The housing market is continuing to register positive momentum in 2025 with Zoopla’s latest House Price Index showing all key measures of market activity posting double-digit growth.

The number of sales agreed is 10% higher, with 11% more homes for sale than a year ago, meaning more buyers in the market.

Increased levels of housing market activity have mirrored other measures of economic activity including robust earnings growth, higher retail sales and improving consumer confidence.

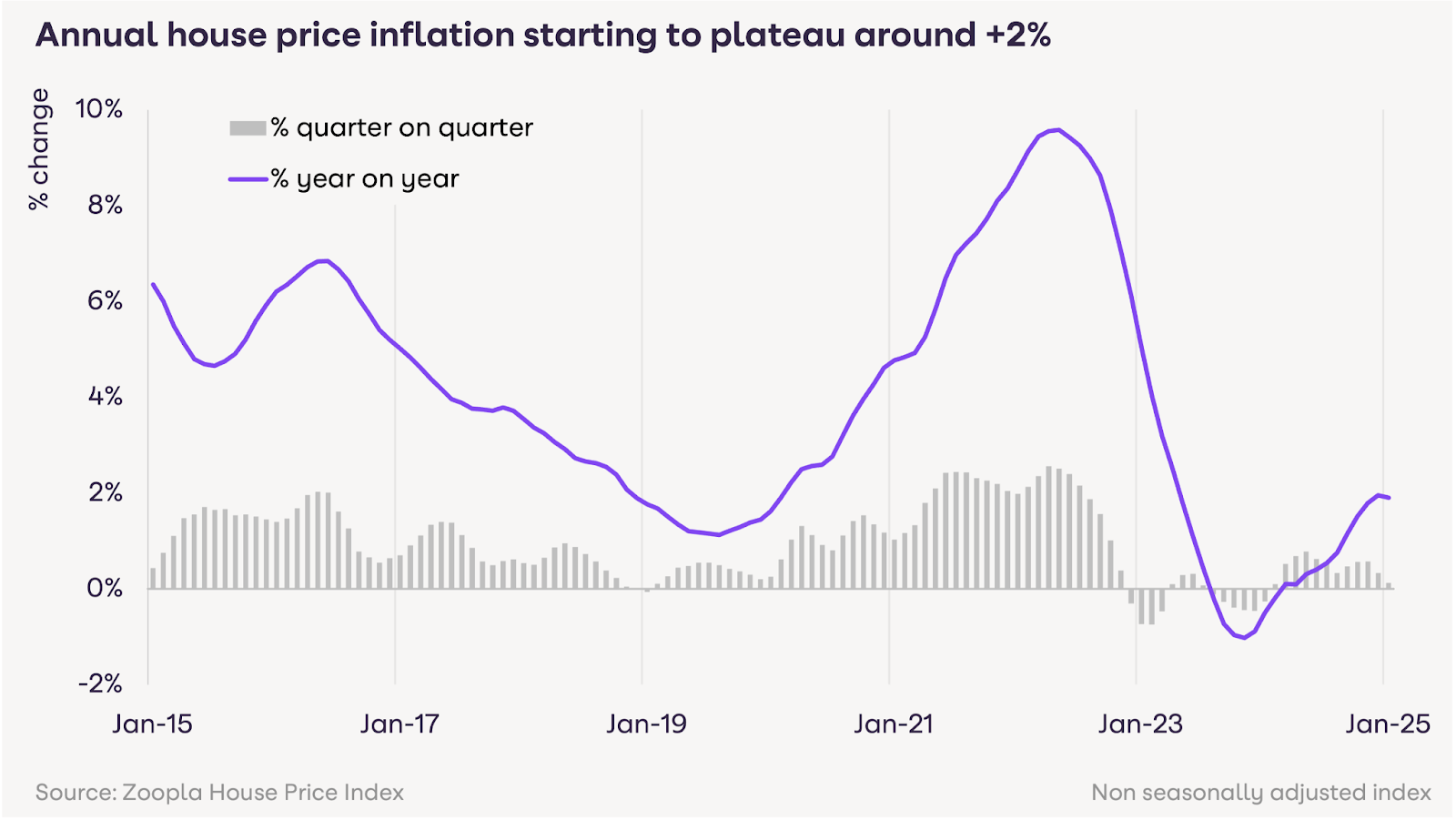

While market activity continues to increase, the annual rate of house price growth edged lower to 1.9% in the 12 months to January 2025, down from 2% in December 2024.

