Ageas Protect has appointed Nick Erskine to the role of national sales and strategy manager.

He will take up the position in August.

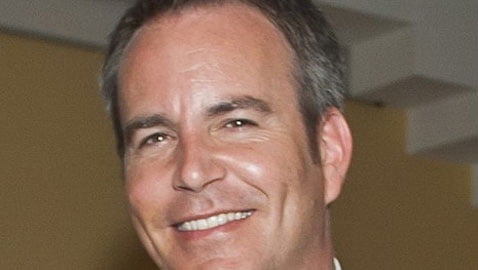

Erskine (pictured) will be responsible for supporting Ageas Protect’s business growth plans for launching new products and services to the intermediary market.

His priority will be to develop the overall sales strategy, while overseeing the national accounts.

Erskine has over 20 years experience in the intermediary protection sales sector. His most recent sales and strategy roles were with PruProtect as head of national accounts and progress from Royal Liver as strategic account manager.

Darren Spriggs, managing director of Ageas Protect, said: “Nick has a wealth of experience that we’re delighted to add to our first rate management team. His understanding of the intermediary market will be a real asset and complements our growth plans.

“Nick’s appointment further demonstrates our commitment too, not only providing the intermediary market with the innovative products and services their customers demand, but also to building an exceptional team that continues to generate progressive solutions for those customers.”