Buy-to-let investors are accelerating a shift northward as high yields and lower entry costs in the North of England and the Midlands help counter rising taxes and borrowing costs, latest research from Hamptons reveals.

With affordability pressures mounting in the South, the North’s buy-to-let market continues to attract investors seeking resilience and returns in a shifting landscape.

The trend marks a dramatic rebalancing of the UK’s rental investment market, driven by a combination of regulatory pressure, high stamp duty costs and declining returns in the South.

Source: Hamptons

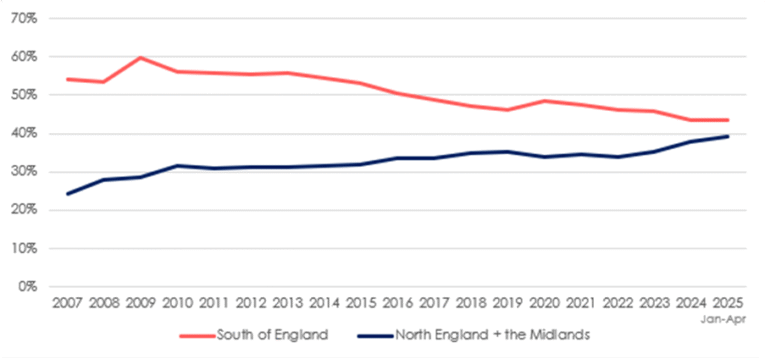

In the first four months of 2025, a record 39% of buy-to-let purchases took place in the North or Midlands, compared to 24% in 2007 and 34% in 2022, when interest rates began rising. In contrast, just 43% of new landlord purchases this year were located in the South of England, including London – down from 53% in 2015, prior to sweeping regulatory changes. The remaining 17% of transactions occurred in Wales and Scotland.

FINANCIAL ADVANTAGES

Investors in the Midlands and North paid an average of £150,480 for a property this year, nearly half the £292,240 average paid in the South. That translates to a stamp duty saving of £11,190, now a significant cost following the increase in the stamp duty surcharge for second homes from 3% to 5% in November 2024.

Source: Hamptons

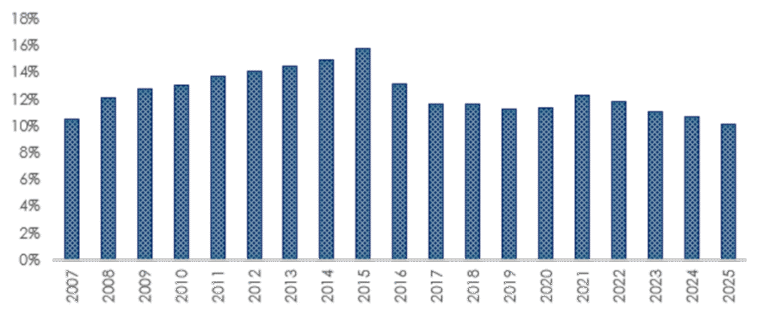

Despite this regional shift, overall buy-to-let investment has declined. Landlords accounted for 10% of all property purchases in Great Britain during the first four months of the year – the lowest proportion since 2007. The figure was 11% in 2024 and 16% at its peak in 2015.

KING OF THE NORTH

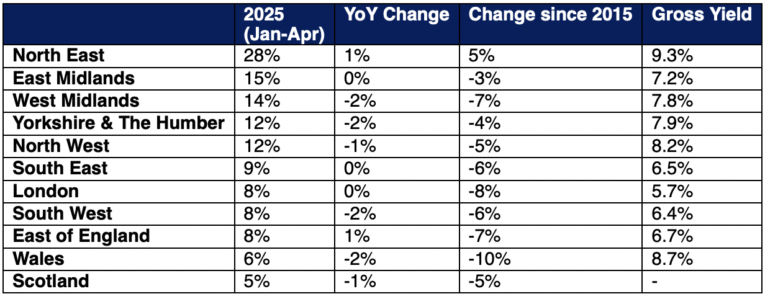

Regionally, the North East stands out. There, landlords purchased 28% of all homes sold so far this year – up from 23% in 2015 – making it the most buy-to-let-active region. With average gross yields of 9.3%, the North East also offers the strongest returns, well above the national average of 7.1%.