House price growth continues to follow a north-south divide. Average prices are 7.2% higher in Northern Ireland and 3% higher in the North-West.

House prices across London and southern England are 1% to 1.2% higher over the last year.

House price growth stalled or slowed across most regions and countries of the UK in January. This reflects the sharp dip in consumer confidence in the wake of last year’s Autumn Budget, with mortgage rates increasing 0.5% since September 2024, squeezing buyer power.

The moderation in price growth also reflects buyers starting to factor in higher stamp duty from April 2025.

The moderation in price growth also reflects buyers starting to factor in higher stamp duty from April 2025. Half of homeowners will have to pay an extra £2,500 per purchase while another third will pay up to the same amount. Two-fifths of first-time buyers will pay higher stamp duty from April but 60% will still pay no stamp duty.

Home buyers will expect to reflect this extra cost in their offers, typically looking to split the cost with the seller. The amounts are not large, but the overall impact will keep house price growth in check over 2025.

SURGE IN FLATS LISTING

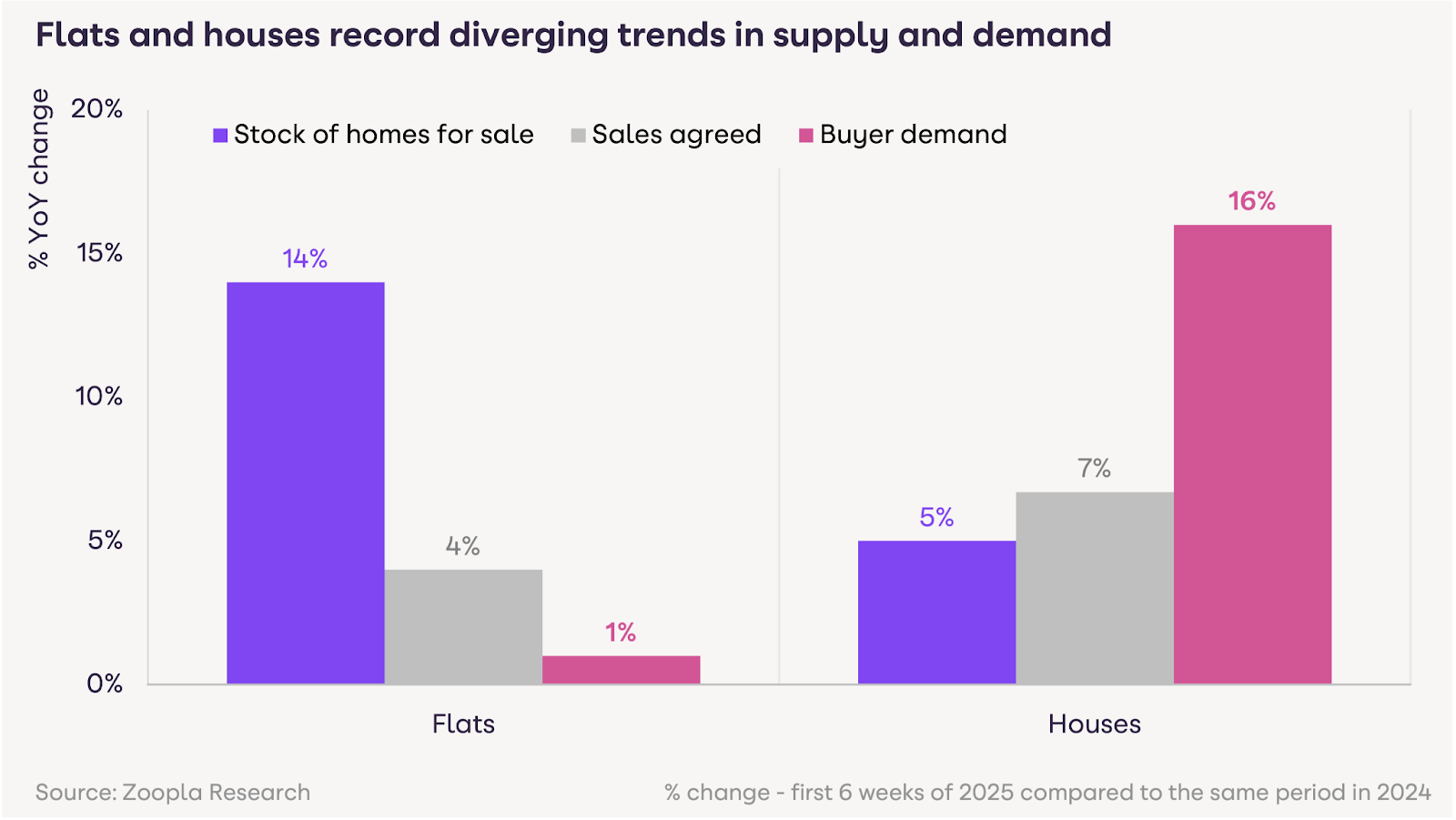

The early weeks of 2025 have seen a double-digit increase (14%) in the number of flats on the market, with a more modest increase of 5% in the number of houses for sale. A return to price increases for flats in 2024 has brought more supply to the market, with flats accounting for one in four homes currently for sale.

The increase in the number of flats for sale is running well ahead of the growth in new sales agreed (4%) and buyer demand (1%). In contrast, the demand for houses is 16% higher than a year ago, while the available supply is just 5% higher.

This mismatch in supply and demand explains why values of flats have risen by just 0.5% in the last year, with house values up 2.2%. House values are unlikely to rise faster given the greater choice of homes for sale and the extra stamp duty costs for many buyers.

Most owners of new flats for sale are facing smaller capital gains than owners of houses. Two in five (40%) flats for sale have an asking price less than £20,000 above the original purchase price compared to just 6% of houses. This includes 15% of flats listed for sale at an asking price below the last purchase price.

