House price growth in the UK is losing momentum as a surge in homes for sale strengthens the position of buyers in the property market, according to Zoopla’s latest House Price Index.

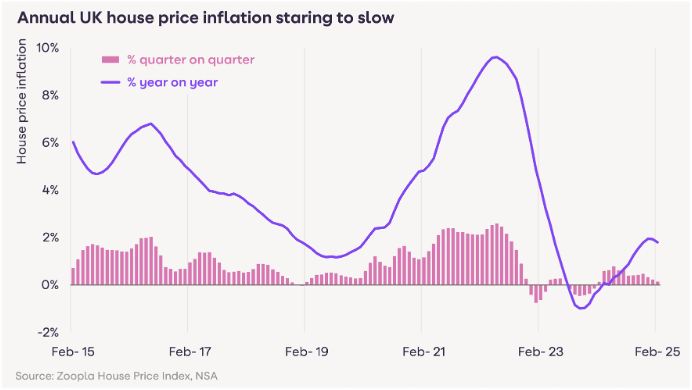

The annual rate of house price growth dipped to 1.8% in February, down from 1.9% in January, and is expected to slow further in the months ahead.

The average home in the UK is now valued at £267,500 – £4,750 more than a year ago. However, the increase in housing supply is outpacing the growth in sales, reinforcing a buyer’s market.

Estate agents are now listing more properties, with the average branch having 33 homes for sale compared to 29 a year ago. This trend is expected to accelerate further as the spring selling season – typically the busiest period for new listings – gets underway.

Mortgage rates have remained static, with a 5-year fixed deal averaging 4.4%, slightly higher than the 4% seen at the end of 2024.

