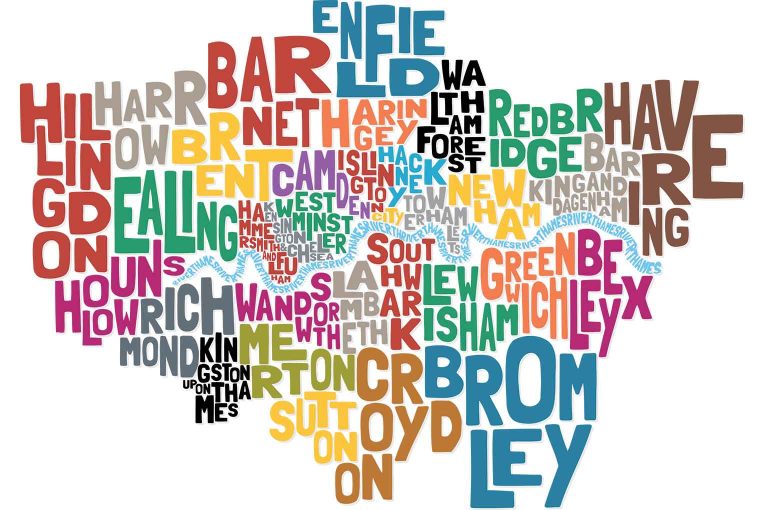

The rate of London ‘outmigration’ has slowed to the lowest level since 2013, according to Hamptons’ analysis of Countrywide estate agency data.

Londoners purchased 5.7% of homes sold outside the capital in 2024, down from a peak of 8.2% in 2022 and 7.8% last year. The return to the office, combined with falling house prices in the capital, has reduced the number of moves taking place.

Chart 1: Share of homes sold outside the capital to a Londoner

Source: Hamptons

Source: Hamptons

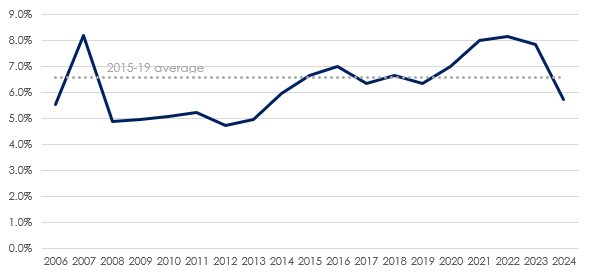

In number terms, Londoners will purchase a total of 57,020 homes outside the capital this year. This is 45% or 46,200 fewer than in 2021 when London outmigration numbers previously peaked. Pre-Covid, Londoners bought an average of 70,060 homes outside the capital each year, meaning purchase numbers are down around 19% compared to the 2015-19 average, partly due to fewer people moving home in general.

Chart 2: Number of homes bought by a Londoner outside the capital

Source: Hamptons

Source: Hamptons

First-time buyers made up a record 31% of Londoners purchasing a home outside the capital this year, a figure that has more than doubled since 2013. Overall, London-based first-time buyers bought 17,680 homes outside the M25 this year, 69% more than a decade ago.

However, mover numbers have fallen by 41% over the last decade. Those trading a home in the capital for one outside purchased a total of 24,710 homes in 2024, down from 41,850 in 2014.

Strong house price growth outside the capital over the last decade has reduced the amount of extra space London leavers can buy. Average property prices have risen 39% outside the capital over the last decade, compared to 26% growth in London.

In some areas of the capital, particularly in central London, property prices have fallen over that period, limiting London leavers’ purchasing power and reducing their incentive to move.

