Aston University has teamed up with Phoebus Software to create what is being described as the UK’s first suite of generative AI-powered tools to service mortgage and savings accounts.

The collaboration, part of a Knowledge Transfer Partnership (KTP) funded by Innovate UK, will combine the fintech company’s developers with Aston’s expertise in artificial intelligence and digital transformation to design conversational interfaces capable of delivering fast, accurate and personalised support for lenders, building societies and banks.

MODERNISING LEGACY SYSTEMS

Mortgage and savings servicing has long been hindered by ageing software systems that are difficult to adapt and require users to navigate large amounts of data across multiple screens.

Phoebus has already invested millions in addressing these issues, and the new initiative aims to accelerate this modernisation by applying advances in natural language processing, metadata generation and data mining.

The tools under development are expected to enable customers and agents to interact with mortgage and savings systems in a more intuitive way, transforming what has traditionally been a complex process into a seamless and responsive experience.

Robin Jeffery, chief technology officer at Phoebus Software, said: “For our new and existing clients across mortgage and savings, we’re looking to enrich an already market-leading solution with more intuitive and responsive functionality that provides enhanced interaction with concise data and richer responses.

“As a technology-driven business always looking to push boundaries, our long-standing relationship with Aston University’s College of Engineering and Physical Sciences means this KTP is the perfect fit to help reimagine our innovative technology platform so we can offer solutions that truly disrupt and take the lead in the market.”

ACADEMIC PARTNERSHIP

The project is being undertaken in collaboration with researchers in Aston University’s Sir Peter Rigby Digital Futures Institute, which has a growing profile in digital technologies and a track record in applying AI tools to business challenges.

Professor Abdul Sadka, director of the Institute, said: “Co-creating innovative solutions for finance sector challenges using our expertise in AI data analytics will be very rewarding for our institute.

“We’re bringing together a nationally leading academic team who are at the forefront of AI/GenAI technologies and multimodal data analytics to really push the boundaries of what digital technologies can achieve in this space.”

Supervision will be led by Dr Philip Weber, lecturer in computer science and a member of the Aston Centre for Artificial Intelligence Research and Applications and the Aston Institute for Forensic Linguistics.

SECTOR IMPACT

Knowledge Transfer Partnerships are designed to strengthen ties between universities and industry, embedding academic expertise into commercial settings. Aston University is ranked first for KTP project quality and joint first for the number of active projects.

For Phoebus, which provides mortgage and savings technology to banks and lenders across the UK, the partnership marks a significant step towards embedding AI-driven tools that could reshape customer experience and operational productivity across the financial services sector

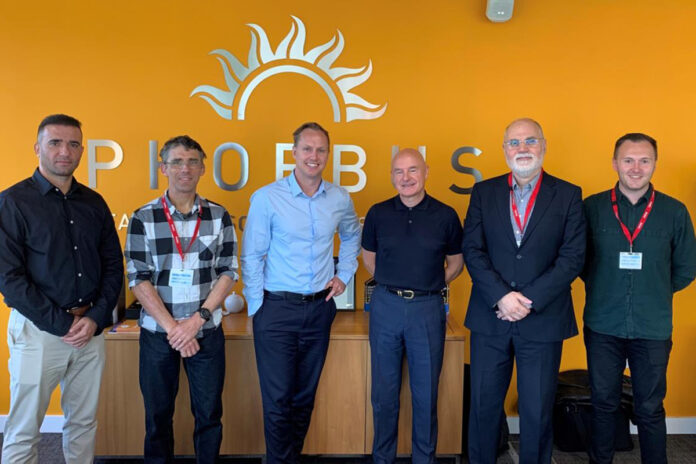

Pictured (L-R): Salah Ebrahimpour (KTP Associate), Philip Weber (Aston University), Nicolas Nicholas (Phoebus Software), Paul Warrington (Innovate UK Business Connect), Abdul Sadka (Aston University), Samuel Burrows (Aston University).