Source: Hamptons / Land Registry

Meanwhile, investor activity has fallen sharply in both Wales and London. In Wales, landlords bought just 6% of homes so far this year, down from 16% in 2015. London saw a similar contraction, with buy-to-let purchases down from 16% in 2015 to just 8% this year. For every rental property bought in London, 3.1 are now being acquired in the North West.

SCOTTISH PULLBACK

Scotland has seen the most pronounced pullback. Just 5% of homes sold there this year went to investors, compared to 10% a decade ago. Stricter rental controls and rent caps are thought to be contributing to the drop.

Northern regions are dominating post-surcharge buy-to-let hotspots. Nine of the top 10 local authority areas with the highest levels of landlord activity since the SDLT increase are in the North or Midlands. Redcar and Cleveland tops the list, with landlords accounting for 50% of all purchases and paying an average of just £3,515 in stamp duty on properties priced around £70,300.

HIGH-YIELD INVESTMENTS

In parallel, landlords are increasingly pursuing high-yield investments. This year, 23% of new buy-to-let purchases delivered double-digit yields, up from 17% in 2024. Lower costs mean investors can better absorb higher mortgage rates and maintenance expenses, helping offset declining rental growth.

Source: Hamptons

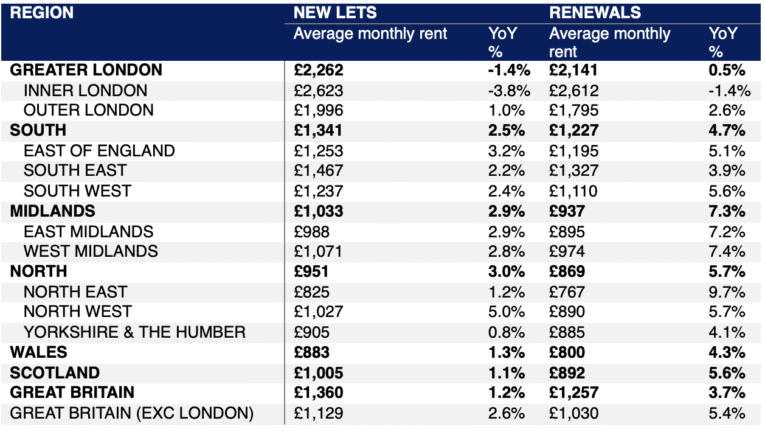

Rental inflation on renewed tenancies is slowing. In April, average renewal rents rose 3.7% year-on-year to £1,257, compared to a 1.2% rise for new lets. However, the growth rate for renewals has slowed significantly from a peak of 9.2% in October 2023.

In London, market conditions are softening further. New let rents in the capital fell 1.4% in April, while renewal rents edged up just 0.5%. Only 23% of London landlords increased rent upon renewal, down from 37% a year ago.

GRINDING TO A HALT

Aneisha Beveridge, Head of Research at Hamptons, said: “Buy-to-let investment is gradually grinding to a halt in some markets where higher purchase and mortgage costs take their toll.

“However, while new landlord purchases remain well below long-term averages, some investors have been looking further afield for new opportunities.

“One of the main ways landlords are trying to mitigate against higher stamp duty and mortgage costs is by seeking better-yielding and cheaper properties, increasingly in Northern England.”

STILL OPPORTUNITIES

And she added: “Based on current trends, 2033 will mark the point at which the bulk of buy-to-let purchases are in the Midlands and North of England, rather than the South. However, this shift could cost the Treasury £161m or a 12% annual fall in revenue due to investors purchasing cheaper properties that come with lower stamp duty bills.

“This may also have a knock-on impact on rents if supply conditions in the South of England worsen, and where tenants’ finances are already most stretched.

“However, investors will still find opportunities in the South of England, particularly if rents continue to rise and house prices pick up pace after nearly a decade of stronger capital growth further North.

“Lower interest rates will also help, not only by lowering mortgage costs, but by reducing rates available on savings accounts, which might make buy-to-let look more appealing.”