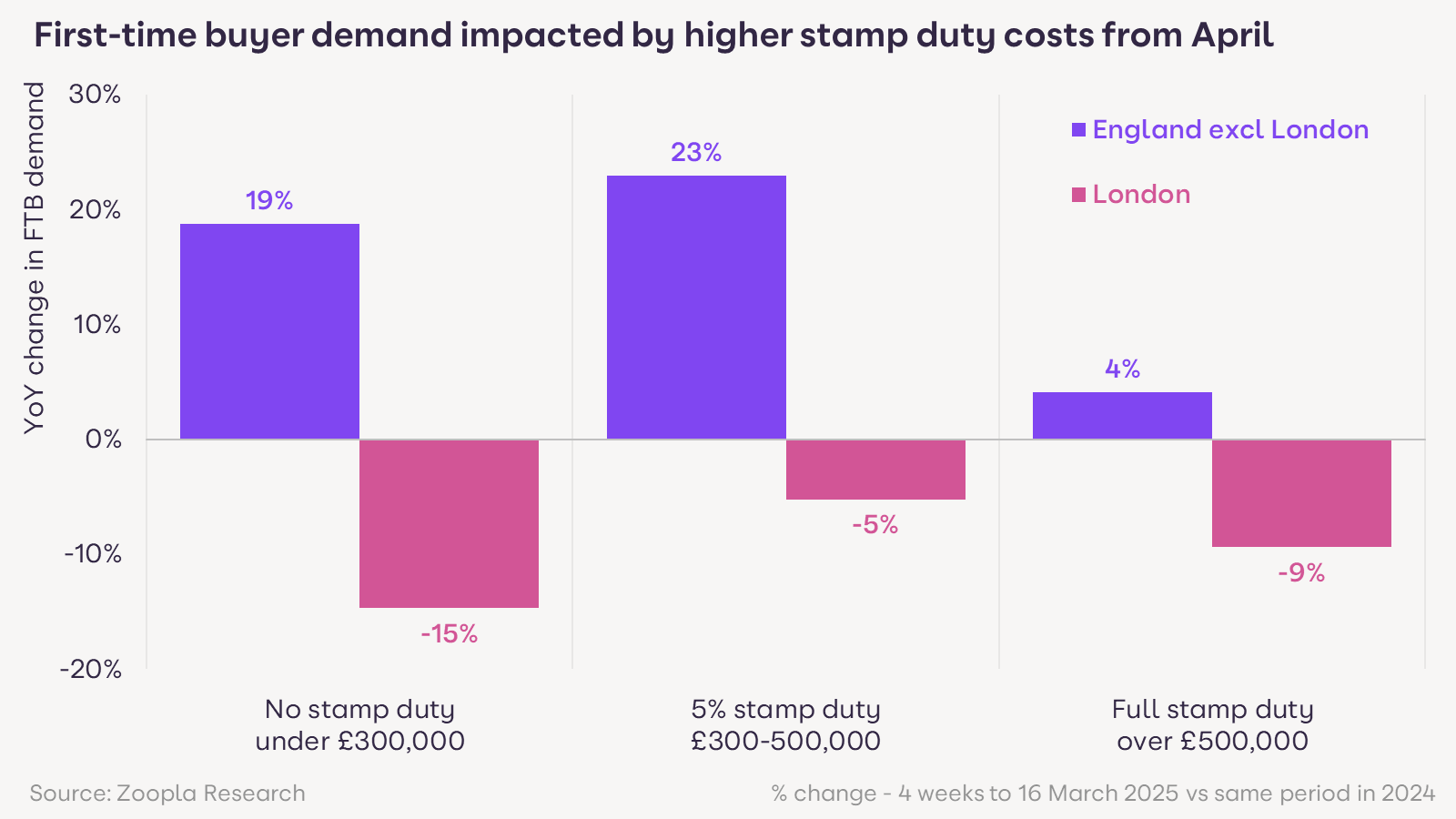

This, coupled with the upcoming return to higher stamp duty rates in April, has dampened buying power.

The changes mean that 80% of home movers and 40% of first-time buyers will face increased stamp duty costs, a factor they are likely to reflect in their offers.

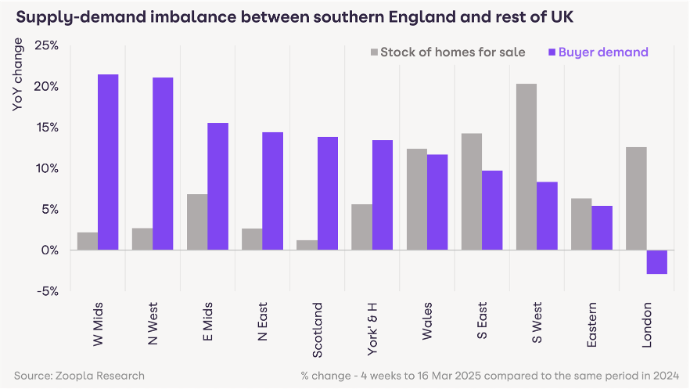

NORTH SOUTH DIVIDE

A sharp contrast is emerging between southern England and other parts of the UK. While buyer demand in the South has risen compared to last year, it has failed to keep pace with the surge in new listings.

This imbalance is reflected in house price growth, which is running at just 1% or lower in London, the South East, South West and East of England. Some areas have even seen house prices decline, including Dartford (-0.8%), Ipswich (-0.2%) and parts of northwest London (-0.1%).

Meanwhile, regions with lower house prices – such as the Midlands, northern England, and Scotland – are faring better.

Buyer demand in these areas has increased by 10% over the past year, and with housing supply growing at a slower rate, prices are rising more quickly. In the North West, house prices are up 3% year-on-year, while Scotland has seen a 2.5% increase.

At a local level, the strongest price growth has been recorded in Motherwell (4.3%) and Kirkcaldy (3.8%) in Scotland.

In northern England, prices in Wigan (3.8%), Blackburn (3.7%), Lancaster (3.6%), and Bradford (3.6%) are rising at more than double the national average. In these areas, house prices remain well below the UK average, ranging between £130,000 and £220,000.

STAMP DUTY AND COUNCIL TAX PRESSURES

London is the only region where buyer demand has fallen compared to last year, down 3%. The anticipated rise in stamp duty from April 2025 has prompted many first-time buyers to accelerate their purchases, creating a temporary lull in demand.

In contrast, first-time buyer activity has remained strong in other parts of England, where the majority of purchases below £300,000 will remain exempt from stamp duty.

From April, a further shift in the market is expected as around 150 local councils across the UK move to double council tax on second homes. This is likely to increase supply in areas with a high concentration of second homes, particularly in the South West, where house prices in locations such as Truro (-0.8%) and Torquay (-0.7%) are already falling.

GROWTH TO SLOW FURTHER

Richard Donnell, Executive Director at Zoopla, said he expected sales to continue rising steadily through 2025 but warned that house price growth will moderate further.

“The increase in homes for sale and the additional costs of stamp duty will put downward pressure on prices. While a slowdown isn’t necessarily a bad thing, the market does need some level of price growth to encourage sellers to list their homes and for buyers to make realistic offers,” he said.

“Sellers will need to be cautious when setting asking prices. With more choice available, it’s important to work with estate agents to ensure properties are priced competitively to attract buyers.”