Housing affordability remains stretched by historic standards despite recent earnings growth marginally outpacing house price growth and a slight reduction in average borrowing costs, latest research from Nationwide reveals.

The Society’s Housing Affordability Report shows a prospective buyer earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 36% of their take-home pay – well above the long-run average of 30%.

Those in London and South of England are the most stretched with the North of England and Scotland the most affordable places to purchase a property.

House prices also remain high relative to average earnings, with the first-time buyer (FTB) house price to earnings ratio (HPER) standing at 5.0 at the end of 2024, still far above the long run average of 3.9.

HIGH DEPOSIT HURDLES

Andrew Harvey, Senior Economist at Nationwide, says: “Consequently, the deposit hurdle remains high. This is a challenge that has been made worse by the record increase in rents in recent years, which, together with the cost-of-living crisis more generally, has hampered the ability of many in the private rented sector to save.”

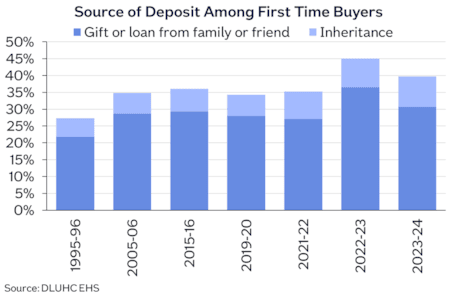

And he adds: “It’s not surprising that a significant proportion of first-time buyers have to draw on help from friends and family to raise a deposit.”

In 2023/24, around 40% of first-time buyers had some assistance raising a deposit, either in the form of a gift or loan from family or friends or through an inheritance.

Despite these affordability challenges, the society says mortgage market activity and house prices proved surprisingly resilient in 2024.

MARKED IMPROVEMENT

Harvey adds: “Annual house price growth ended the year at 4.7%, a marked improvement from the small declines seen at the start of 2024.

“The number of mortgage approvals returned to 2019 levels, despite typical mortgage rates being around three times higher.

“Perhaps even more remarkably, first-time buyers’ share of house purchase mortgages was actually higher in 2024 (54%) than it was pre-pandemic (51%).

“Looking ahead, providing the economy recovers steadily, as we expect, the underlying pace of housing market activity is likely to continue to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth.”