NatWest Group has launched a new ‘green remortgage’ product.

The new product will offer a preferential interest rate to new or existing customers who are looking to re-mortgage an energy efficient property.

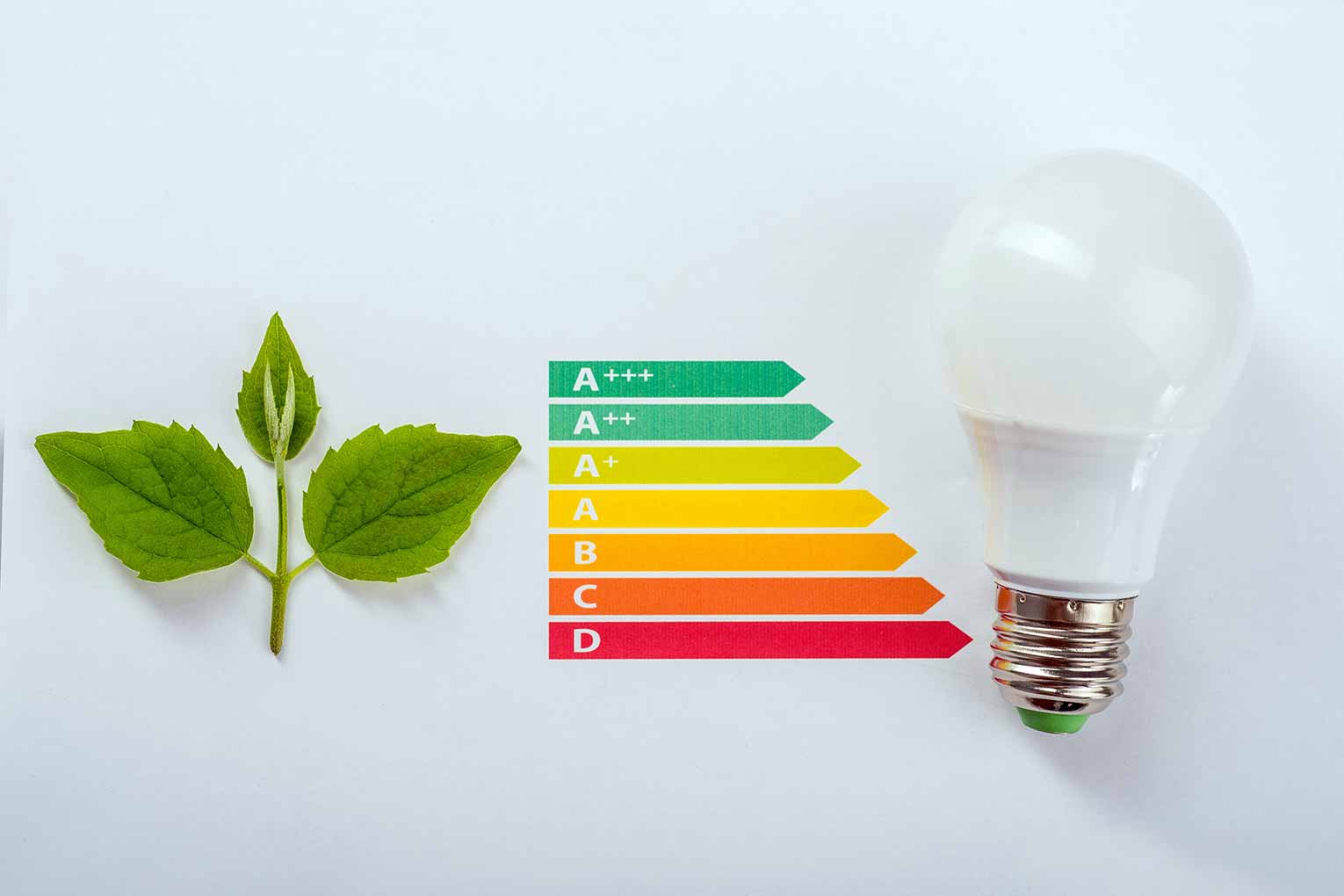

The new product will offer a discounted interest rate to customers re-mortgaging a property with an Energy Efficiency Rating of A or B. Through NatWest and Royal Bank, this will be available through direct channels including in branch, over the phone and via the website.

Every home must have an Energy Performance Certificate (EPC) when it is built, sold or rented – this gives the property an energy efficiency rating from A or 100 (most efficient) to G or 0 (least efficient) and is valid for 10 years.

The new offering will be available at maximum 85% LTV and will apply to residential homes up to a maximum value of £600k. Products available will be two and five-year fixed rates with no product fee and will be available to both first-time buyers and home movers across the UK.

The new product supports the bank’s pledge to help customers become more energy efficient with an ambition that 50% of the bank’s mortgage book is at or above EPC C or equivalent rating of C by 2030.

This week NatWest launched a ‘Sustainable Homes and Buildings Coalition’ with British Gas, Worcester Bosch, and Shelter to improve UK buildings energy efficiency. The Coalition will aim to address the key blockers to meeting net zero in the UK buildings environment.

Miguel Sard, managing director of home buying and ownership at NatWest Group, said: “We were one of the first lenders to bring our green mortgage to market last year and have seen a lot of success in rewarding customers for making greener decisions. We experienced increasing customer demand for a green re-mortgage product and we’re happy to respond to this.

“One of the core parts of our purpose as a bank is to help address the climate challenge and as the principal banking sponsor supporting COP26 in Glasgow later this year, we want to act as a catalyst in supporting the reduction of the carbon footprint from UK residential properties.”