Funding 365 has completed a £7.2 million 75% LTV development exit loan at a rate of 0.69% per month to provide time for its developer borrower to sell their 50 new apartments in Peterborough.

The nine-month facility, introduced by Pilot Fish, enabled the borrower to exit the development funding lines which were secured against their one and two-bedroom flats and penthouse duplexes.

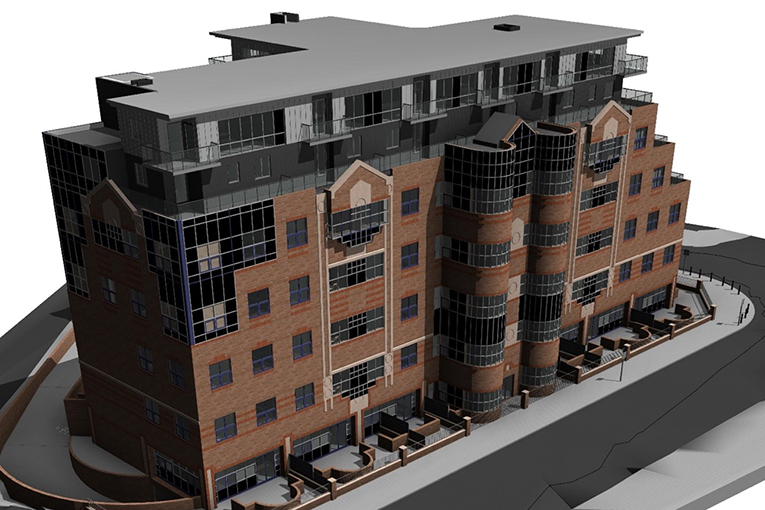

The properties are arranged over six storeys in what was previously a council office block building located in the heart of Peterborough. The quality of the conversion, combined with the prime location of the apartments, enabled Funding 365 to refinance the project at 0.69% per month – with no admin or exit fees.

The case was complex, with multiple development funding lines to be refinanced and many of the units in various stages of sales processes. Funding 365 worked closely with all parties to ensure that the loan progressed as smoothly as possible, including meeting the borrower on site with Pilot Fish. They then worked to deliver their solution the day before the deadline, in order to prevent the borrower from having to pay a whole extra month of interest on their prior borrowing.

Nikhil Shah, Funding 365’s senior underwriter, said: “Peterborough is going through an exciting period of regeneration, and we’re pleased to have had the opportunity to contribute to its growth. Delivering a complex loan like this is incredibly satisfying. Credit to the borrower, Pilot Fish and all of the solicitors for their parts in helping to ensure that it completed so smoothly.”

Richard Jones, Pilot Fish’s managing director, added: “Funding 365 worked in collaboration with us and our client to deliver this complex deal. We were impressed by their pragmatic and flexible approach to dealing with legal issues as and when they arose and we were delighted to get this deal over the line on time, with their support.”