UK housing stock may be at its most plentiful in over a decade but sellers are responding with renewed realism and brokers should take note.

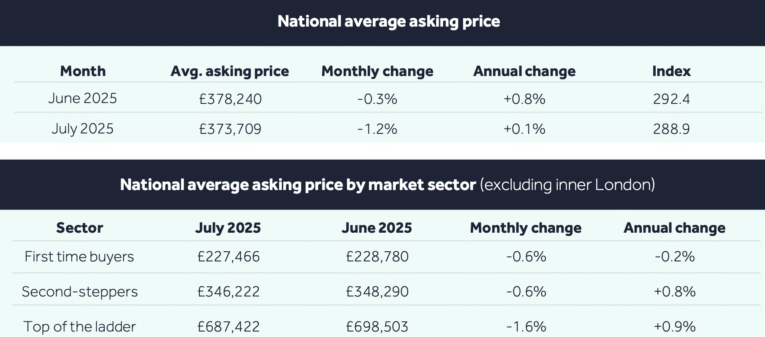

According to Rightmove’s latest monthly data, new seller asking prices fell by 1.2% in July, the largest drop for this time of year in over 20 years.

That brings the average asking price to £373,709 – down £4,531 in a month – and reflects a clear shift in seller strategy as pricing becomes the primary tool to generate buyer interest in an increasingly competitive landscape.

While July traditionally marks a seasonal cooling in activity, the scale of the drop highlights the pressure on vendors to cut through the noise of a supply-heavy market.

PRICING IS KEY

Colleen Babcock, property expert at Rightmove, said: “We’re seeing an interesting dynamic between pricing and activity levels right now.

“The healthy and improving level of property sales being agreed shows us that there are motivated buyers out there who are willing to finalise a deal for the right property.

“What’s most important to remember in this market is that the price is key to selling. The decade-high level of buyer choice means that discerning buyers can quickly spot when a home looks over-priced compared to the many others that may be available in their area.”

MORTGAGE TRENDS

Rightmove’s tracker shows the average two-year fixed mortgage rate is now 4.53%, down from 5.34% this time last year. That represents a saving of nearly £150 a month on a typical mortgage.

The number of sales agreed is 5% higher year-on-year, while new buyer enquiries are up 6%. These are the strongest July activity levels since 2021 – suggesting the market is not just ticking over, but responding to clearer affordability signals.

