Octopus Property is to provide residential developer London Green and equity partner Orlandis Capital with a £12.6 million senior loan to fund the acquisition of a part vacant office building on the Isle of Dogs in East London.

The property benefits from Permitted Development Rights for conversion into 63 residential units and London Green.

Octopus Property’s second Commercial Real Estate Debt Fund (CREDF II) will provide the facility. Repayment will be by development finance with Octopus Property acting as the lender.

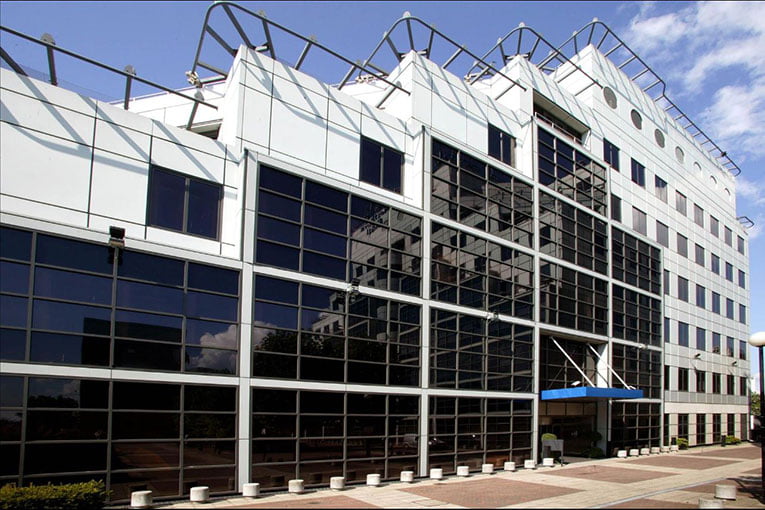

The existing seven-storey building, Boatman’s House, provides 48,500 sq. ft of office space, with one part currently occupied and the rest of the building vacant. The conversion of the site will provide a mix of studios as well as one and two bedroom flats.

Ludo Mackenzie, head of commercial at Octopus Property, said: “Situated in a highly desirable part of East London and working alongside a developer with a track record of successfully delivering high quality residential schemes across the UK, we are very pleased to be involved in this scheme.

“Our ability to provide a range of borrowers with lending products that span the acquisition, development and investment stages of a project continues to differentiate our offering from the peer group and has been a major contributor to what has been a record 2018.

“Despite wider market uncertainty, London continues to be a major focus for residential and commercial real estate strategies and we continue to identify opportunities to provide debt finance for a range of property types and borrowers.”