A decade on from the early 2010s property surge new analysis by Rightmove reveals a significant shift in first-time buyer behaviour with cities regaining popularity while interest in coastal living remains static.

The findings suggest the long-term influence of remote working may be waning, as first-time buyers refocus on employment, infrastructure and lifestyle access typically offered by cities.

The study, which compared buyer enquiry data from January to May 2025 against the same period in 2015, found that demand from first-time buyers for city homes has risen by an average of 16% over the past 10 years. However demand for coastal properties has remained flat.

The research focused on typical first-time buyer stock – homes with up to two bedrooms – across 50 of the UK’s largest cities (excluding London) and 50 of the most popular coastal locations based on enquiry volume.

CITY HOT SPOTS

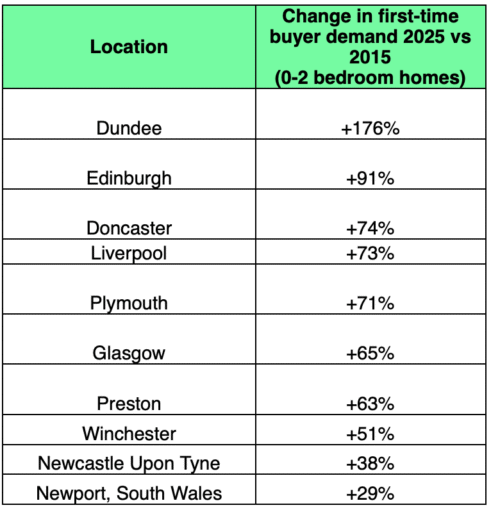

Dundee leads the city resurgence, with first-time buyer enquiries up 176% since 2015, followed by Edinburgh (+91%) and Doncaster (+74%).

London bucks the city trend, seeing a 7% drop in first-time buyer demand over the same period – a decline likely linked to affordability pressures as average asking prices in the capital remain among the highest in the country.

Both city and coastal locations analysed have seen house prices rise by an average of 41% over the past ten years. Yet while pricing has moved in lockstep, buyer behaviour has diverged significantly.

FIRST-TIME BUYER CITY APPEAL

Colleen Babcock, property expert at Rightmove, said: “We’ve seen a number of changes to the property market over the last 10 years. Perhaps most notably is during the pandemic, when many people temporarily left cities and looked to the coast or countryside.

“Comparing where we are now versus a decade ago, it looks like there’s even more appeal from potential first-time buyers to live in cities, though the data does show that it can vary quite widely from city to city, and it will also depend how first-time buyer friendly a particular location is in terms of the type of homes that are available for sale.”

She added: “Coastal areas haven’t seen the same level of growth as cities from this type of buyer, and again it may be partly due to the availability of suitable homes in these areas for first-time buyers as well as affordability.”