Simply Business, a provider of small business and landlord insurance, has revealed the locations of the buy-to-let hotspots across the UK by analysing over 100,000 landlord insurance policies.

The data shows a significant change in the top areas for buy-to-let investment potential. London has recovered as the buy-to-let capital of the UK, with 13% growth in new buy-to-let landlords between 2023-2024, compared to just 4.11% growth the previous year.

After faltering in 2023, London’s strong continued tenant demand and the broad array of property types buoyed the market once more last year.

While Glasgow topped the chart in 2022-2023 with 11.95% growth, last year saw it fall back to the bottom of the board, with a much more conservative 7% growth in new policyholders.

Mike Harvey, a landlord in London with 25 years’ experience in the market, said: “The London rental market is performing very well. It’s straightforward to find good tenants, and rental incomes remain strong.

“As a landlord, I’m also finding that insurers are very competitive at the moment, and I have easy access to a wide range of tradespeople who are always quick to respond when I need help with my properties.

“We have a two-unit block and have found these to be the least hassle, with the nicest tenants and best investment return – so we’re very pleased with this position for the short and long term.”

UK’S BUY TO LET HOTSPOTS

| 2024 Ranking | City | Region | Annual growth* | 2023 Ranking |

| 1 | London | South East | 13.00% | 10 |

| 2 | Birmingham | West Midlands | 12.00% | 6 |

| 3 | Leicester | East Midlands | 12.00% | 5 |

| 4 | Leeds | Yorkshire | 11.00% | 3 |

| 5 | Manchester | North West | 10.00% | 7 |

| 6 | Nottingham | East Midlands | 10.00% | 2 |

| 7 | Bristol | South West | 9.00% | 4 |

| 8 | Edinburgh | Scotland | 9.00% | 9 |

| 9 | Liverpool | North West | 8.00% | 8 |

| 10 | Glasgow | Scotland | 7.00% | 1 |

| *difference in new Simply Business landlord insurance policies between 2023 and 2024 | ||||

REGULATION TO AFFECT MARKET

London is also home to the largest group of multi-property landlords in the UK – followed by Manchester, Birmingham and Nottingham. This will be an area to watch closely as we move into 2025. Last year, the Simply Business 2024 Landlord Report revealed significant challenges in the market, as landlords navigate an onslaught of confusing legislation and soaring costs.

The report, which surveyed nearly 2,000 landlords across the nation, found that almost three quarters (71%) say they think the new Government will have a negative impact on the buy-to-let market, with 69% pointing to constantly changing and confusing government legislation as their biggest challenge.

BEST AREAS FOR HMO INVESTORS

Simply Business says that it is possible that stamp duty increases, higher mortgage rates and stricter energy efficiency regulations may make portfolio ownership less appealing, or simply untenable, for landlords. In this context, houses in multiple occupation (HMOs) may become an increasingly attractive investment route.

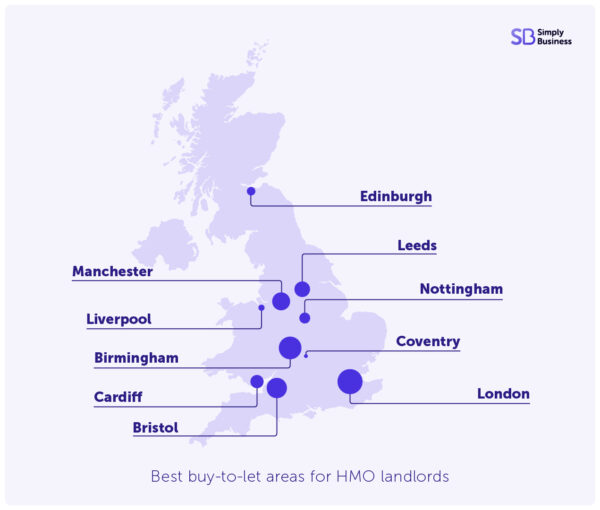

The UK’s HMO hotspots, all linked as areas of high rental demand, with a strong student and youth population, as well as plenty of property options to choose from, are: London, Birmingham, Bristol Manchester, Leeds, Cardiff, Nottingham, Edinburgh, Liverpool and Coventry.

FUTURE CHALLENGES

As well as regulatory complexity, rising costs are a major issue for landlords, with 38% reporting they consider them to be the biggest threat to the rental market. Over a third (35%) say they saw monthly mortgage repayments increase in 2024, up from 31% in 2023. Of those, 10% have seen monthly repayments increase by between £500 and £1,000.

Julie Fisher, UK CEO at Simply Business UK, said: “2025 will be a game-changer for UK landlords, with new regulations and rising costs reshaping the market. It’s incredibly telling that we’re starting to hear landlords talk about availability of tradespeople in the context of their investment decisions – driven in large part by the new minimum Energy Performance Certificate (EPC) regulations.

“We know from our research that half of landlords need to make improvements to reach an EPC rating of C, and over a third (34%) report they will need to spend up to £10,000 to comply with the rules.

“Though challenges remain, the importance and resilience of landlords – and the market – should not be underestimated. Rental demand remains high as people seek flexible housing to suit their studies and work, and landlords that are able to follow and adapt to the changes effectively can absolutely still find opportunities for steady rental income and capital growth, with a vital role to play in the UK housing market.”