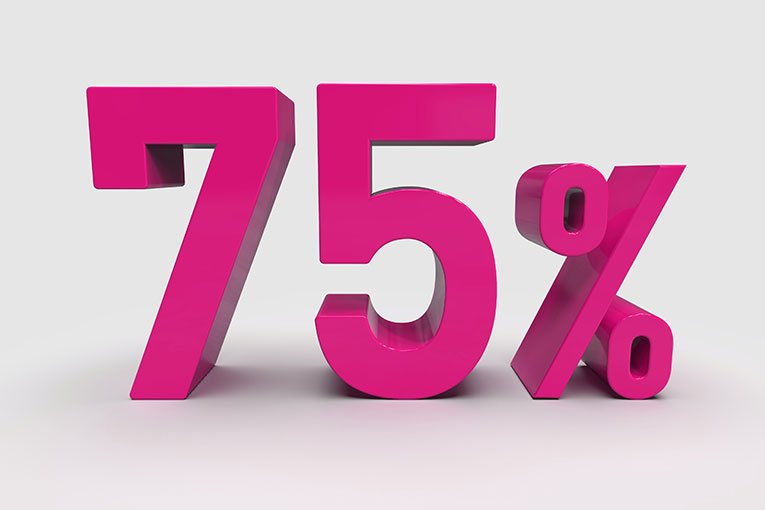

LendInvest has announced that automated valuation models (AVMs) will now be accepted up to 75% loan-to-value (LTV) on its unregulated bridging products, as the lender continues to simplify and accelerate its short-term lending proposition for property investors.

The move, unveiled today by the London-listed fintech, marks a significant enhancement to its bridging range, aiming to support SME developers and investors seeking fast access to capital for purposes such as auction purchases, refurbishment projects and bridge-to-let transitions.

By increasing the AVM threshold, LendInvest enables a faster route to funding by removing the need for physical valuations in more cases, a move designed to reduce time and cost for borrowers. The enhancement is complemented by the lender’s dual legal representation option, further streamlining the path from application to completion.

The firm also recently revamped its bridging enquiry process, making it fully mobile-responsive via its Mortgage Portals platform. Brokers can now submit an initial enquiry in as little as 90 seconds. For returning clients, the system pre-fills borrower information automatically, enabling subsequent applications to be processed more efficiently.

Leanne Ardron, managing director for short-term lending at LendInvest, said: “At LendInvest, we’ve always been focused on how we can make short-term lending simple for our brokers and their clients. By offering AVMs up to 75% LTV, we are continuing to enhance our proposition for property investors, no matter their needs.

“Along with mobile-friendly bridging enquiries and other options like dual representation, we’re proud to cut the complex on short-term lending.”