Advisers are expecting strong growth across the individual protection market as a whole and in their own businesses over the next two years, according to new independent research for HSBC Life (UK) Ltd.

The research, which was conducted as the coronavirus crisis forced the UK into lockdown, found advisers specialising in individual protection forecast 14% growth for the advised protection market by 2022. They also predict their own firm’s protection sales will expand by the same amount over the period.

65% of advisers questioned believe there is an opportunity to grow the advised market substantially in the next two years, highlighting the optimism among advisers despite the current uncertainty. Almost all advisers surveyed, expect some growth in the market.

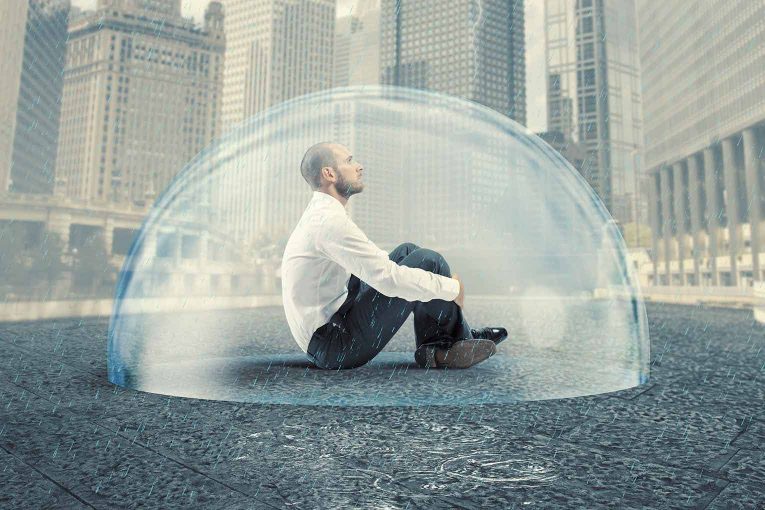

The market is predicted to grow through a challenging economic period, with many individuals likely to seek out the security afforded by protection products as a reaction to current events.

Policies expected to see the most growth are identified as critical illness insurance, which 50% of advisers believe will achieve the largest expansion in sales, while 47% believe income protection insurance is most likely to benefit from the expanding market.

Advisers say there is a growing recognition among clients that protection products are important – 61% say cover is regarded as very necessary by many customers. However, 38% believe policies are seen as affordable, which could be a potential brake on growth in the advised market.

Mark Hussein, CEO of HSBC Life (UK) Ltd, said: “The cover that protection offers customers is increasingly seen as invaluable, with people recognising that looking after themselves and those they love is a vital investment. Recent events have only served to underline this thinking. We have recorded a 30% increase in visits to our Life Insurance webpages, emphasising increased awareness and demand for protection products and reinforcing the opportunity for advisers.

“It is interesting that so many advisers at this time are optimistic about growth in the advised protection market despite the uncertainty and that they believe critical illness and income protection are likely to be the biggest opportunities for growth over the next two years as the protection market expands. Recent feedback and support of IFAs for our own protection offering has demonstrated that this opportunity is there.

“Advisers are resilient and adaptable and are seeing there is an opportunity to demonstrate their value and expertise to customers, while also growing their own businesses supporting customers in protecting what is valuable to them.”