UK house prices rose at their fastest pace since January with the average property price climbing to a new record high of £299,862 in October, according to the latest Halifax House Price Index.

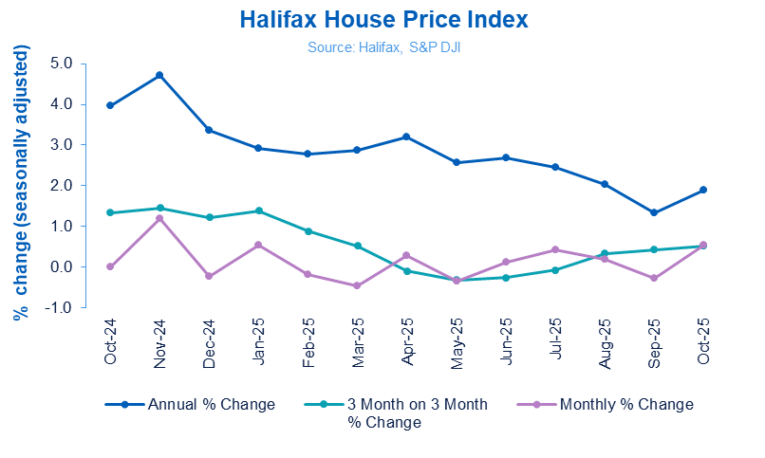

Values increased by 0.6% over the month, reversing September’s 0.3% decline and marking the fourth rise in the past five months.

Over the quarter, prices were up 0.5%, while the annual rate of growth accelerated to 1.9% from 1.3% in September – signalling that the housing market remains more resilient than expected amid economic uncertainty.

The increase comes as mortgage approvals reached their highest level of the year, suggesting that demand from homebuyers has held firm despite affordability pressures and relatively high borrowing costs.

CAUTIOUS OPTIMISM

Average mortgage rates remain around 4% but easing inflation and expectations of future rate cuts have provided cautious optimism for both buyers and lenders.

While house prices have now risen for most of 2025, affordability continues to weigh on sentiment.

The average UK home has gained £1,647 in value since September, and with prices now near £300,000, many households are finding it increasingly difficult to move up the ladder.

However, incomes have grown faster than property values for almost three years, slowly improving the underlying affordability picture.

HIGHEST ON RECORD

Amanda Bryden, Head of Mortgages at Halifax, said: “October saw the biggest monthly rise in UK house prices since January this year, with the value of the average UK home increasing by £1,647.

“That brings the typical property price up to £299,862 – the highest on record – while annual growth also increased to 1.9%.

“Demand from buyers has held up well coming into autumn, despite a degree of uncertainty in the market, with the number of new mortgages being approved recently hitting its highest level so far this year.”

AFFORDABILITY CHALLENGE

But she added: “Even so, affordability remains a challenge for many, with property prices at record levels and rising living costs continuing to squeeze disposable incomes.”

Regionally, Northern Ireland remains the strongest performing market, with annual price growth of 8% taking the average home to £219,646. Scotland also saw a solid 4.4% rise to £216,051, while prices in Wales were up 2% to £229,558.

In England, the North East led growth with a 4.1% annual increase to £180,924. London and the South East were the only regions to record price falls, slipping by 0.3% and 0.1% respectively. The capital remains the most expensive part of the UK, with an average property price of £542,273.

STRONGER POSITION

Mark Harris, chief executive of mortgage broker SPF Private Clients, says: “Affordability is slowly improving as lenders ease criteria and reduce rates, which is putting those ready to proceed with their purchases in a stronger position.

“Although the Bank of England held interest rates at yesterday’s meeting, the vote was closer than expected with four of the nine members favouring a rate cut, which bodes well for a further reduction in December.

“Market expectations are for another rate cut before the end of the year, with Nationwide, Santander, Halifax and NatWest, among other lenders, reducing rates in recent days in an effort to drum up business before year end.”

COMPETITION PUSHING PRICE UP

Tomer Aboody, director of specialist lender MT Finance, says: “With the Budget coming up, many fear further hits to the economy. Possibly in anticipation of this, buyers have been making their move.

“With a lack of supply due to little encouragement from the government for people to move, we are seeing competition among buyers pushing prices up.”

MARRED BY UNCERTAINTY

Professor Joe Nellis is economic adviser at MHA, the accountancy and advisory firm, said: “The Halifax House Price Index reveals a housing market caught between stability and strain. A rise in prices of 0.6% in October shows resilient demand but year-on-year growth of 1.9% is one of the weakest paces in 2025.

“The overall figures show a market losing momentum but not collapsing. Buyers remain cautious, stretched by higher mortgage rates and cost-of-living pressures, while sellers are holding firm on price expectations.

“The result is a market that is quiet and marred by uncertainty, despite more positive growth in October than expected.”

BUDGET RUMOURS

Ian Futcher, financial planner at Quilter, added: “Several months of speculation on what is to come has driven caution across all aspects of personal finances, and the housing market had been bearing much of the brunt.

“The market impact of the rumours around possible changes to property taxation has seemingly been countered by lower borrowing costs, which have been very gradually easing affordability constraints.

“The Bank of England’s decision to maintain the base rate at 4% may give prospective buyers or home movers pause for thought, especially as a further rate cut is widely expected by early next year which could result in buyers holding off in the hopes of securing more favourable rates.

“While house prices have risen slightly for now, the market may well re-enter its holding pattern until the Chancellor provides some much-needed clarity at the budget later this month.”

FRAGILE CONFIDENCE

Tanya Elmaz, managing director of intermediary sales at Together said: “The modest rise in house prices in October could be a sign of reviving buyer confidence in what has been an unspectacular year for the market.

“This confidence will be fragile. Yesterday’s decision by the Bank of England to hold interest rates at 4% means borrowing costs may stay higher for longer, and the upcoming Budget continues to loom over the market.

“Rumoured tax changes, including a potential reform of the stamp duty regime and a possible property tax on houses worth over £500,000 may be dampening activity as buyers assess the unknown secondary impacts.

“There have also been suggestions that National Insurance could be introduced on landlords’ rental income, which could be another hammer blow to the private rental sector.”