21% people in the UK say their household would not be financially secure for any length of time if it lost its main income as a result of serious illness, according to research from Scottish Widows.

47% admit that their savings would last just six months or less if they became unable to work, raising concerns over the nation’s financial resilience should the unexpected happen.

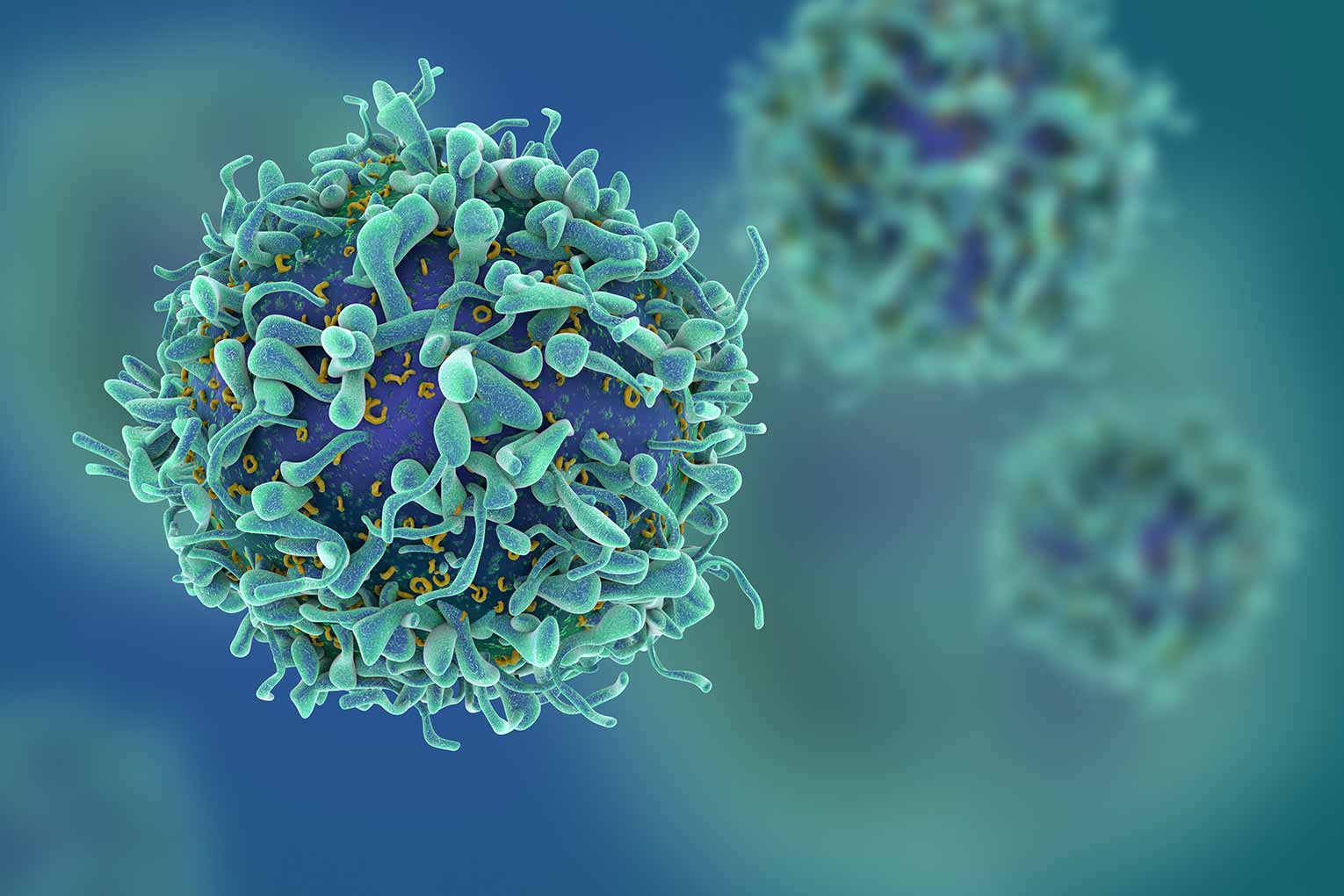

With a number of national cancer awareness campaigns taking place through November, including Lung Cancer and Pancreatic Cancer, Scottish Widows is highlighting the fact that many Britons are under-protected should serious illness strike.

Lung cancer is the third most common cancer in the UK, accounting for 13% of all new cases, and 130 new cases being diagnosed every day. It’s the second most common cancer in both males and females, with 1 in 13 men and 1 in 17 women being diagnosed with the illness during their lifetime. Pancreatic cancer is the eleventh most common cancer in the UK, with 26 cases diagnosed every day, with incidence rates having increased by a tenth over the last decade.

Scottish Widows’ research also reveals that fewer than one in 10 (8%) people in the UK have critical illness insurance, and just a third (34%) have life cover.

The insurer paid out more than £1.5million in critical illness claims relating to lung cancer and pancreatic cancer in 2016, with men accounting for 52% of lung cancer claims and women accounting for 100% of pancreatic cancer claims. The average age for diagnosis among men in 2016 for lung cancer was 55, and the average age for women was 55 for lung cancer and 51 for pancreatic cancer.

Scott Cadger, head of underwriting and claims strategy at Scottish Widows, said: “Our research shows that there are an alarming number of families who could face a significant financial struggle in the event of an unexpected loss of income due to serious illness or death. It’s crucial for them to put an appropriate plan in place to protect their finances and provide the peace of mind that there’s a safety net in place.”

The Scottish Widows research also reveals that a lack of planning is leaving many UK households in a vulnerable position. When asked how they’d cope should they or their partner not be able to work for six months, 24% of people said they’d rely only on state benefits, and two-fifths said they’d rely on savings.

At a time when welfare reform is resulting in significant changes to benefits such as child and working tax credits, income-based job seeker’s allowance, income support and housing benefits for those renting and with a mortgage, all of which are being replaced by Universal Credit, Scottish Widows says that families need to do all they can to protect themselves in the event of the unexpected happening.