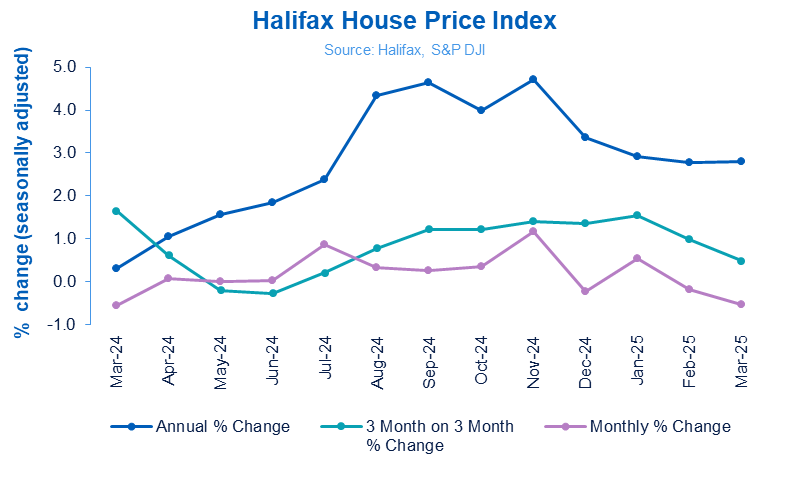

UK house prices recorded a sharper-than-expected monthly fall in March, declining by 0.5% – more than double February’s drop of 0.2% – latest figures from Halifax reveal.

The average price of a home now stands at £296,699, down £1,575 from the previous month.

Despite the monthly decline, the annual rate of growth held firm at 2.8%, suggesting the market remains resilient amid shifting buyer behaviour and evolving economic conditions.

STAMP DUTY DEADLINE

Amanda Bryden, Head of Mortgages at Halifax, attributed the fall to a post-rush slowdown following a surge in completions ahead of the March stamp duty deadline.

She said: “House prices rose in January as buyers rushed to beat the March stamp duty deadline. However, with those deals now completing, demand is returning to normal and new applications are slowing.”

She added: “March saw more completions than January and February combined, including our busiest single day on record.

“Following this burst of activity, prices – which remain close to record highs- unsurprisingly dipped.”

REGIONAL DIVIDE

While the UK’s overall average price fell, regional data revealed a stark divergence across the country.

Northern Ireland led the way with annual price growth of 6.6%, bringing the average home value to £206,620. Scotland followed with a 4.3% rise to £213,750, up from 3.8% in February.

Wales also recorded robust growth at 3.7%, with average prices hitting £227,332. In England, Yorkshire and the Humber saw prices climb 4.2% year-on-year, with homes now averaging £215,807.

In contrast, London continues to lag, with annual growth slowing from 1.5% in February to 1.1% in March. Despite subdued growth, the capital still commands the UK’s highest average property price at £543,370.

AFFORDABILITY

But Bryden warned: “Potential buyers still face challenges from the new normal of higher borrowing costs, a limited supply of available properties, and an uncertain economic outlook.

“With further base rate cuts anticipated and positive wage growth, mortgage affordability should continue to improve gradually. We still expect a modest rise in house prices this year.”

STIMULUS NEEDED

Gareth Lewis, managing director of specialist lender MT Finance, said: “The housing market needs some stimulus as even with the better weather, the flurry of activity one would expect in spring time is being dampened by the national insurance hikes and having to pay more for everything.

“We have been seeing marginal uplifts in pricing on relatively small volumes of transactions; now we are seeing marginal decreases on larger volumes of transactions.

“Buyers are pushing harder to get a better deal even if it is just marginal, particularly those who are going to pay higher stamp duty because they were too late to meet the deadline.

“Many will try and renegotiate as the month progresses but their success is likely to vary from transaction to transaction.”

STRONG POSITION

Chris Little, chief revenue officer at finova, said: “Today’s data may reflect a slight dip in overall activity, but the market itself is still in a strong position.

“Gradually falling mortgage rates and easing inflationary pressures have improved affordability and the data will eventually catch up with these more positive market trends. However, as the Stamp Duty Land Tax threshold deadline comes into effect, we may see a few marked shifts in activity, especially among first-time buyers.

“Santander reduced its mortgage affordability stress-test rate last month, which may create some opportunities for buyers to potentially borrow more money – especially if other lenders follow suit.”

“Lenders being more flexible will always be welcome, but ultimately, historic supply shortages are going to continue straining affordability. The Spring Statement promised a new injection of 1.3 million homes over the next five years, but without access to a suitable workforce, the UK may struggle to meet these ambitious targets.”

ECONOMIC HEADWINDS

Jonathan Samuels, chief executive of Octane Capital, added: “We’ve seen considerable improvements to the mortgage landscape over the last 12 months and this has driven a heightened degree of buyer activity, which in turn, has ensured that house price growth has remained strong and stable, with property values up on both a quarterly and annual basis.

“This positive rate of appreciation has come despite the wider economic headwinds blowing in from the United States and elsewhere around the world, with the expectation being that the UK property market will continue to march forward undeterred.”

MATURING MARKET

And Gareth Samples, chief executive of The Property Franchise Group, said: “The stabilisation of house prices reflects a maturing market, where increased supply and steady demand are creating a more balanced environment for buyers and sellers alike.

“With competition at its highest level in a decade and more homes available than in recent years, buyers have greater negotiating power, leading to price sensitivity. However, the sustained level of transactions and mortgage approvals signals continued confidence in the housing market.

“As interest rates remain stable and economic conditions evolve, we anticipate a measured yet positive trajectory for the market throughout 2025.”