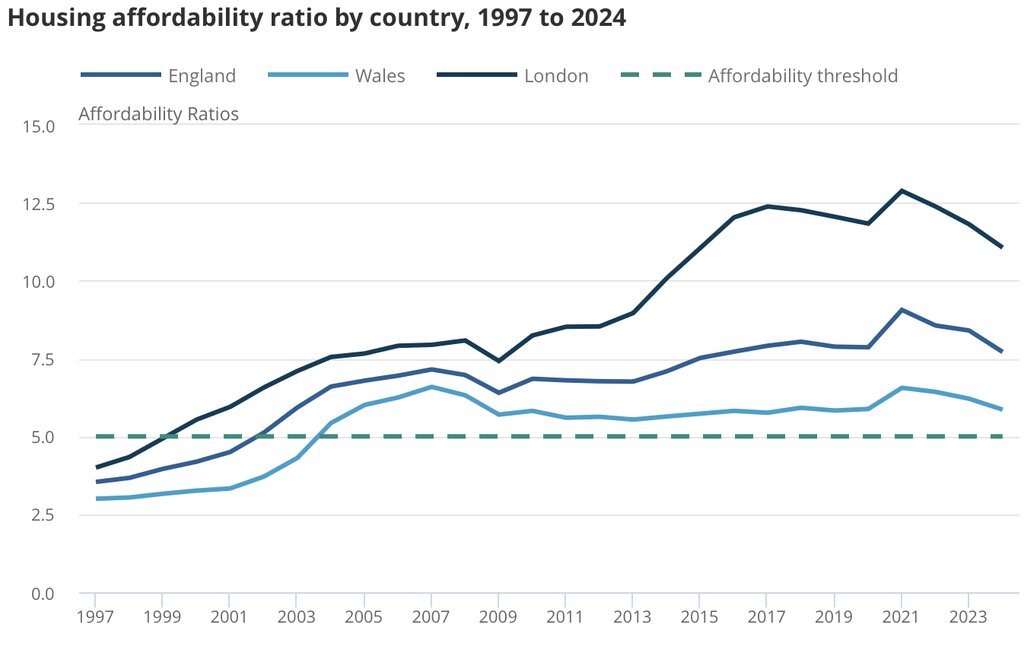

Housing affordability in England and Wales has returned to levels last seen before the coronavirus pandemic, as wages outpaced house price growth, according to new data from the Office for National Statistics (ONS).

In 2024, the median house price in England stood at £290,000, equating to 7.7 times the median full-time salary of £37,600.

In Wales, the median home cost £201,000, or 5.9 times the median earnings of £34,300. The figures mark a significant shift from the sharp deterioration in affordability seen between 2020 and 2021.

While median house prices have risen just 1% since 2021, wages have increased by 20% over the same period, bringing affordability levels back to those recorded in 2018, 2019, and 2020.

AFFORDABILITY IMPROVEMENT

The ONS found that in 2024, 9% of local authorities (27 out of 318) had homes available at less than five times workers’ annual earnings, a level deemed relatively affordable. This marks the highest proportion of affordable areas since 2015, though still far below the 88% recorded in 1997, when the data series began.

Over the past year, affordability has improved in 91% of local authorities (289 out of 318) but worsened in the remaining 9% (28 areas).

The most affordable local authorities in 2024 were Blaenau Gwent (with an affordability ratio of 3.8), Burnley (3.9), and Blackpool (3.9). At the other end of the spectrum, Kensington and Chelsea remained the least affordable, with an affordability ratio of 27.1 – seven times less affordable than the most accessible markets.

REGIONAL TRENDS

Between 2019 and 2024, affordability ratios worsened most in the East Midlands, with four of the 10 largest increases occurring in the region. In contrast, all ten of the largest improvements were recorded in London boroughs.

London, traditionally the least affordable region in England, saw its affordability ratio peak at 12.9 in 2021.

By 2024, the figure had fallen to 11.1, bringing it back in line with 2015 levels. In Wales, affordability ratios have been more stable over the years, peaking at 6.6 in 2007 and remaining between 5.5 and 6.5 since 2009.

HOUSE PRICES FALLING

The return to pre-pandemic affordability levels has been driven by both modest declines in house prices and continued wage growth.

Over the year to September 2024, the median house price in England and Wales fell by £7,500 (2.6%), while median annual earnings rose by £2,400 (5.6%).

Although affordability has improved, many first-time buyers continue to face challenges in getting onto the property ladder due to high deposit requirements, mortgage rates, and regional disparities in earnings.

The long-term trajectory of affordability will depend on interest rate movements, housebuilding activity and broader economic conditions.

AFFORDABILITY RATIO HAS DECREASED

Toby Leek, President of NAEA Propertymark, said: “As many people battle increases in ongoing expenses, it’s positive to see that this easing counteracts some of those pressures and allows home ownership aspirations to continue for many people.

“Notably more so in England, the affordability ratio has decreased significantly, with areas from up and down the country becoming more affordable allowing people across the country to step onto the housing ladder or move home more easily.

“In Wales, affordability has notoriously been better than across other areas of the UK, therefore, to see this further improve in 2024 is great news.”

ONGOING ISSUES

But he added: “However, ongoing issues remain, especially for first-time buyers as the average deposit needed to enter the market and take advantage of more competitive mortgage deals currently sits at around £50,000 which is out of reach for many people.

“Alongside this, interest rates are higher than what many are used to witnessing, which continues to place additional pressure on finances.

“Government-backed schemes are needed for first-time buyers moving forward and once inflation, and in turn interest rates, continue on their downward path, we hope this also offers the extra boost many other people need in order to work toward their home ownership goals.”