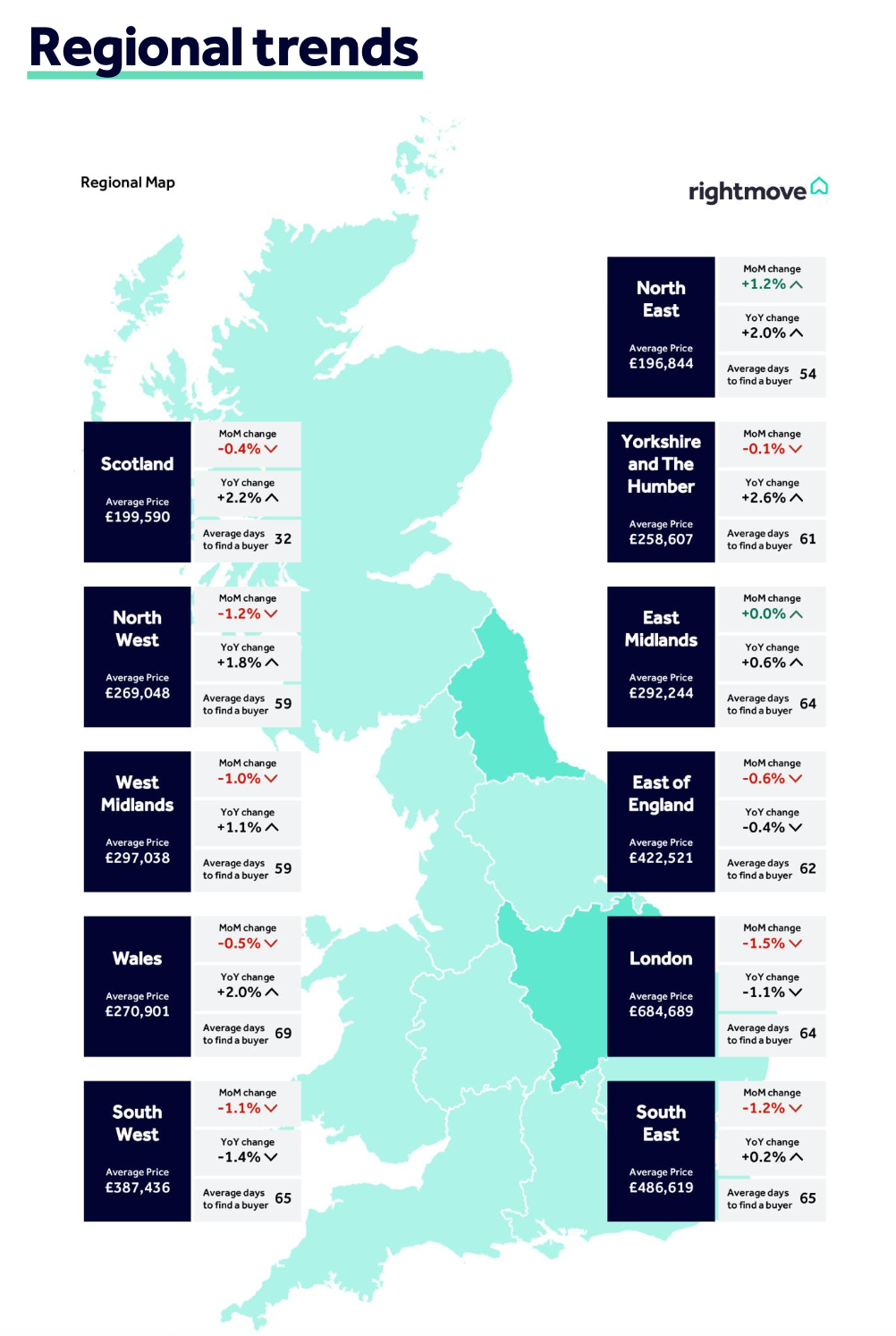

REGIONAL DIFFERENCES

London remains the biggest regional drag on average asking prices, down 1.5% in July. Inner London saw an even steeper fall of 2.1%, impacted by April’s rise in residential stamp duty and broader tax policy uncertainty – particularly among non-doms and second-home investors.

Meanwhile, the North East – the UK’s most affordable region – saw a 1.2% rise in asking prices, continuing the trend of stronger growth in lower-value markets.

While price growth is softening, transaction volumes are heading in the right direction, creating more opportunity for advisers and lenders alike.

Rightmove has now trimmed its 2025 price forecast from +4% to +2%, citing the sheer weight of supply. But it is holding firm on its full-year forecast of 1.15 million transactions.

MORE SALES AGREED

Babcock added: “It’s been a promising first half of the year for activity levels, particularly when you consider that some will have brought their plans forward to try to avoid added stamp duty from April.

“Even after the stamp duty deadline, we’re seeing more sales being agreed and more new potential buyers entering the market than at the same time last year.

“Still, the knock-on effect of high buyer choice is slower price growth, so we’re revising down our prediction of how much the asking price of a home will increase over the whole of the year.

“Looking ahead to the second half of 2025, there will still very likely be the usual quieter seasonal periods around the summer holidays and Christmas, but we expect market activity to continue to be resilient.

“Crucially, buyer affordability is heading in the right direction, and another two Bank Rate cuts before 2026 would be a big boost to this.”

RETURN TO NORMALITY

Nathan Emerson, CEO of Propertymark, said: “The housing market is witnessing a steady return to normality following stamp duty threshold changes for those living in England and Northern Ireland at the start of April.

“As we enter the summer months, when the housing market tends to achieve a peak in sales in activity, it is good to see yet further resilience in house prices year on year.

“We have seen encouraging signs from Rachel Reeves’ Leeds Reforms which are designed to potentially better help lenders serve those on lower incomes. However, such reforms alone will not help keep house prices manageable without the UK Government and the devolved administrations meeting their individual housing targets to keep pace with real world demand.”

RATE REDUCTIONS

Tomer Aboody, director of specialist lender MT Finance, added: “With affordability increasing, putting buyers in a better position to purchase, sellers are competing for a relatively limited number of buyers.

“A reduction in pricing further indicates eagerness from sellers to attract those buyers, which has also increased transaction levels.

“With stamp duty increasing, buyers have been hit but are taking advantage of lower interest rates. We could potentially see at least one more rate reduction this year which will further drive demand.”