Royal London has introduced a new approach to cancer underwriting, broadening the access to cover.

The insurer believes the changes will help to address the protection gap for those who have previously been diagnosed with cancer.

The changes allow the mutual insurer to expand the instances it can offer terms for Critical Illness (CI) and Income Protection (IP) where in the past it may have been unable to do so. Life Cover outcomes have also been amended to reflect current evidence. This will mean improved terms for customers who’ve previously had a range of different cancers, including breast, colorectal and skin.

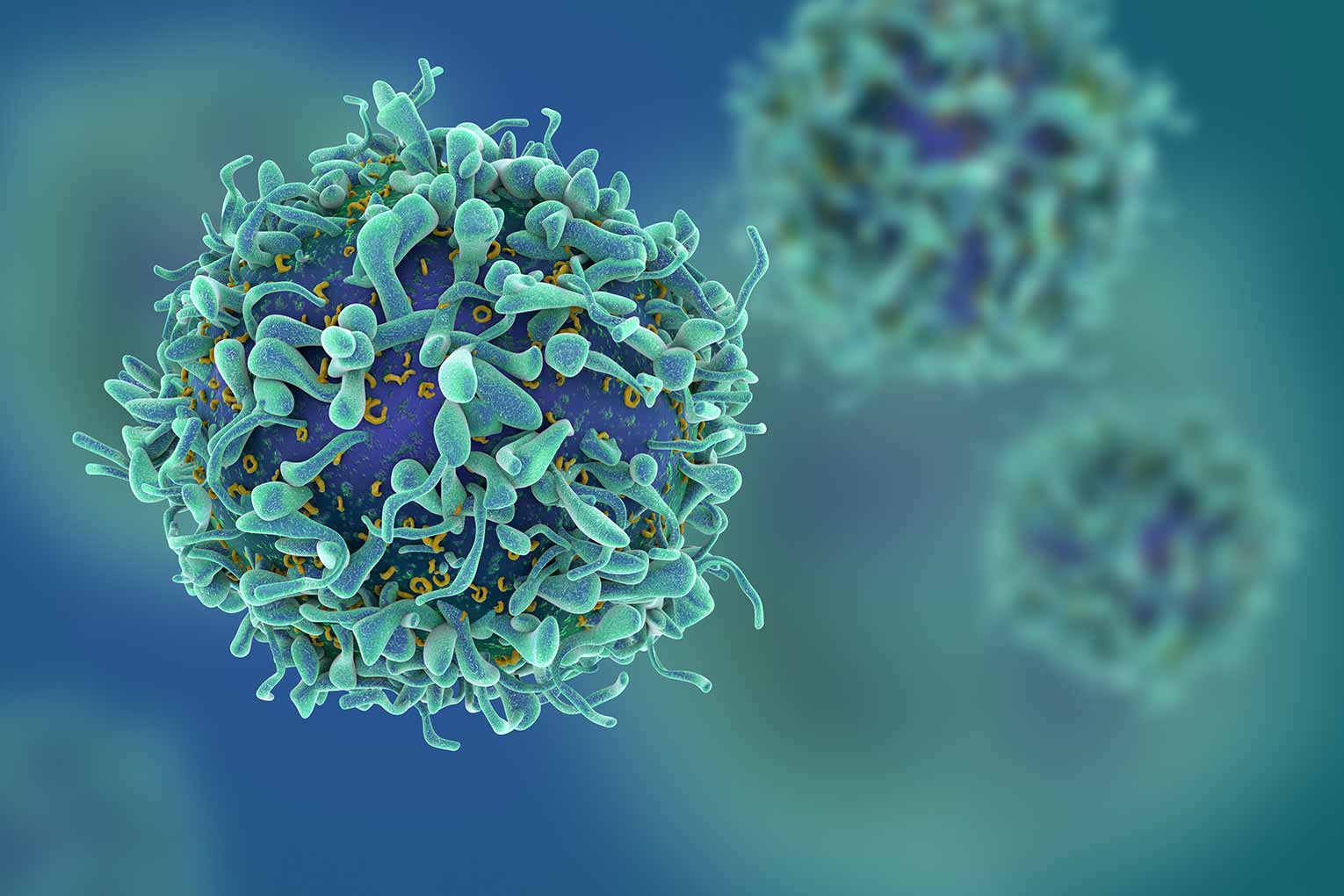

Around one in every two people are likely to develop some form of cancer diagnosis in their lifetime, and two thirds of adult critical illness claims were related to cancer last year.

Royal London says cancer is an “incredibly complex” area to underwrite, with over 200 different types, all with their own staging/grading, but believes updated guidance for cancer will be a development welcomed by advisers and their clients.

Craig Paterson, chief underwriter at Royal London, said: “Improving cancer survival rates has led to a growing protection need for those who have previously had the disease that could also help address the protection gap.

“It’s important we continue to keep pace with medical advancements to offer fair and accurate decisions that benefit customers with a history of cancer.

“The changes we’ve made are part of our commitment to provide evidence-based outcomes and to broaden access to insurance by offering cover to as many customers as we can.”

Royal London has a strong track record in supporting health and financial resilience and has committed over £3m to Cancer Research UK since 2022 to help tackle cancer inequalities and support research into hard to treat cancers.