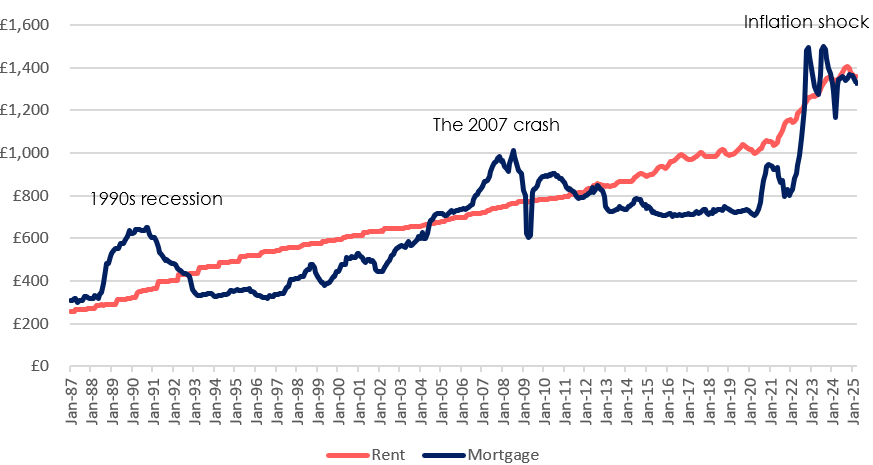

The monthly cost of buying a home is now the same as renting across Great Britain as stabilising mortgage rates bring the housing market back in line with its long-term trend, new data from Hamptons reveals.

A typical first-time buyer with a 10% deposit now faces average monthly mortgage payments of £1,328, marginally below the average monthly rent of £1,356.

This marks a significant shift from two years ago, when rapidly rising interest rates made renting £48 per month cheaper than buying.

MORE COST-EFFECTIVE

For much of the past four decades, buying has generally been the more cost-effective option.

Since January 1987, renting has only been cheaper than buying in 36% of months, with those instances closely aligned to periods of spiking interest rates rather than falling rents.

Source: Hamptons / Bank of England

The three key periods when renting became more affordable than buying were during the early 1990s, the financial crisis of 2007–10, and after the 2022 mini-Budget, when mortgage rates surged. At their peak in the early 1990s, mortgage rates of 15% pushed average monthly payments to £649 for a buyer with a 10% deposit – nearly double the average rent at the time.

NORTH-SOUTH DIVIDE

While costs have levelled nationally, a clear north-south divide persists. In London and across the South East, South West, and East of England, renting remains more affordable than buying on a monthly basis. In contrast, in the North East, North West and Scotland, owning is still typically cheaper.

In London, the monthly cost of renting has remained below that of buying since July 2022. An average buyer in the capital would currently save around £115 per month by renting rather than purchasing with a 10% deposit.

REGIONAL VARIATIONS

These regional disparities reflect how the same interest rate can have differing effects depending on property prices.

In London, a 4.6% mortgage rate is enough to make renting and buying cost-equivalent, while further north, mortgage rates would need to exceed 6% for the balance to shift.

Source: Hamptons

At the current average mortgage rate of 5.11%, it takes 16.5 years before repayments outweigh the interest portion of monthly mortgage payments.

By comparison, when rates peaked at 6.57% in August 2023, it took 19.5 years for repayments to surpass interest – at that rate, 86% of the first monthly payment covered interest alone. When rates were just 2.38% in March 2022, that balance was achieved within one year.

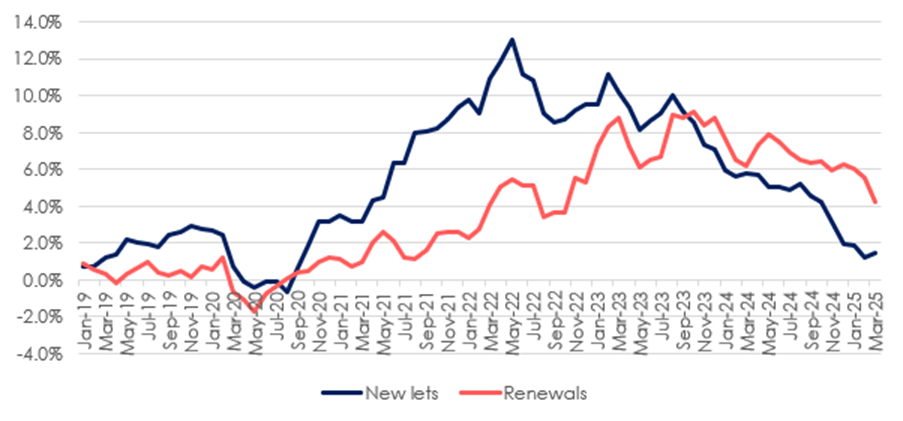

COOLING RENTAL GROWTH

In the 12 months to March 2025, the average cost of a new tenancy rose by 1.5%, while renewals saw stronger growth at 4.2%, highlighting the premium paid by new renters. London remains a drag on the national average, with rents in the capital falling 1.7% year-on-year, driven by a 4.4% decline in Inner London.

Aneisha Beveridge, head of research at Hamptons, said: “It typically takes an economic shock for renting to fall materially below the cost of buying. As the inflation shock unwinds, we could see further rate cuts – bringing down the cost of borrowing and easing pressure across both housing tenures.”