More than one in six residential properties in England and Wales were sold off-market between 2022 and 2024, according to new analysis from TwentyCi.

The property data firm found that 15.8% of all transactions during the three-year period took place without the homes ever appearing on property portals, agent websites, in shop windows, or at auction.

Instead, they were sold privately through word of mouth, buyer networks, or estate agents matching homes with clients already on their books.

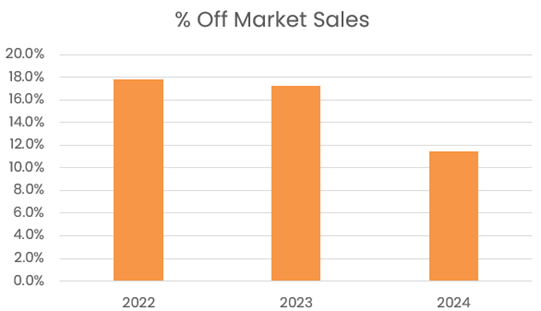

However, the research – featured in TwentyCi’s latest Property & Homemover Report – shows a clear decline in the trend. Off-market transactions accounted for 17.8% of all sales in 2022, edged down to 17.2% in 2023, and then fell sharply to 11.4% in 2024.

Katy Billany, executive director of TwentyCi, said the contraction reflected “a structural market recalibration”. She added: “Supply grew by 10% in 2024 compared with 2023, alongside successive interest rate reductions, encouraging more sellers to come forward.

“In a buyers’ market, sellers need a full marketing package, professional photography, portal listings, and active promotion to secure a sale.”

THE £1M DIVIDE

TwentyCi’s analysis identified a distinct split between the sub-£1 million and £1 million-plus markets. Only 6.7% of homes sold off-market below the £1 million threshold, compared with 20.1% above it.

The findings point to two very different markets: one transparent and price-sensitive, the other private and built around exclusivity. Transactions at the top end of the market often involve limited viewings and strict privacy controls, while sellers of homes under £1 million typically depend on broad exposure to attract interest.

“In a market where the average time to go SSTC now stands at 77 days – the longest in the past five years – sellers of homes under £1 million should question whether the off-market approach puts them in the best position to secure a sale,” said Billany.

MARKET HOLDS STEADY THROUGH Q3 2025

Overall, the property market has maintained steady activity compared with 2024 levels. New instructions rose by 1.7% in the third quarter, while sales agreed were up 3.2%.

The fall in exchanges seen in the previous quarter, caused by buyers rushing to complete before the stamp duty changes earlier in the year, has now corrected, bringing transactions broadly back in line with last year.

PRICE CUTS REMAIN AT RECORD LEVELS

Price reductions have become a hallmark of 2025, with 919,000 recorded so far – 16% more than a year ago and the highest on record. More than a third (38.7%) of all completed listings have seen at least one reduction, with the biggest increases in the £1 million-plus bracket, where price cuts rose 3.1%.

The trend is easing in the North but intensifying in London and the South. Inner London has been the weakest-performing area, with price reductions rising by three percentage points.

Meanwhile, fall-throughs continue to climb, reaching more than 82,000 in the third quarter alone – up 0.5% year-on-year.

Billany said: “With 82,000 sales falling through in Q3 alone, we’re fully behind the government’s push to shake up the homebuying process. Waiting four months just to exchange contracts is far too long – no wonder buyers get cold feet, or unexpected issues crop up in surveys. A bit more upfront info at the start could really help smooth things out. As we head into the final stretch of the year, we’re cautiously optimistic.”

DAMAGE CONTROL

Chris Williams, founder of Novus Strategy, the technology consultancy for the home buying and selling industry, said: “The big takeaway from this data, coming just days after the Government announced major homebuying reforms, has to be the sheer scale of the damage being inflicted on the property industry by fall-throughs.

“There have been 312,691 cancelled purchases in the last year according to TwentyEA/Ci, which is an absolutely eye-watering figure. Fall-throughs often occur due to the length of time it takes to complete a purchase, with changing circumstances, life events and long chains all exacerbating the problem.

“If we can reduce completion times and make the process more transparent, these numbers should fall sharply, as industry pilots have already demonstrated.”

BILLIONS WASTED

And he added: “Abandoned purchases are responsible for billions of pounds wasted each year and the human cost of this disruption is also extensive.

“Behind every cancellation will be a family that can’t move into a larger home, a couple unable to move in together or a pensioner struggling to downsize. Industry suffers too, from housebuilders and estate agents to mortgage brokers and lenders all shouldering the cost of wasted effort and investment.

“The industry has been calling on the Government to mandate improvements.”

“The industry has been calling on the Government to mandate some of the improvements we need to see, and the far-reaching consultation revealed earlier this month was very welcome as it will inject some much-needed momentum.

“We’re already starting to see some of the green shoots of collaboration in industry that will deliver the transformation required, driven by organisations such as the Open Property Data Association (OPDA).

“All the different players involved in transactions are investing now in getting this right and the rewards will be extreme. It’s easily possible that transaction levels will reach a new, permanently higher plateau that everybody will benefit from.”