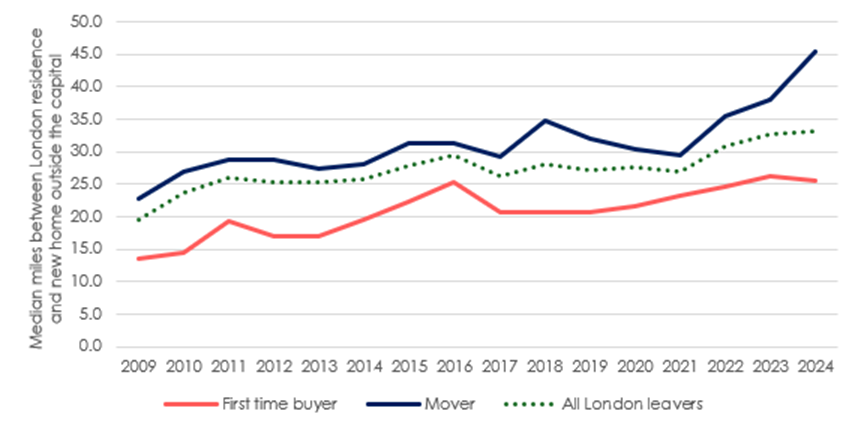

Chart: Average moving distance by London leaver

Source: Hamptons

Source: Hamptons

In search of more affordable areas, those leaving London (movers and first-time buyers) are moving further than ever before. The average London leaver (excluding second home buyers and landlords) moved 33.1 miles outside the capital this year, 19% or 5.3 miles further than the 2015-19 average (chart 3).

However, whilst relatively high mortgage rates and a lack of equity growth have meant that those trading a home in London for the country are moving further than ever before, first-time buyers are staying closer to the M25. The average London leaver selling a home in the capital now moves 45.4 miles, 13.7 miles further than pre-Covid. Meanwhile, the typical first-time buyer moved 25.5 miles this year, down from a peak of 26.3 miles in 2023 (chart 3).

Brentwood has seen the biggest rise in the share of buyers from London compared to pre-Covid (2019). Here, Londoners purchased 47% of homes sold in 2024, up from 23% in 2019. Rushmoor, Colchester and Epsom & Ewell follow (table 1).

In fact, all of the top 10 areas that have bucked the trend and seen the biggest increase in London buyers since 2019 are located in the East or South East of England. Many of these are more affordable locations with good transport links into the city, popular with first-time buyers.

Wychavon, in the West Midlands, is the first local authority outside the South of England that’s seen the biggest rise in London buyers and sits in thirteenth place. Here, Londoners purchased 11% of homes sold this year, up from 3% in 2019.

Blackpool, where Londoners purchased 9% of homes sold this year, up from 4% in 2019, is the first local authority in the North of England on the list, recording the twenty-fourth largest increase in the country. However, most of these London buyers were purchasing an investment property. The average gross yield on a new buy-to-let purchase in Blackpool reached 10.1% this year, compared to 5.7% in London.

Aneisha Beveridge, head of research at Hamptons, said: “The capital’s homeowners haven’t had the housing market on their side in recent years. They’ve had to adapt to higher interest rates and post-pandemic trends, which have shifted against them and suppressed property prices in the capital. This has weighed on their ability to move, driving down the number of people leaving London this year.

“Stagnant or falling property prices in parts of the capital have limited equity growth, while house prices elsewhere have risen much more quickly since Covid. With a trophy home slipping out of reach, many London homeowners have opted to stay put or move even further out of the capital to get more house for their money.

“First-time buyers have been the exception to the rule, with many keen to escape the capital’s rental market. As mortgage rates have fallen this year, it’s generally become cheaper to buy than rent again, even with a small deposit. However, the high income and savings bar needed to buy a home in London has pushed more aspiring homeowners to look beyond the capital for their first home.

“Looking ahead, we expect an uptick in London outmigration numbers next year as the capital’s property market begins to pick up as mortgage rates edge down further. This could encourage a generation of more recent homeowners who have been restrained for a decade by limited or no price growth in the capital to make their move.

“But with mortgage rates likely to remain above historic levels, we expect more of these movers to look further afield to secure the home they could have bought in the Home Counties a decade ago.”