Bridging finance participants have launched a new report highlighting the latest trends shaping the UK’s bridging market.

The infographic covers data gathered from bridging lender, MTF and packagers Brightstar Financial, Enness Private Clients, Positive Lending and SPF Short Term Finance (SPF).

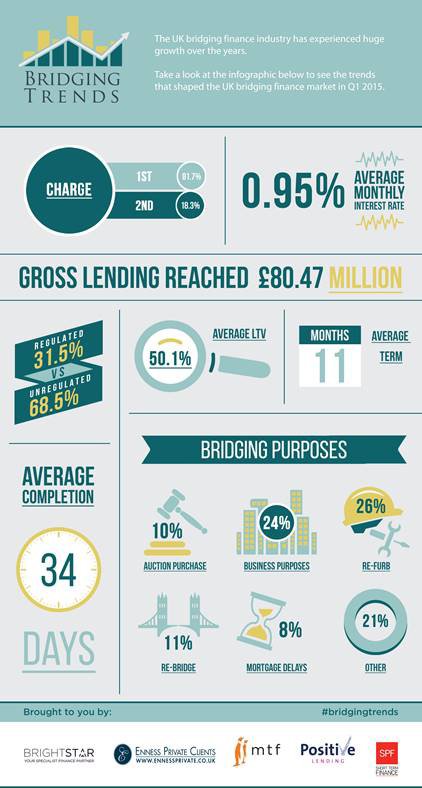

Bridging Trends will be updated quarterly and will measure key indicators such as average monthly interest rate, typical loan purpose and average completion time.

“There has been a lack of transparency in the bridging finance sector and we thought it would be beneficial to bring together a number of the UK finance industry’s largest packagers to collect data and present the objective information as a benchmark for the sector,” said Joshua Elash, director of bridging finance lender MTF.

“Bridging Trends will be a useful tool for financial market players as it will deliver a more realistic representation on the specialist lending market.”

In the first quarter of 2015, gross lending reached £80.5 million, while the average term was 11 months and the average monthly interest rate was 0.95%.

The average LTV was 50%, property refurbishment was most popular use for bridging loans and 69% of bridging loans were unregulated.

Elash added: “In its first quarter, the data has already shed light on some interesting factors in the bridging finance market. A significant percentage of bridging loans are unregulated, suggesting they are largely being used in a commercial context. LTV levels remain sensible, notwithstanding some recent entrants offering high LTV loans.

“However, the most significant result involves duration. An 11 month average term signifies how the bridging loan market has changed over time from being a short term fix to a longer-term facility, providing extra breathing space to the rising number of borrowers struggling to secure mainstream funding. These results suggest ‘bridging finance’ is no longer a broadly appropriate phrase and poses the question, ‘is this the new breed of specialist lending?'”

Kit Thompson, director of bridging at Brightstar Financial, said: “The split of first and second charge business was as I would expect, as was the Regulated vs Non-regulated business split. The real stand-out trends for me were the average LTV, which was surprisingly low (at 50%). The average monthly rate, which at 0.95% was higher than I expected and also the 11 month average term, which once and for all should put to bed the misconception that bridging loans are typically repaid in less than six months.

“Here at Brightstar we always encourage our brokers and borrowers, to take more time than they consider they need, just to safe-guard them against defaulting. With exit fees generally being a thing of the past, clients can always redeem early, but failing to repay by the end of the term can be extremely costly. This is where borrowers need to seek advice from bridging experts.”