Paradigm Protect has launched a new relationship with retirement, investment and protection provider, Canada Life.

The directly authorised protection proposition is just one of a handful of distributors which will have access to Canada Life’s individual protection products.

Canada Life specialises in life insurance and life insurance plus critical illness cover.

Both products are available on a level, increasing or decreasing term basis. Canada Life’s life insurance provides terminal illness cover right up to the end of the policy and includes up to £300,000 accidental death benefit (during the underwriting process).

Canada Life’s critical illness contract includes:

- Full cover for over 40 critical illnesses.

- 19 additional illnesses for a lower amount of cover.

- Comprehensive child cover automatically protecting clients’ children from 30 days old up to the age of 18, or 22 if they are in full-time education.

- Children will also be covered for six child-specific illnesses from birth.

Canada Life says that over four in five clients go through the underwriting process without further referral. Its newly-developed technology provides a streamlined quote and application process.

For applications where additional medical evidence is required, Canada Life will not ask for a General Practitioner’s report (GPR); instead it says it trusts a client’s disclosure through tele-underwriting, or in some cases will request a medical screening.

Mike Allison, head of protection at Paradigm, said: “We’re incredibly pleased to be able to offer Canada Life’s range of Individual Protection products through the members of Paradigm Protect.

“We are currently one of a small number of distributors who have access to these very effective, market-leading products and I’m sure advisers will be keen to utilise this access and ensure their clients have access to both the life insurance and life insurance plus critical illness cover offering.

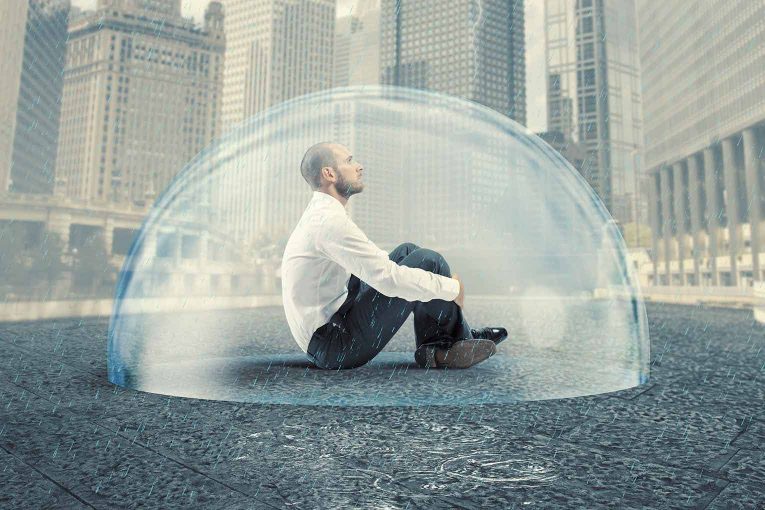

“It’s highly important that we confront the ‘protection gap’ in the UK and ensure clients are not leaving themselves at considerable risk by under-insuring. This is particularly important for clients who may not have seen their adviser for a number of years, and whose circumstances could well have changed drastically during that time.

“By committing to protection, advisers are doing all they can to provide at the very least, an adequate amount of protection for all. We’re looking forward to working with the Canada Life team and to helping develop their presence with Paradigm member firms.”

Natalie Summerson, head of individual protection sales at Canada Life, added: “We are delighted to be working with Paradigm Protect and its member firms which are passionate about reducing the protection gap. We have designed our individual protection proposition with the customer and adviser controlling the speed of decision.

“This enables our customers to obtain terms in a timely manner. We believe our approach which uses technology to keep the adviser and customer firmly in control, is key to helping protect more individuals and their families for when the worst happens.”