More 2 Life has published a guide to understanding equity release lending criteria to help advisers manage client expectations.

Analysis of More 2 Life cases suggest that there are some signs that advisers should look out for when speaking to potential clients as it may make it harder to place the case or result in it being declined all together. The lending criteria around equity release plans are based on ensuring that the asset will increase in value and any issues which might impact on the value or saleability are avoided.

While criteria does typically vary from funder to funder, features such as a large proportion of the property boasting a flat roof, being situated near a busy commercial property or on a flood plain will mean that the case is more likely to be declined.

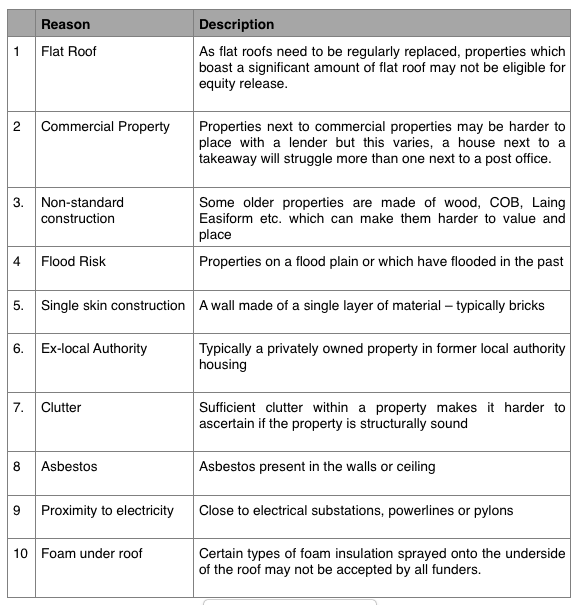

More 2 Life has identified the following potential barriers to an equity release application being successful:

Dave Harris, CEO at More 2 Life, said: “With increasing numbers of people aware of the benefits of equity release, we know that being declined by a lender can be devastating for the client and a real disappointment for the adviser who has worked to help them.

“We don’t expect advisers to be able to tell if a property is on a flood plain or not but if the client mentions that they have been flooded in the past, this should sound alarm bells and they will be aware that the case might be more difficult to place.

“Every funder has slightly different criteria and as More 2 Life work with a variety of different organisations, we are in the fortunate position that we can help the vast majority of our customers but we believe it is important to educate advisers so they can start to manage their clients’ expectations.”