The number of homes flipped across England and Wales has fallen to its lowest level since 2013 as rising stamp duty charges and a cooling sales market combine to erode investor profits, according to new figures from Hamptons.

In Q1 2025, just 2.3% of all homes sold were flipped – defined as bought and resold within 12 months – down from 3.6% in Q1 2024 and half the level recorded at the height of the trend in 2017.

In absolute terms, 7,301 homes were flipped during the quarter, a figure 27% below the 10-year seasonal average of 10,000.

While 80% of these homes were sold for more than they were bought for, only 66% turned a profit once stamp duty was considered and fewer still once renovation costs were factored in.

STAMP DUTY COSTS

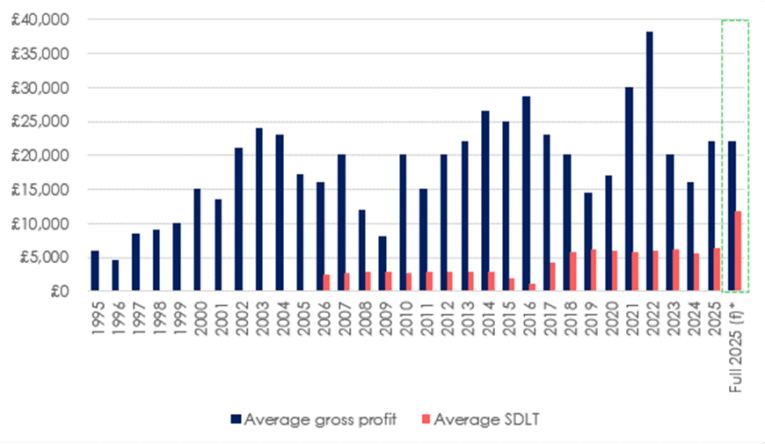

Stamp duty is now the single largest upfront cost facing most flippers. A combination of the increased 5% second home surcharge (introduced in October 2024) and the halving of the nil-rate band to £125,000 in April 2025 means investors today face an average SDLT bill of £11,920 per flipped property – roughly 30% of the average gross profit of £22,000. That compares with just 10% of profits in 2015.

Source: Hamptons

Over the past decade, stamp duty on flipped homes has increased by 236%, while average gross profits have fallen from a 2022 peak of £38,000 to just £22,000.

Net profits after SDLT now average £12,000, delivering a 7% yield on purchase price, less than half the 16% return achieved in 2015.

Hamptons warns that profitability will be further squeezed when factoring in rising refurbishment costs and slower house price growth.

Based on Q1 sales and current stamp duty rates, just 59% of flipped homes would have achieved a net profit – the lowest figure since 2009.

REGIONAL VARIATIONS

Flipping has increasingly retreated from the South, where high prices and taxes have undermined viability. In London, just 1.5% of homes sold in Q1 2025 had been flipped, down from 3.2% a decade ago. The average SDLT bill on a flipped property in the capital now stands at £33,000, equivalent to 23% of gross profit.

By contrast, the North East remains a stronghold for flippers. Here, 4.7% of homes sold in Q1 2025 were flipped – more than double the national average – with Redcar and Cleveland topping the local authority leaderboard.

The region is also the only part of England and Wales where flipping has increased over the past decade, thanks in part to a high proportion of sub-£40,000 properties that are exempt from stamp duty altogether.

WIPING OUT PROFIT

Aneisha Beveridge, Head of Research at Hamptons, said: “Bigger stamp duty bills are wiping out a lot of profit from flipping. The 5% surcharge for investors, coupled with a reduction in the point at which buyers start paying stamp duty, means it’s harder than ever to make the sums stack up.

“Stamp duty bills now account for nearly a third of gross profits. And in some cases, these bills are now higher than the cost of renovating the property.

“This, together with rising material and labour costs and, in some places, falling house prices, makes flipping homes an increasingly tricky business.”

UNINTENDED CONSEQUENCES

And she added: “The second home stamp duty surcharge was introduced to tilt the market towards first-time buyers at the expense of landlords, something that it has successfully done.

“However, it has also multiplied the costs for those people who are refurbishing homes to a level that’s increasingly unviable.

“These are often empty homes which need a lot of love and are typically projects which most first-time buyers and movers have shied away from.

“These rising upfront costs have pushed investors further North, where properties can still be bought without paying any stamp duty.

“It’s also where more house price growth has been concentrated over the last few years. While the returns aren’t as high as with homes in the South in cash terms, higher yields and lower tax bills continue to make the North the homeland of flipping.”