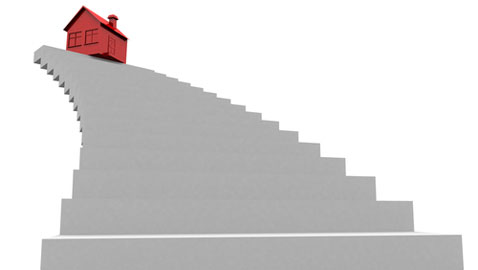

28% of second-time buyers could be stuck on the first rung of the property ladder because they are in negative equity or their home hasn’t increased enough in value for them to buy their second home, according to research from Post Office’s Step-Up report.

It found that costs involved in moving have also meant 30% of all prospective second-time buyers are having difficulty in climbing the property ladder. House hunters looking for their second home estimate they need an average of £7,279 to cover costs such as stamp duty and solicitor’s fees alone. This rises to £12,313 for those living in London.

As a result some second-time buyers still need a helping hand to raise the money to move. 8% of second-time buyers are relying on their parents or other family members for financial help, and a further 11% are turning to their partner.

7% are hoping an inheritance will help bolster their home-buying funds, while 6% have taken an additional job to get some extra cash to fund their move.

John Willcock, head of mortgages at Post Office, said: “We are often reminded of first-time buyers’ struggle to get onto the property ladder. However, it’s clear that second-time buyers are finding it difficult too. Stagnant or decreasing property prices in many areas of the country, the high costs involved with moving and lack of available properties on the market have meant too many people are unable to move up the property ladder.

“Relying on the bank of mum and dad is not just the preserve of first-time buyers – second-time buyers are also looking to their parents to fund the move up the ladder. In the years before the financial crisis it was almost guaranteed your property would go up in value enough to move into a second, larger home, but many are finding that their homes just aren’t increasing enough.”

Second-time buyers are also struggling to move because they can’t shift their first property, with 17% stating they can’t find a buyer for their home. Meanwhile, 16% just can’t find a property they want to buy.