76% of landlords who let to students think that demand for property is either good or excellent, according to a new survey by Paragon Mortgages.

Despite reports of a modest decline in student numbers for the 2012/2013 academic year, the buy-to-let lender says those landlords who do let property to student tenants are feeling positive.

Research by BDRC Continental of NLA landlords also reported on student landlords’ growing confidence in the market, with 70% saying that they rate the prospects for future investment in student property as good.

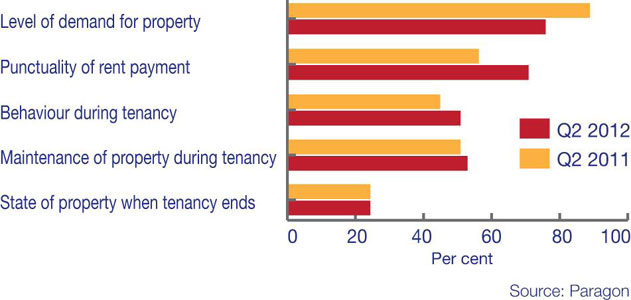

Of those surveyed in the PRS Trends Survey, 71% said that they find student tenants good or excellent in terms of the punctuality of paying rent. 53% also rated student tenants’ behaviour as good or excellent.

Any negative experiences reported by landlords centred on the maintenance of property during the tenancy agreement, with just 38% rating this as good or excellent, and only 24% rating the state of the property as good or excellent at the end of the tenancy agreement.

Landlords were also asked to comment on whether the changes in tuition fees would affect demand for student rental property. Of those letting to students 57% said that in their view there had been no change in demand for student lets.

“The student rental market is one of the largest specialist components of the private rented sector,’ said John Heron, managing director of Paragon Mortgages.

“Letting student property is appealing to landlords as they usually benefit from higher than average rental yields as rooms tend to be let on an individual basis. There are generally lower levels of arrears too as student tenancy agreements benefit from parental guarantees.

“Landlords who let a proportion of their portfolio to students are feeling positive about the market and their experience of letting to students continues to be good. This is an area of the private rented sector which will continue to thrive as long as the demand for university places continues.”