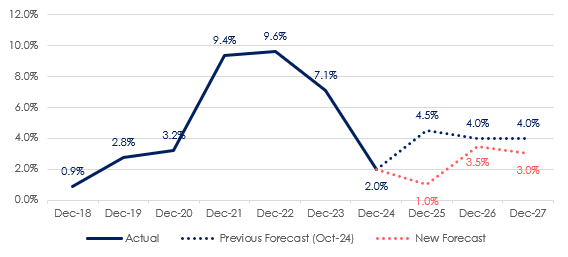

Hamptons has sharply downgraded its rental growth forecast for 2025, projecting that rents across Great Britain will rise by just 1.0% by December – a significant drop from its previous estimate of 4.5%.

The revision reflects a faster-than-expected cooling in rental growth, with average rents on newly let properties rising just 0.4% in the year to June, the weakest annual rate since August 2020 and a marked slowdown from 5.0% growth recorded in June 2024.

Driving this shift is a surge in first-time buyer activity, prompted by falling mortgage rates.

Source: Hamptons

In the first half of 2025, first-time buyers accounted for a record 33% of all home purchases across Great Britain.

As more affluent renters transition into homeownership, tenant demand has weakened: down 11% year-on-year and now 20% below 2019 levels.

RENTS DECLINING

Aneisha Beveridge, Head of Research at Hamptons, said: “What initially appeared to be a London-centric slowdown has now spread across the country, with rents declining in multiple regions and growth easing elsewhere.

“A combination of falling mortgage rates and a weaker labour market has shifted the dynamics – more affluent renters are becoming first-time buyers, while the economic slowdown is limiting what others can afford.”

And she added: “That said, this isn’t the end of the rental growth story. The structural shortage of rental homes remains unresolved, and upcoming regulatory changes, such as the Renters’ Rights Bill and new EPC requirements, are likely to constrain supply further and add to landlords’ costs.

“A slowdown in build-to-rent development this year is also expected to result in fewer new rental homes entering the market in the coming years. These pressures will continue to underpin rental growth over the medium term, even as the market recalibrates in the short term.”

BUY-TO-LET MARGINS STRAINED

While buy-to-let margins have been under sustained pressure in recent years, falling mortgage rates have reduced some of the financial strain on landlords.

With remortgaging now more affordable, many investors are less reliant on raising rents to offset costs.

At the same time, more properties are sitting on the market for longer – not due to new landlord investment, but because tenants are exiting the sector faster than they are being replaced. As a result, rental stock rose 8% year-on-year in H1 2025.

ECONOMIC HEADWINDS BITE

Broader economic conditions are also weighing on rental growth. According to HMRC data, the UK has seen a net loss of 178,000 payroll employees over the past year – with job losses concentrated in hospitality and graduate roles, sectors that historically house a high proportion of renters. The unemployment rate is now expected to rise to 5% by Q4 2026.

Meanwhile, wage growth is slowing. Average earnings rose 5.0% in May, but the Bank of England forecasts this will ease to around 3% in 2026 – further limiting tenants’ capacity to absorb higher rents.

LONDON LEADS THE DECLINE

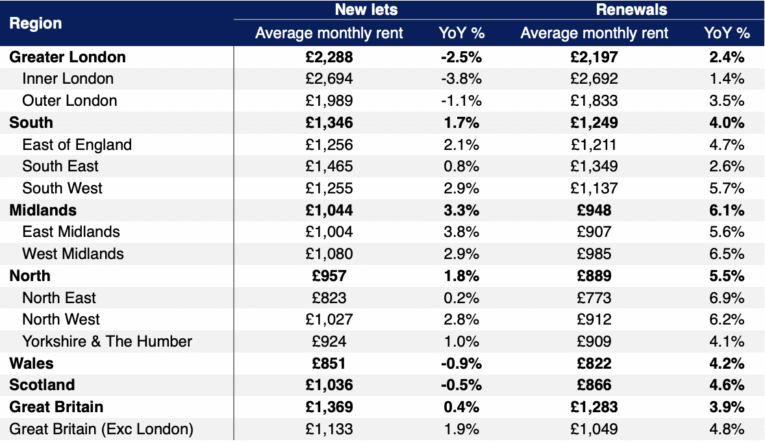

The cooling market, once centred in London, is now broad-based. Rents fell in London, Scotland and Wales in June, with growth decelerating sharply across all regions.

London remains the biggest drag on national figures. Rents in the capital fell 2.5% year-on-year in June, marking the sixth consecutive month of decline and the sharpest annual fall since May 2021. Inner London rents dropped 3.8%, bringing the average to £2,694 pcm – the lowest since October 2022.

Source: Hamptons

In Scotland, average rents dipped 0.5% – the first annual decline since 2019 – while in Wales, rents fell 0.9%. Even in the North of England, where rents had been growing fastest, annual growth slowed from 8.1% in June 2024 to 1.8% this year. The South and Midlands fared slightly better, posting 1.7% and 3.3% annual growth respectively.

RENEWALS CATCH UP WITH RENTS

The slowdown is also impacting renewals. While rents on renewed tenancies are still rising faster than those on new lets, growth has nearly halved – down from 7.6% to 3.9% year-on-year.

The average renewal now costs £1,283 pcm – just 6% or £86 per month less than a new let, narrowing the gap from 12% (£151) a year ago.

PRESSURES PERSIST

Despite the short-term slowdown, Hamptons expects structural pressures – from limited supply to new regulations – to reignite rental inflation from 2026. The agency has revised its growth forecasts for 2026 and 2027 down by 0.5% to 3.5% and 3.0% respectively, but these remain ahead of inflation and wage projections.

Over the five years to the end of 2027, Hamptons forecasts cumulative rent growth of 18% – equating to an additional £2,650 per year for the average tenant in Great Britain.

For landlords, lenders, and policymakers,the data points to a short-term reprieve for renters but continued structural imbalance in the medium term.

The evolving dynamic between rising homeownership, regulatory change and constrained rental supply will remain a critical theme for the UK housing market well beyond 2025.