Gatehouse Bank has announced reductions of up to 0.20% on its range of fixed-term buy-to-let purchase plans for UK residents.

The revised pricing applies to both two-year and five-year fixed-term products and includes standard and green options, with the reductions available to new and existing customers.

The changes extend to more complex property types such as Houses in Multiple Occupation (HMOs) and Multi-Unit Freehold Blocks (MUFBs), and the lender continues to accept applications from both individual borrowers and UK-registered Special Purpose Vehicle (SPV) limited companies.

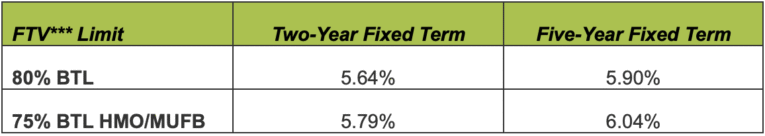

STARTING RENTAL RATES

The new starting rental rates now begin at 5.64% for two-year fixed terms at 80% finance to value, and at 5.90% for five-year equivalents.

For those seeking finance on HMO or MUFB properties at up to 75% FTV, rates start at 5.79% for two-year terms and 6.04% for five-year options.

Gemma Donnelly (main picture), head of customer propositions at Gatehouse Bank, said the changes reflected the bank’s commitment to supporting the UK’s buy-to-let market.

“We remain committed to supporting homebuyers and landlords to achieve their property ownership goals within the UK buy-to-let market,” she said.

“We are confident that today’s changes will help more people to access the home finance products they need and ensure we continue to provide a competitive offering within the market.”

Gatehouse Bank offers finance that complies with Shariah principles, meaning it charges rental rates instead of interest, based on the customer’s ownership share of the property. Its buy-to-let finance is available across a variety of structures, with no changes announced to eligibility or underwriting policy.