The cost of purchasing a home is set to rise for the majority of buyers in England and Northern Ireland from April 2025, as the Stamp Duty Land Tax (SDLT) relief introduced in the 2022 mini-budget ends and rates revert to previous levels.

The changes will have significant implications for affordability assessments and client advice and will likely see an increase in demand for higher loan-to-value (LTV) products, and potential downward pressure on house prices as buyers adjust their budgets to accommodate higher transaction costs.

Now new analysis from Zoopla highlights the varied impact of these changes across different regions and buyer segments. The shift is expected to generate an additional £1.1bn in annual stamp duty revenue for the government.

HOMEOWNER IMPACT

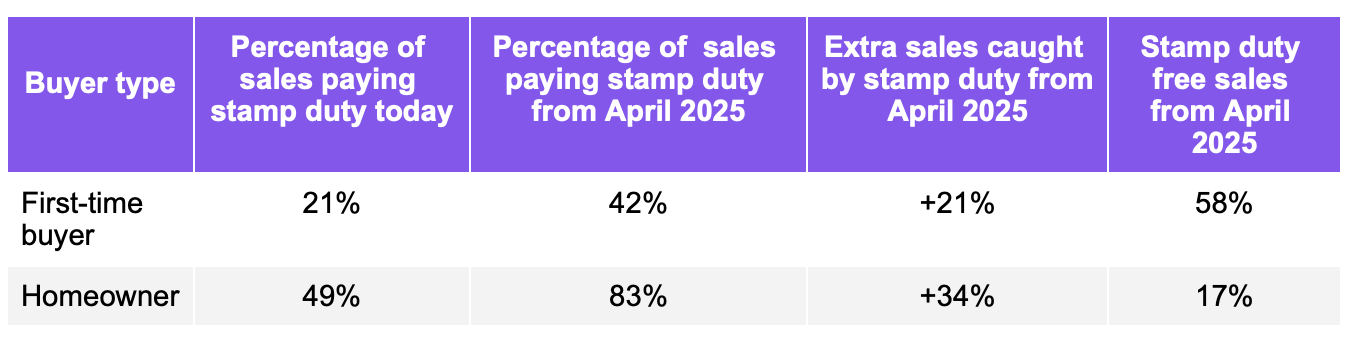

From 1st April 2025, 83% of homeowners purchasing a main residence will be liable for stamp duty, a sharp increase from the current 49%. The reintroduction of the 2% tax band for properties priced between £125,000 and £250,000 will mean that fewer than one in five transactions (17%) will remain exempt.

For purchases exceeding £250,000, buyers will face an additional £2,500 in stamp duty costs. Meanwhile, buyers purchasing between £125,000 and £250,000 will incur a 2% charge on the purchase price, amounting to a maximum of £2,500. Zoopla estimates this will contribute an extra £900m in stamp duty revenue.

The sharpest regional increases in stamp duty liability will be seen in the West Midlands (66% more transactions affected), East Midlands (55%), and North West (50%).

FIRST-TIME BUYERS

First-time buyers (FTBs) will continue to benefit from a £300,000 exemption threshold. As a result, 58% of FTBs will avoid stamp duty entirely, particularly in areas with lower house prices such as the North East (2% liable), Yorkshire and the Humber (3%), Northern Ireland (5%), and the North West (5%).

However, the proportion of FTBs liable for stamp duty will double to 42%, disproportionately affecting those purchasing in London and the South East. Buyers in the £300,000-£625,000 bracket will face additional costs of up to £15,000 per transaction. For instance, purchasing a £350,000 property will incur a £2,500 charge, while a £550,000 purchase will see stamp duty rise from £6,250 to £15,000. This shift is projected to generate an extra £200m in tax revenue.

BIG TAX REVENUES

Richard Donnell, Executive Director at Zoopla, said: “Stamp duty has become a significant source of government revenue, nearing £10bn annually. From April, we will see a substantial increase in the number of buyers paying this tax.

“Existing homeowners will need to budget for up to £2,500 in additional costs per transaction, though capital gains from property sales may help offset this. However, buyers are likely to factor in these costs when making offers.

“It is encouraging that most first-time buyers will still pay no stamp duty, but those purchasing in high-value areas will face steeper costs, impacting affordability and market activity. The case for stamp duty reform remains strong, but the challenge lies in replacing the billions in lost tax revenue.”

BUYER IMPACT

Toby Leek, NAEA Propertymark President, added: “The increase in Stamp Duty charges from April is clearly going to impact buyers in some parts of the country more than others.

“London and the South East are the two most expensive regions in England to buy a house, and April’s changes will make it harder for first-time buyers to step onto the housing ladder compared to those living in the North of England.”