OneSavings Bank has made changes to its lending conditions for residential buy-to-let and commercial mortgages through its Kent Reliance and InterBay commercial brands in advance of the new energy efficiency regulations which come into effect on 1 April.

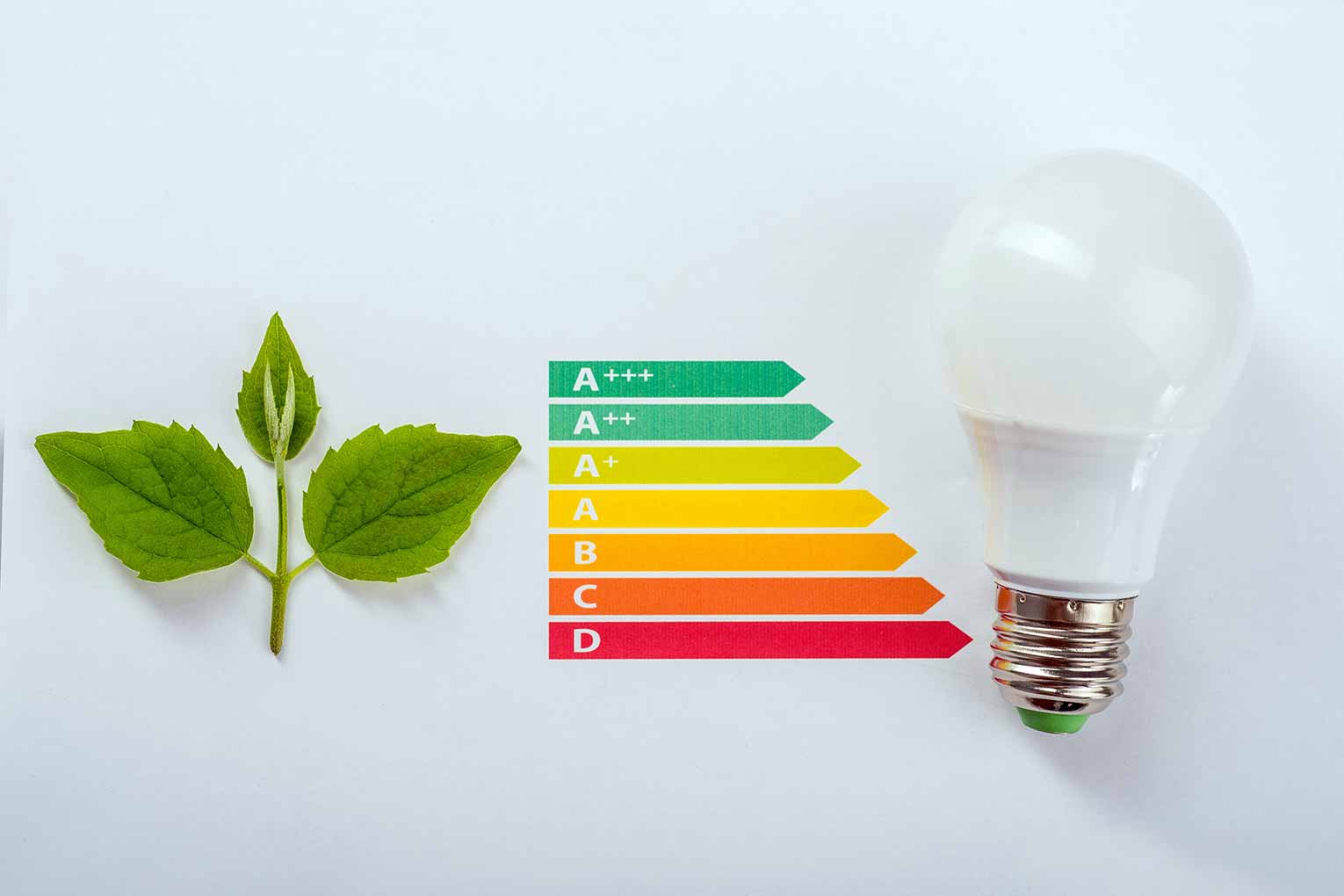

From next month it will be unlawful to grant a new tenancy on any residential or commercial property with an energy performance certificate (EPC) rating of ‘F’ or ‘G’.

Because this, OneSavings Bank has announced the following changes:

Buy-to-let: all mortgage offers will contain a requirement for the acting solicitor to advise the borrower that any properties rented out in the private rented sector must have a minimum EPC rating of E.

Commercial properties: properties that do not meet the minimum standard (E rating) will be referred to OSB’s real estate team to review. Where appropriate, a condition will be included in the formal mortgage offer to ensure that the property receives a rating of ‘E’ or above within three months of completion.

Adrian Moloney, sales director at OneSavings Bank, said: “The new regulations bring added complexities into a highly regulated market, but we want to ensure the new requirements are as straightforward as possible for our broker partners.

“Ensuring that properties are energy efficient is important and a reflection of the market’s drive towards professionalisation; however, we wanted to make sure that a low rating didn’t necessarily mean landlords would be prohibited from accessing lending. Instead, we’ve introduced proportionate terms into our conditions to raise awareness and act as an incentive for landlords to improve their properties, which will ultimately help them attract tenants.”