HOUSING A MISSED OPPORTUNITY

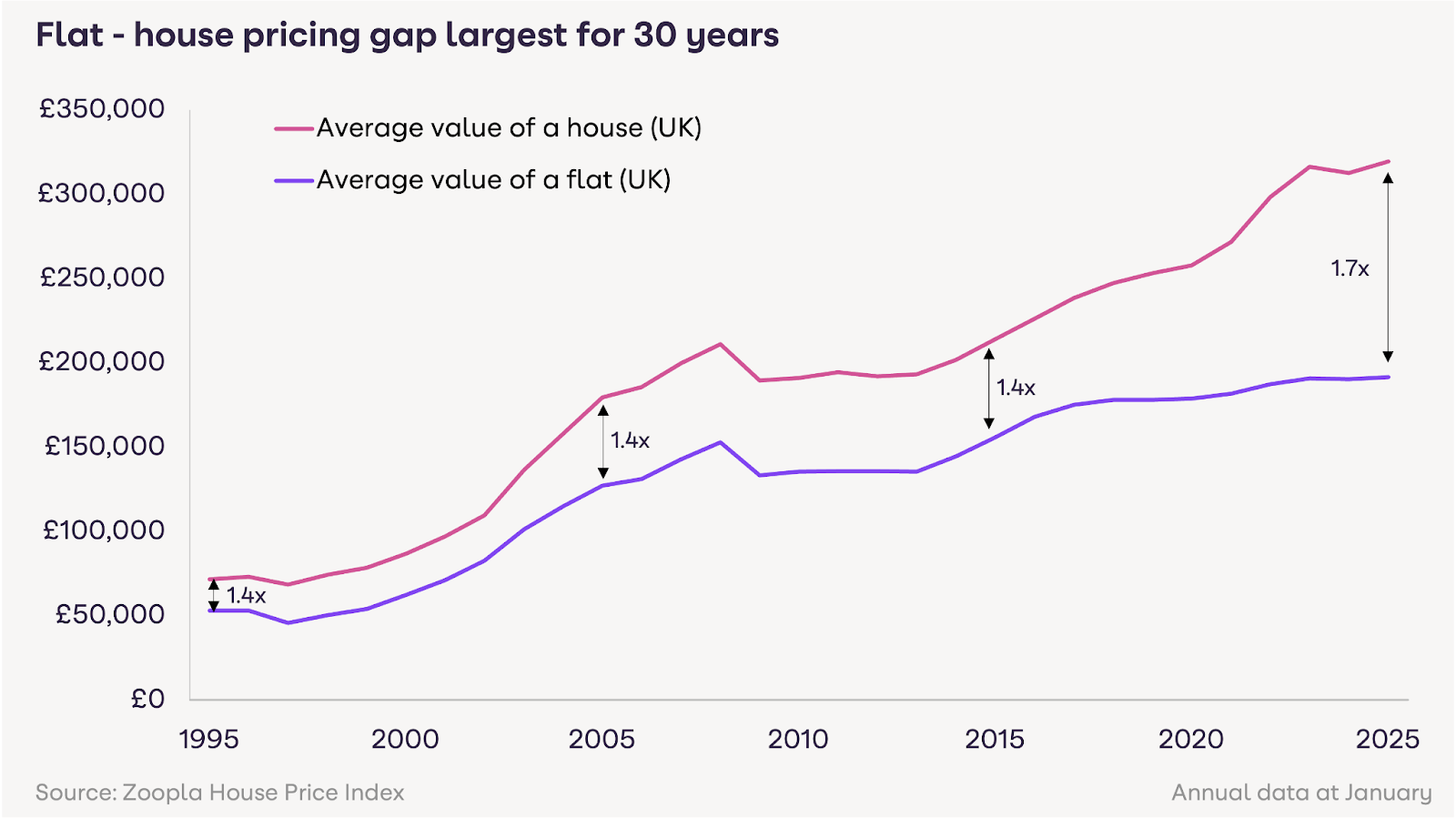

The search for space over the pandemic boosted demand for houses more than flats, while concerns over running costs for flats e.g. service charges and ground rents, as well as fire safety concerns for some newer flats, have impacted demand, acting as a drag on the price of flat prices. The average value of a flat has increased by just seven per cent over the last five years compared to house values increasing by a quarter (24%).

Looking at pricing over the longer term shows the gap between the value of houses and flats is at a 30-year high, with the average house value (£319,500), 67% higher than the average value of a flat (£191,300).

However, whilst flats are better value for money, buyers are still prioritising houses, especially first-time buyers. Zoopla data shows that over half (52%) of first-time buyers looking to buy today, outside London want a three-bed house. This is up from 44% in 2017. Demand for one and two-bed flats has declined from 25% to 17% over the same period.

RESILIENT MARKET

Richard Donnell, Executive Director at Zoopla, said: “The housing market remains resilient with more people looking to move home in 2025 and 2026 than this time last year.

“Average earnings rising by 6% over the last year, well ahead of inflation, is boosting buyer confidence and helping to reset housing affordability.

“Flats have become even cheaper compared to houses over the last five years. Buyers are still prioritising houses over flats but there are opportunities for canny buyers prepared to do their homework and weigh up the purchase of a flat rather than potentially waiting longer to buy a house.”

GROWTH IN CHECK

And he added: “While market activity is on the rise we expect house price growth to be kept in check over 2025.

“There has been a sizable increase in homes for sale in the early weeks of the year which is giving buyers greater choice and stronger negotiating power.

“Higher stamp duty costs for many from April will keep a lid on prices which we expect to increase by two to 2.5% with above average growth in more affordable markets outside southern England.”

RACE TO COMPLETE

