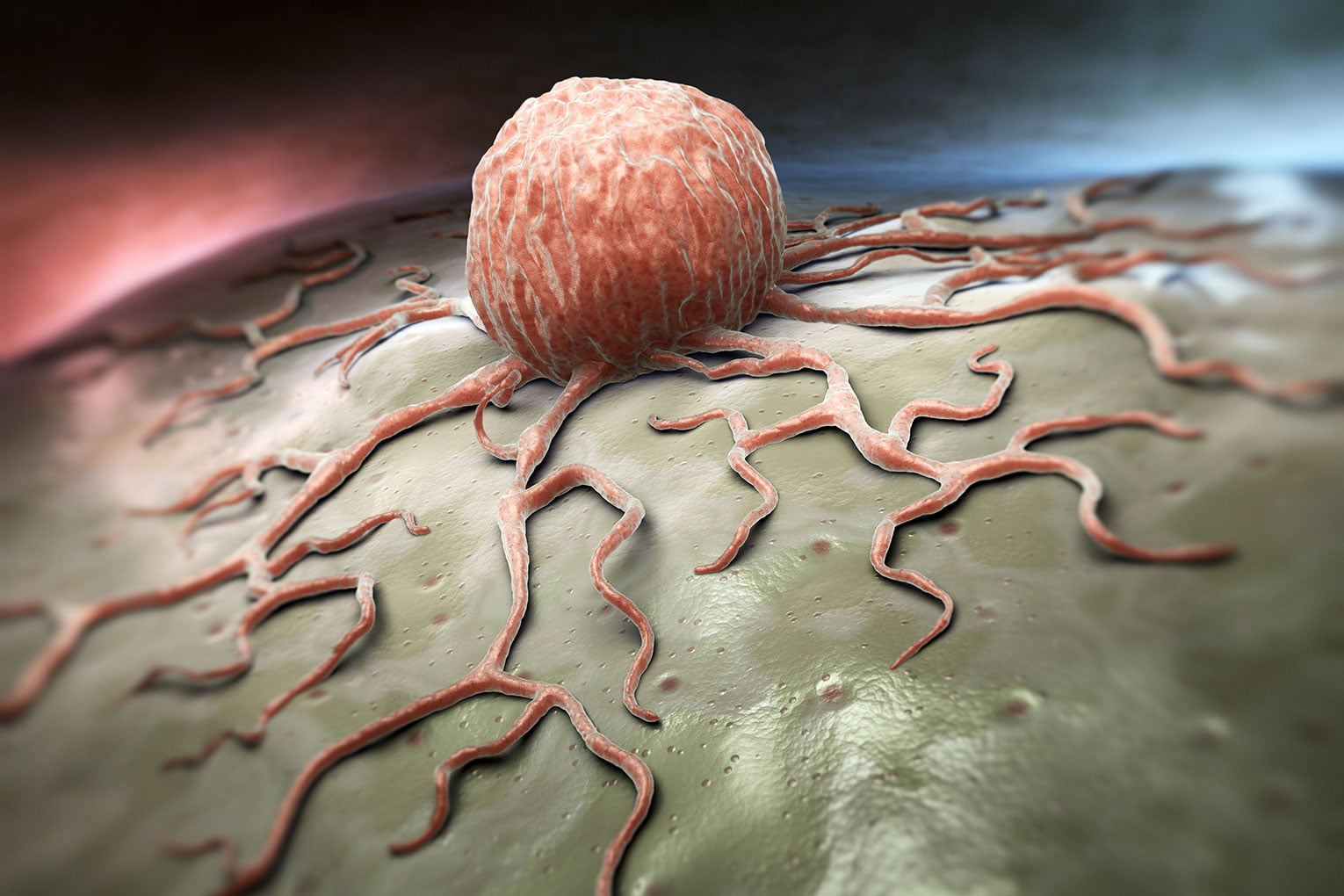

AIG Life has launched Key3, critical illness insurance which pays a lump sum upon diagnosis of one of three key medical conditions – cancer, heart attack or stroke.

It can be bought with or without life insurance. Like AIG’s comprehensive critical illness cover, Key3 comes with access to Best Doctors which can be used by the insured person for up to three years after payout, as well as access to AIG Life’s unique Claims Support Fund.

With this simpler form of critical illness insurance, AIG Life is targeting individuals who haven’t traditionally considered such insurance, including younger single people who rent rather than own their homes, people who may choose not to seek full face-to-face financial advice and those on a tighter budget.

It was developed following research with intermediaries who said cancer, heart attack and stroke – which accounted for almost 80% of AIG Life’s adult claims in 2015 – are the medical conditions that customers fear most, and following testing with consumers who said they might be interested in insurance covering these key three medical conditions if it came at a lower cost than comprehensive critical illness cover.

Adam Winslow, CEO of AIG Life, said: “Key3 gives customers financial support to help them recover from cancer, a heart attack or a stroke. In our lifetime every other person in the UK will get cancer, while someone has a heart attack every seven minutes or a stroke every 12 minutes. Yet there is a huge market of UK customers who do not have critical illness insurance and don’t realise they need a financial plan in place if they fall seriously ill.

“This fills a gap in the market for customers who feel they can’t afford comprehensive critical illness insurance or who, like Generation Rent, do not own a home and are not prompted by a house purchase to look at how they will manage financially if they suffer from cancer, a heart attack or a stroke.”