A month after Labour’s first Budget raised the stamp duty surcharge (SDLT) on second homes from 3% to 5%, landlords remain undeterred.

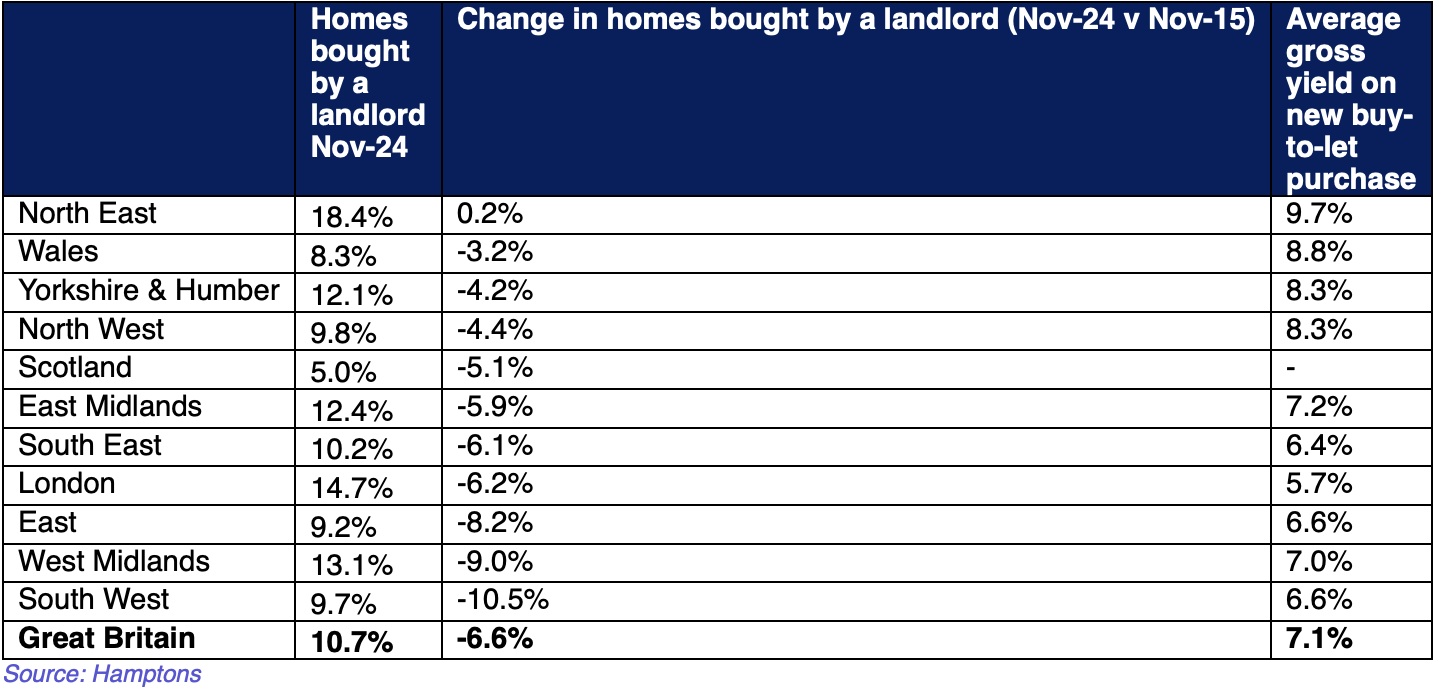

Data from Hamptons reveals that in November, 10.7% of homes sold in Great Britain went to investors, slightly above the 2024 average of 10.2%.

Despite the overnight cost increase, the proportion of investors withdrawing from agreed purchases remained modest, at half the levels observed after the 2022 mini-Budget, when mortgage rates soared. This resilience highlights a market adapting to evolving economic pressures and fiscal policy changes.

The North of England continues to benefit most from the SDLT hike. Lower property prices in this region mean smaller absolute increases in stamp duty bills, sustaining its appeal to landlords.