Tony Hall, Head of Business Development at Saffron for Intermediaries, said: “First-time buyers are racing to complete purchases before the stamp duty changes in April, and today’s figures really hammer that home. But even with an 11% rise in homes on the market, there remains a strain on supply of new housing.

“The last time the UK built enough homes was in 1979, when social housing was a priority. Since then, we’ve consistently fallen short. Proposed changes to affordability tests, like including rental payments, could help more buyers enter the market but also risk driving up demand without enough homes to meet it.”

SERIOUS ABOUT SUPPLY

And he added: “It’s clear the government is serious about the supply issue – they set out their stall last summer with the 1.5 million homes target. But it’s not just about building more homes. If we’re going to solve the supply issue, we need to think beyond traditional new builds and explore alternative routes to homeownership as well.

“There’s huge potential in repurposing underused commercial buildings in urban centres.”

“For instance, there’s huge potential in repurposing underused commercial buildings in urban centres, making better use of spaces that are already there, meanwhile our research shows 64% of 18–24-year-olds would or already have considered pursuing a custom- or self-build project.

“Both present a valuable opportunity for brokers and lenders to expand their business and support borrowers in this specialist corner of the market.”

STAMP DUTY CHANGES

Nathan Emerson, Chief Executive of Propertymark, said: “With Stamp Duty changes across England and Northern Ireland due to take effect from April, we have seen an increased keenness from many people to complete as soon as possible, to typically save themselves around £2,500 pounds when purchasing an average priced property.

““The magnitude of house price growth does typically vary across different areas of the UK; however, with inflation now standing higher at 3%, we may see this influence base rate decisions over the coming months to help maintain overall stability within the economy.

“With an ever-growing population, all devolved governments must not only turn their attention to ensuring house building targets are delivered in the areas where there is a need, but also ensure that the right type of homes are being built in line with the shift in buyer behaviour.”