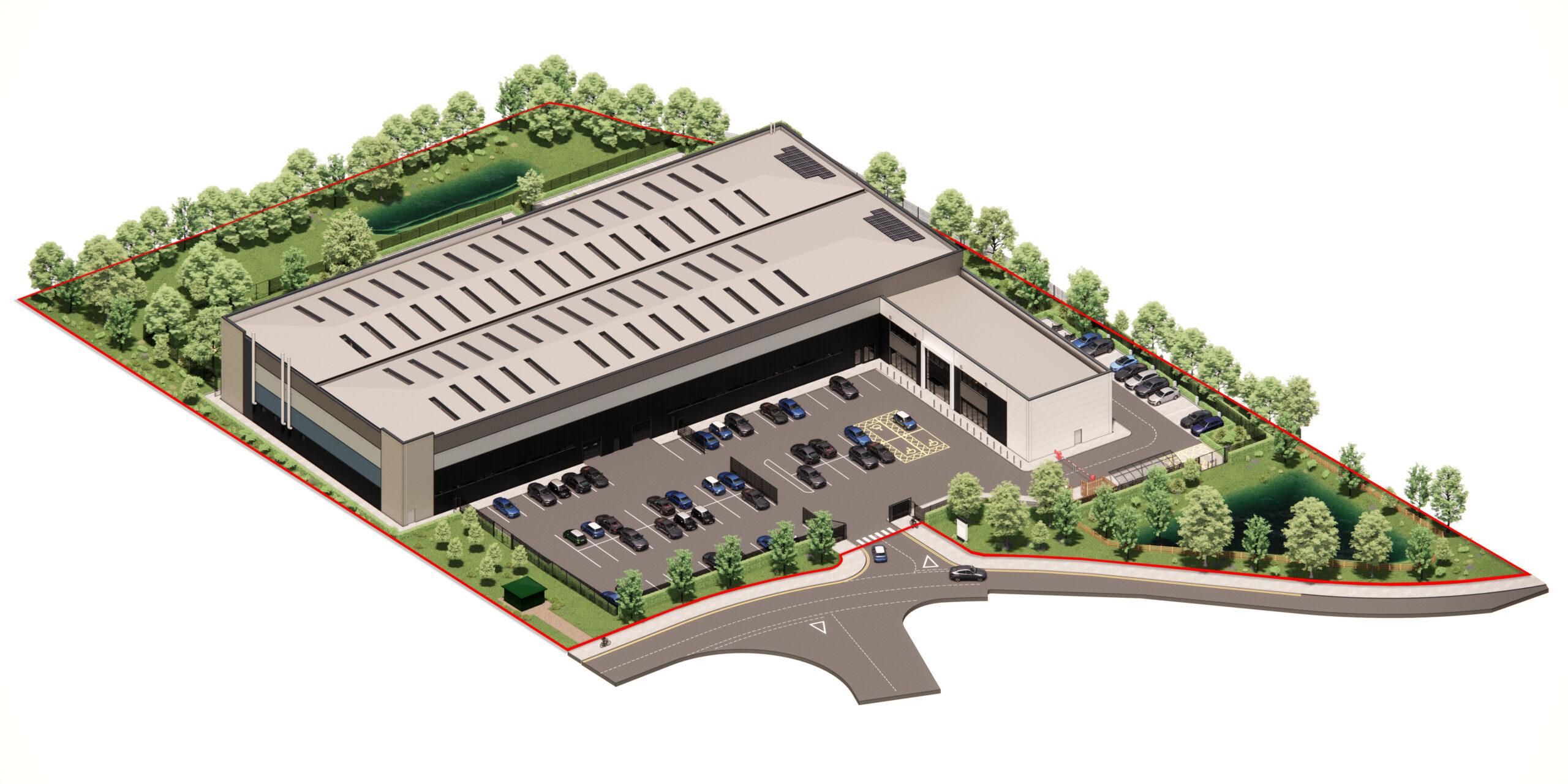

Developer and property investor Pigeon has secured a multi-million-pound green loan from Virgin Money to fund a new 86,316 sq ft industrial warehouse and office space at Theobald’s Business Park in Cheshunt, Hertfordshire.

Non-residential buildings account for 5% of UK emissions, so providing this loan plays a

Pigeon is aiming for the highest standards of efficiency and functionality with the project, which is known as ‘The MAX50 scheme’.

Featuring a mezzanine floor and office space, this modern facility aims to meet the growing demand for premium industrial and commercial environments.

ESG STRATEGY

Virgin Money’s Hotel & Real Estate Finance team provided its first green loan to fund the development, supporting Pigeon’s Environmental, Social, and Governance (ESG) strategy and their transition towards net zero. The project is aiming to meet high environmental standards, with EPC A and BREEAM1 Excellent ratings.

The groundbreaking ceremony (main picture) in March, with the development expected to be completed by early 2026.

FIRST GREEN LOAN

Hugh French, development director at Pigeon, said: “We are delighted that Virgin Money is supporting us with finance to develop this new facility for Stephen James Group.

“We have formed a strong relationship with their Real Estate team and are proud to have received the team’s first green loan.

“In addition to a high standard of sustainability, Cheshunt MAX50 will generate over £4m in social impact for both the local community and wider region.”

SIGNIFICANT MILESTONE

Jonathan Sant, senior director real estate finance at Virgin Money, added: “Supporting Pigeon with our first green loan from the Hotel & Real Estate Finance team is a significant milestone for Virgin Money.

“The MAX50 scheme perfectly aligns with both our commitment to providing sustainable finance and Pigeon’s ESG strategy.

“We look forward to seeing this state-of-the-art facility contribute to the local economy and set new benchmarks in environmental standards.”