The North of England continues to benefit most from the SDLT hike. Lower property prices in this region mean smaller absolute increases in stamp duty bills, sustaining its appeal to landlords.

However higher stamp duty costs in southern regions, particularly outside London, are further discouraging buy-to-let investments.

While landlord activity remains below the 2015 peak of 15.7%, it is consistent with trends from recent years. Investors accounted for 10.8% of buyers in 2019 and 10.9% in 2020 – highlighting a stabilising market where buy-to-let investments are a smaller but persistent share of transactions.

INVESTORS ON TRACK

Hamptons’ analysis indicates that most landlords who agreed purchases before the surcharge increase have remained committed.

Only 28% of these deals were renegotiated or remarketed in the three months leading up to the Budget, a sharp improvement from the fallout of the 2022 mini-Budget.

For a typical £300,000 property, an investor now faces an SDLT bill of £17,500 (5.8%), compared to just £2,500 (0.8%) for movers and zero for first-time buyers. These figures will rise by an additional £2,500 for investors and movers in April 2025, further sharpening the financial divide.

REGIONAL SHIFTS

The North East has emerged as a stronghold for buy-to-let activity.

The North East has emerged as a stronghold for buy-to-let activity.

In November, 18.4% of homes sold in the region were purchased by landlords, surpassing pre-2016 levels before the initial SDLT surcharge was introduced.

Here, average property prices mean smaller stamp duty bills; for example, a typical £115,000 buy-to-let purchase now incurs a £5,750 stamp duty charge, up from £3,450.

A growing number of southern-based investors are looking northward, drawn by lower costs, higher yields, and faster property price growth.

The North East currently offers an average gross yield of 9.7%, compared to 5.7% in London, making it an increasingly attractive investment option.

REVENUE SPIKE

The original 3% SDLT surcharge introduced in 2016 significantly exceeded government revenue estimates, raising two to three times the projected £700 million-£900 million annually.

The latest hike to 5% is expected to generate an additional £400 million annually, with November’s robust buy-to-let activity supporting these projections.

In Scotland, where the SDLT surcharge increased from 6% to 8% on December 5, revenue from landlords and second-home buyers accounted for 31% of total stamp duty revenue in 2024 (January-October).

Meanwhile, in England, this share stood at 47% for the first nine months of the year, underscoring the sector’s substantial fiscal contribution.

STRONG BUT SLOW RENTAL MARKET

Rental growth is slowing after a four-year boom, with average rents on newly let properties rising by just 2.6% over the past year – the smallest increase since November 2020.

Despite this, rents have surged 31.6% since 2020, outpacing wage growth.

Scotland and Northern England lead the way, with annual rent increases of 7.2% and 5.7%, respectively. In London, however, rents edged up by just 0.4%, reflecting the slowest growth in the country. Southern England saw increases ranging from 1.8% to 2.9%.

Improved rental stock is easing pressure on rents. The number of homes available to rent across Great Britain in November was 13% higher than the previous year, narrowing the gap with pre-pandemic levels. Stock levels are now only 10% below those seen in November 2019.

LANDLORD RESILIENCE

Aneisha Beveridge, Head of Research at Hamptons, says: “Early signs suggest new landlords have shown resilience to yet another cost increase. While buy-to-let purchases remain subdued compared to historic peaks, their numbers have not collapsed.”

And she adds: “Landlord activity is increasingly concentrated in the Midlands and Northern England, where the surcharge has a smaller impact. Falling interest rates next year could further bolster buy-to-let returns, particularly in regions offering gross yields above 8%, making them a compelling option for investors seeking alternatives to lower-yield savings accounts.

“After unprecedented growth, rental increases have slowed to pre-pandemic levels. However, forces driving rent growth haven’t disappeared entirely, with renewing tenants still facing above-average hikes, albeit at a moderating pace.”