Lenders are being urged to prepare for a surge in borrower arrears as planned changes to local authority funding threaten to drive council tax increases of more than 25% in parts of London and the South East.

The warning from Target Group follows deputy prime minister Angela Rayner’s announcement of a “fair funding review” that would see money redirected towards areas deemed to have greater social need, primarily in the North of England.

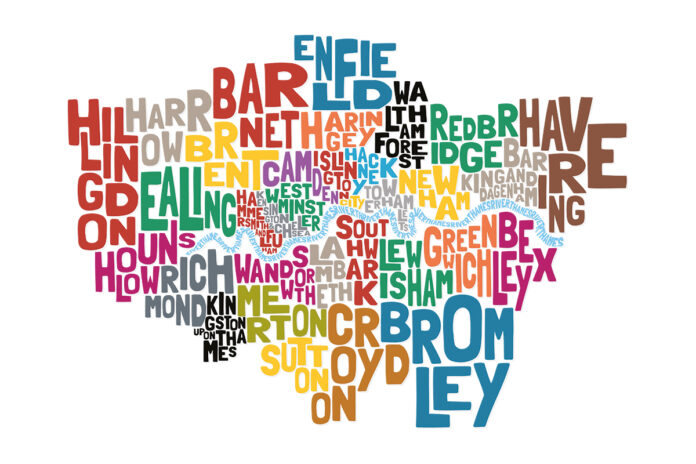

Under the proposed redistribution, some of the capital’s boroughs could lose a significant portion of their central government grants. Eight London boroughs, including Camden, Hammersmith & Fulham, and Wandsworth, are expected to be particularly hard hit.

In one example cited by Target Group, a London council facing a £30.1 million shortfall in the 2028–29 financial year said that a 1% rise in council tax would bring in only £1.1 million. The implication, the council noted, was that it would need to raise council tax by 27.4% to bridge the gap – a level of increase rarely seen in peacetime.

Melanie Spencer, growth director at Target Group, said the government’s proposals had the potential to cause severe financial stress for many households.

“It’s early days but if these reforms proceed as planned, some boroughs could lose more than 70% of their current government grant,” she said.

“Lenders should be deeply concerned the government’s proposals could leave local authorities in the position of having to ramp up council taxes by more than a quarter.

“Borrowers in those local authorities won’t have budgeted for this. And this could well be the thin end of the wedge.

“If councils across the south east and south west of the country start having to put up council tax by more than 25%, borrowers in those areas are going to find themselves very stretched.”

Spencer called on lenders to ensure their collections teams are prepared to deal with a potential rise in arrears, warning that support for vulnerable borrowers will need to be both proactive and precise.

“Lenders need to focus on using data intelligently to identify borrowers who may be starting to struggle and early engagement with people who have started to slip into arrears,” she said.

“The cost-of-living crisis is far from over and the support lenders offer will need to be targeted and timely. Lenders will need the right systems in place to manage processes proactively. Early contact and remediation are key to keeping repossession a last resort and achieving better outcomes for borrowers and lenders alike. That requires investment in systems.”

While local authorities are ordinarily limited to a 5% council tax rise without holding a local referendum, the government does issue waivers to certain councils each year, allowing them to bypass that threshold.

The fair funding review has already prompted concern among southern councils, who argue the proposals could disproportionately affect areas with high living costs. Although ministers say the reforms are intended to address inequality, critics warn that sudden reductions in central support will leave many councils with no option but to raise taxes sharply or make deep service cuts.

For lenders, the challenge lies in anticipating the financial impact on borrowers who may not yet realise the scale of the increases being discussed. With mortgage arrears already under pressure from rising interest rates and household costs, a sharp and unexpected rise in council tax could push many over the edge.