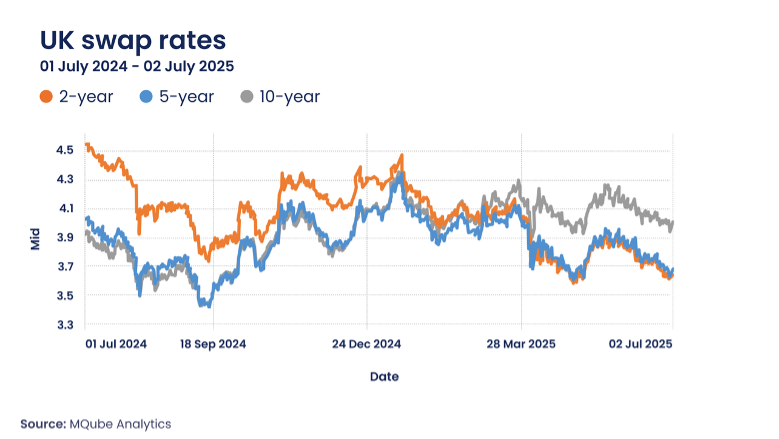

Over the last 12 months, we’ve seen three notable things happen in the swaps market and interest rates in general.

Firstly and obviously, rates have fallen. For example, the two-year SONIA swap is down around 80bps; some of that is due to an anticipation of cuts to Bank Base rate, some of that now realised.

Secondly, longer-term rates – by this I’m talking 10-year+ – have diverged significantly from shorter rates and there is now a considerable ‘risk premium’ being asked by the markets for borrowing ‘long’.

Thirdly and most interestingly, the two and five-year swap curves have essentially converged. The markets are seeing no difference in rates between the two terms, so the cost of borrowing is ’flat’ after two years and no longer falling (albeit lenders themselves will have additional different internal costs for different terms).

What does all this mean and why does any of this matter?

Well, it matters if you look at what has been sold, is now being sold, where rates could potentially go in the future, and the risk customers might be exposed to.

Of course, it goes without saying that every customer’s circumstances are unique and that judging information on a macro level clearly can’t be applied individually. However. as a basic rule shorter-term fixed rates are generally a good option when rates are high and are anticipated by the market/experts to fall over the short to medium term.

The idea is simply that, on maturity, customers look to lock into a longer-term rate (five years for example when interest rates are at, or towards the bottom of, the market. This, as you will appreciate is an art not a science, but as a principle it’s a sound one.

Based on the above, as swaps have fallen over the last 12 months (in anticipation of Bank Base rate coming down over time), you would expect the ratio of two and five-year rates being sold to adjust accordingly.

However, looking at the data, this doesn’t appear to be the case. Taking ESIS data from Twenty7Tec from 1 July 2024 to 31 March 2025 (a nine month period), the ratio of five-year to two-year ESIS generation was 53/47. In short, more five-year fixes appear to have been sold than two-year ones. Given that rates were widely expected to fall, this is surprising.

If we then take the data from the much more recent period of 1 April to 30 June (deliberately shorter to reflect recent changes to rates and swaps), you would perhaps expect five-year to at least maintain the same ratio, if not increase, given that we are (arguably) at or approaching the bottom of the interest rate curve. However, the situation has in fact reversed and is now 47/53, with more two-year ESISs being generated over this period.

While the numbers may to some not look materially different, they are based on significant amounts of sales data and given how much the swap rates have fallen (see graph), all logic suggest that five-year sales relative to two-year would have increased still further.

The question therefore is quite simply, why?

The most simple explanation could be rate. If you go back to July 2024, two-year was being priced at an approx. 50 bps premium to five-year, decreasing gradually through time as the swap curves merged. This appears to have had the effect of making five-year artificially/relatively more attractive (hence increasing five years sales in 2024)

While that helps explain the five-year/two-year differential at the start of the data, now, when rates between two and five-year are now essentially the same (give or take a few basis points), it perhaps doesn’t explain why two-year sales are remaining so high, especially when the future outlook for rate reductions looks less clear cut or positive (and given that future rate cuts are priced into the swap curve).

Are brokers or customers expecting further rate reductions and are banking on coming off a two-year fixed in 2027 to even lower rates? Is there a general expectation that the events since 2022 have been some sort of aberration?

Where is the bottom of the interest rate curve?

It’s an impossible question to answer and I’m sure one which brokers are having to grapple with on an almost daily basis.

Swaps are obviously anticipating future cuts to Bank Base Rate and currently the general view is that we will end up with Bank Base around 3.50%/3.75% in early/mid 2026. Beyond that, it is to be honest, a lottery.

The market is and continues to be very volatile and there are lots of macro risks at both a national and international level. The assumption therefore that rates will continue to fall (above and beyond where swaps currently are) is not one that can or should be made. We have already seen in the last few weeks that swaps do have the very real potential to go back up.

A Bank Base rate of circa 3.5% could well be the longer-term reality. Selling two-year rates therefore on the assumption that in two years’ time rates will be either at or lower than current, is, in my view, a risk given the potential for divergence from this. It could be a risk a customer wishes to take, but stability for many could well be more important.

The risk of a Black Swan event

Those of you familiar with the concept will know that by their very nature they aren’t predictable (although they are sometimes claimed to be in retrospect; arguably Lis Truss/Kwasi Kwarteng short-lived ‘mini budget’ could be put into this category!)

Since rates went up at the start of 2022, we’ve already seen the impact customers on short-term fixes faced when coming off a low rate and going onto a much higher rate.

As we pass the mid-point of 2025, we face a number of (known) challenges which have the potential to negatively impact mortgage rates. These range from stubborn inflation that hinders the Bank of England ability to act, to increasing government borrowing costs/debt that push up gilts/swaps costs. That’s without including Trump, Ukraine/Russia and the Middle East…

Where next?

Just like the markets, I don’t know where rates will go over the next few months or years, but I do know there are a lot of challenges and risks which are unique. Bank base rate is in probability going to be coming down in the months ahead but this is already priced into the swap curves. Given all of this and where we are now, we may well be at or nearly at the bottom of the rate curve.

In view of all this, two-year appears to be taking a much bigger slice of the pie than it maybe deserves…