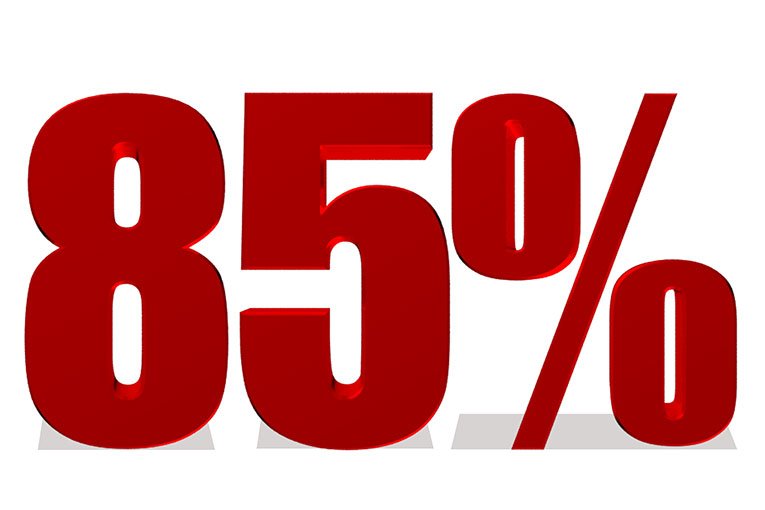

Foundation Home Loans has launched a new five-year fixed buy-to-let mortgage at 85% loan-to-value (LTV).

The product, part of the lender’s F1 range, is available to both individual landlords and limited companies. It carries no product fee, offers a fixed rate of 6.49%, and is available for loans of £100,000 or more.

In addition, there is no minimum income requirement and Foundation will continue to offer same-day decisions in principle.

By entering the 85% LTV market, the intermediary-only specialist lender aims to provide a low-deposit option to landlords who may otherwise struggle with affordability barriers. The product has been designed to appeal to a broad spectrum of borrowers, from first-time landlords to experienced investors seeking to release equity or add to their portfolios.

Tom Jacob, director of product and marketing at Foundation Home Loans, said the move marked a “significant step” for the business and the buy-to-let market more widely.

“Extending our core buy-to-let offering into the 85% LTV band represents a significant step for the business and a big moment in buy-to-let lending,” he said.

“It provides landlords and our intermediary partners with a compelling, low-deposit route to access funding in a market where affordability can often be a barrier – particularly for those looking to maximise leverage or reduce upfront costs.

“Whether it’s a client’s first rental property or an addition to an existing portfolio, this product opens up new borrowing opportunities with the reassurance of a competitive, fee-free rate and our trademark fast turnaround times. We expect it to be an extremely popular option.”

The new offering complements Foundation’s existing buy-to-let range, which spans standard and specialist cases, and reinforces its positioning as a responsive lender focused on evolving market needs.