The pace of UK house price growth eased in April, as the property market responded to recent changes in stamp duty and a flurry of pre-deadline activity in the previous month.

According to Nationwide, annual house price growth slowed to 3.4% in April, down from 3.9% in March. On a monthly basis, prices fell by 0.6% after seasonal adjustments—marking a pause in the recovery trend seen earlier this year.

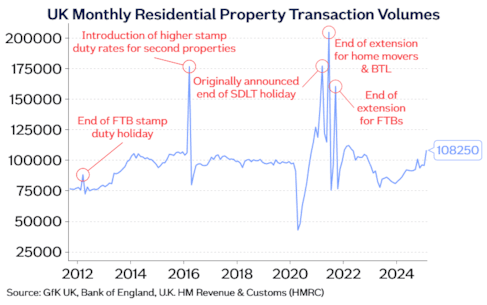

Robert Gardner, Nationwide’s Chief Economist, attributed the cooling to the expiry of temporary stamp duty thresholds at the start of April, which had prompted many buyers to accelerate transactions into March.

“Early indications suggest there was a significant jump in transactions in March,” he said. “The market is likely to remain a little soft in the coming months, following the pattern typically observed following the end of stamp duty holidays.”

But despite the short-term dip, Gardner remains cautiously optimistic.

“Underlying conditions for potential home buyers in the UK remain supportive,” he said, citing low unemployment, rising real wages, and strong household finances. He also said that borrowing costs could ease if the Bank of England cuts interest rates in the coming quarters, as many analysts now expect.

Recent moderation in swap rates – the benchmarks used to price fixed-rate mortgages – may further support affordability and stimulate demand as the market moves into the summer months.

The April figures suggest that while the end of tax incentives has temporarily dampened momentum, the foundations for a resilient property market remain in place.

ANOTHER RATE CUT

Mark Harris, chief executive of mortgage broker SPF Private Clients, says: “Another rate cut from the Bank of England next week would give a timely boost to the housing market and wider economy as the weather heats up and properties look their best.

“Lenders have been doing their bit by reducing rates and introducing enhanced affordability measures in recent days. Sub-4% mortgage rates are increasingly available and with cheaper fixed-rate mortgages and reversion rates for borrowers coming to the end of their current deals, it points to a lower rate environment going forward.

“Easing inflation is playing a part, along with the Financial Conduct Authority clarifying its stance on stress rates.”

“Easing inflation is playing a part, along with the Financial Conduct Authority clarifying its stance on stress rates.

“Many lenders are enhancing loan-to-incomes, with April’s seven times income the latest and most eye-catching of these. With NatWest, Leeds, Nationwide and Halifax all targeting first-time buyers in particular, this is encouraging for the general overall health of the housing market as more of these will help facilitate transactions further up the ladder.”

STAMP DUTY REFORM

Tomer Aboody, director of specialist lender MT Finance, says: “With buyers rushing to complete their transactions before the end of March due to the stamp duty changes, we are seeing the slowdown in April.

“With many of the budget decisions also coming into effect from this month, a subdued few months could be upon us as consumers and businesses grapple with the changes.

“Will the government see this as an opportunity to potentially own up to some erroneous decisions, and possibly reform stamp duty? Only time will tell.”

MEASURED MARKET PERFORMANCE

Jonathan Samuels, chief executive of Octane Capital, said: “It’s clear that improvements to the mortgage market and the lower rates being offered by lenders have helped to drive market confidence in recent months.

“Of course, mortgage rates still remain higher than many buyers have become accustomed to in previous years and this has resulted in a more measured market performance where house price growth is concerned.

“However, we’ve seen monthly mortgage approval numbers sit above the 60,000 threshold since January of last year, which demonstrates buyer confidence in the market and bodes very well for the year ahead.”

TRADE TARIFF TURBULENCE

And Tom Bill, head of UK residential research at Knight Frank, said: “House prices have come under pressure since the start of the year as supply outpaced demand, with buyers hesitating due to the stamp duty cliff edge in April and wider mood of economic uncertainty.

“However, the turbulence caused by US trade tariffs has since put downwards pressure on mortgage rates, which, together with the better weather, will support demand.

“The risk is that inflationary pressures creep back into the system for reasons that include recent employer tax changes, which could mean the Bank of England slows the pace of rate cuts. Together with renewed speculation ahead of the autumn Budget, it could curb buyer numbers after the summer.”