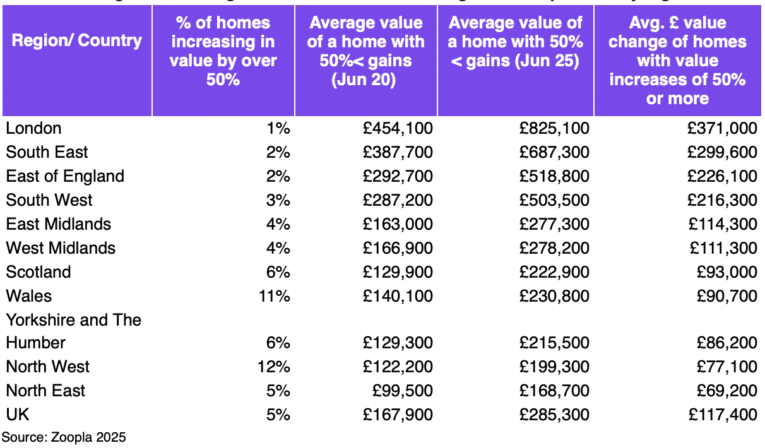

More than one million UK homes have increased in value by 50% or more since the onset of the pandemic, according to new research by Zoopla, with growth concentrated in northern England and Wales.

The property portal’s analysis reveals that average gains for these homes reached £117,400 over the past five years.

Overall, 80% of UK homes are now worth at least 5% more than in 2020, with average gains of £60,800.

Despite a slowdown in buyer demand in 2023 caused by rising mortgage rates, property values have increased by an average of 20% across the country since the start of the pandemic.

KEY DRIVERS

More than half of homes that saw 50% or more in value growth are located in the North West, Yorkshire and the Humber, and Wales.

Average value increases in these areas were £77,100, £86,200 and £90,700 respectively. Analysts point to a combination of pandemic-era lifestyle shifts, strong rental growth and the relative affordability of these markets as key drivers.

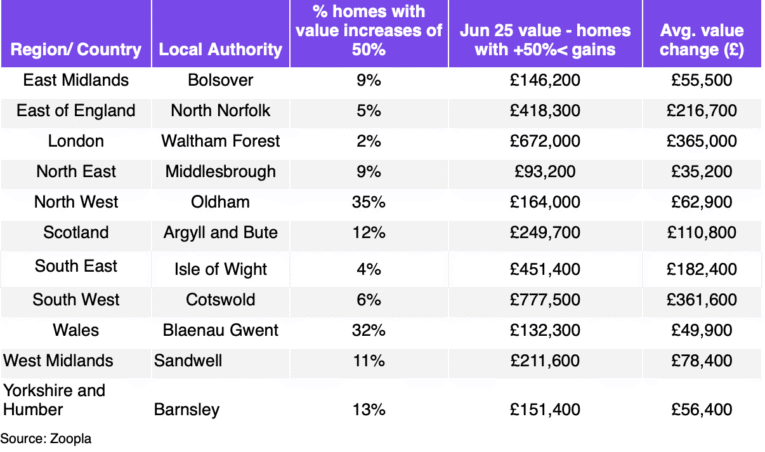

South Wales emerged as a standout region, with towns such as Blaenau Gwent and Merthyr Tydfil seeing nearly one in three homes grow in value by 50% or more – equivalent to average increases of £49,900 and £51,100.

In the North West, areas such as Rochdale, Oldham and Bolton also recorded sharp increases, with average gains of more than £60,000.

By contrast, just 2% of homes in southern England recorded value increases of 50% or more.

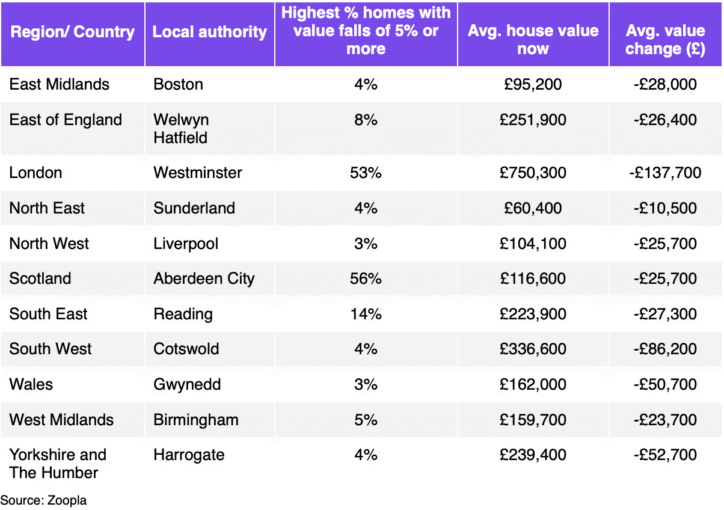

In London, 13% of homes fell in value by at least 5% – the average loss reaching £34,000 – with the steepest declines seen in Westminster and Kensington and Chelsea.

Price falls were also seen in Aberdeen, where more than half of homes declined in value due to the long-term contraction of the oil and gas sector.

ONE MILLION HOMES

Richard Donnell, Executive Director at Zoopla, said: “Our latest analysis clearly shows there is no single housing market and that house price trends vary widely across the UK.

“One million UK homes have seen their value increase by 50% or more over the last five years as higher mortgage rates and rising rents encourage home buyers to seek out value for money in localised markets across northern England and Wales.

“Home value growth has been weaker across southern England and particularly in London.

REDUCED BUYING POWER

And he added: “A combination of high prices and higher mortgage rates have reduced buying power and this has been reflected in flat prices and modest price falls in inner London.

“The UK currently has the most homes for sale in seven years. It’s critically important serious sellers fully understand the local market dynamics impacting the value of their home and seek the advice of agents on where to set the asking price for their home in order to achieve a sale.”