The average asking price for newly listed properties has risen by 1.1% (+£3,876) this month to £371,870, latest data from Rightmove reveals.

February and March typically see the highest proportion of homes securing buyers but the increased number of listings this year means sellers are facing greater competition.

An estimated 74,000 transactions, including 25,000 first-time buyers, are expected to complete in April rather than before the March 31st stamp duty deadline. These transactions will incur an estimated additional tax cost of £142 million.

The government’s upcoming Spring Statement is the last opportunity for any potential changes to be announced, though no extension has been confirmed.

MARKET TRENDS

Agreed sales are up 9% compared to the same period last year while the number of new sellers has increased by 8%.

Mortgage rates remain a key factor, with the average 5-year fixed mortgage rate currently at 4.74%, down from 6.11% in July 2023 but only slightly lower than 4.84% recorded in March 2024.

Matt Smith, mortgage expert at Rightmove, said: “Lenders are pricing competitively where possible but global economic conditions continue to influence mortgage rates.

“The Bank of England’s next interest rate decision is expected to result in a hold, with a potential cut in May, though market conditions remain unpredictable.”

MARKET PRICING

Despite economic uncertainty, the property market remains active.

Sarah Bush, Head of Residential Sales and Lettings at Cheffins, says that sellers who had previously delayed putting their homes on the market are now moving forward.

She said: “Realistic pricing is key when it comes to the current market, and particularly in countryside locations, price sensitivity is still prevalent.

“The most testing part of the market is the upper end, where realistic pricing is particularly important. This is where sellers need to be mindful of not overpricing if they are looking for a successful sale.”

And Chris Rosindale, Chief Operating Officer at Connells Group, added: “The market is performing well, and the number of property exchanges we’re seeing is ahead of last year. Despite the upcoming changes to Stamp Duty, we haven’t seen any slowdown in buyers’ appetites to purchase a home, even now knowing that they won’t meet the deadline of 31st March.

“The beginning of this year has seen overall growth in the sales market, with more sellers bringing their homes to market.

“Some stability in interest rates and modest house price growth have certainly helped to increase confidence from both buyers and sellers, and overall attitudes towards moving home are positive. Pricing is still key and setting realistic asking prices is vital to achieving the best sale.”

SINGLE-DIGIT GROWTH

Tom Bill, head of UK residential research at Knight Frank, said: “Buyers have started the year in circumspect mood, despite the prospect of a stamp duty increase in April.

“Most mortgage rates have remained stubbornly on the wrong side of 4% due to volatility on global markets, which means equity-rich, needs-driven buyers have been more active by comparison.

“We expect low single-digit house price growth this year, but this month’s spring statement and the future rate of UK inflation will be key factors in setting the trajectory of the housing market in 2025.”

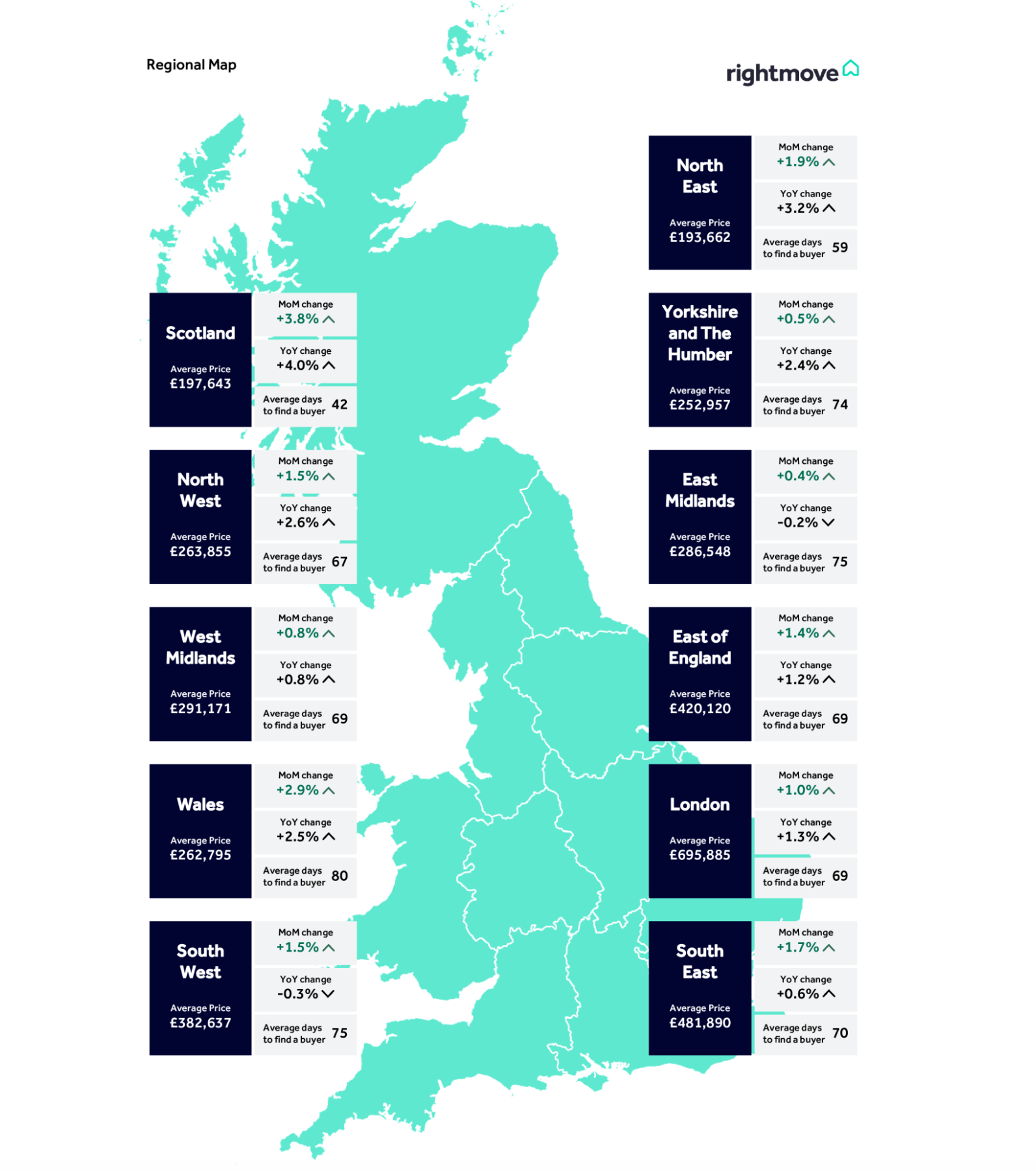

REGIONAL TRENDS