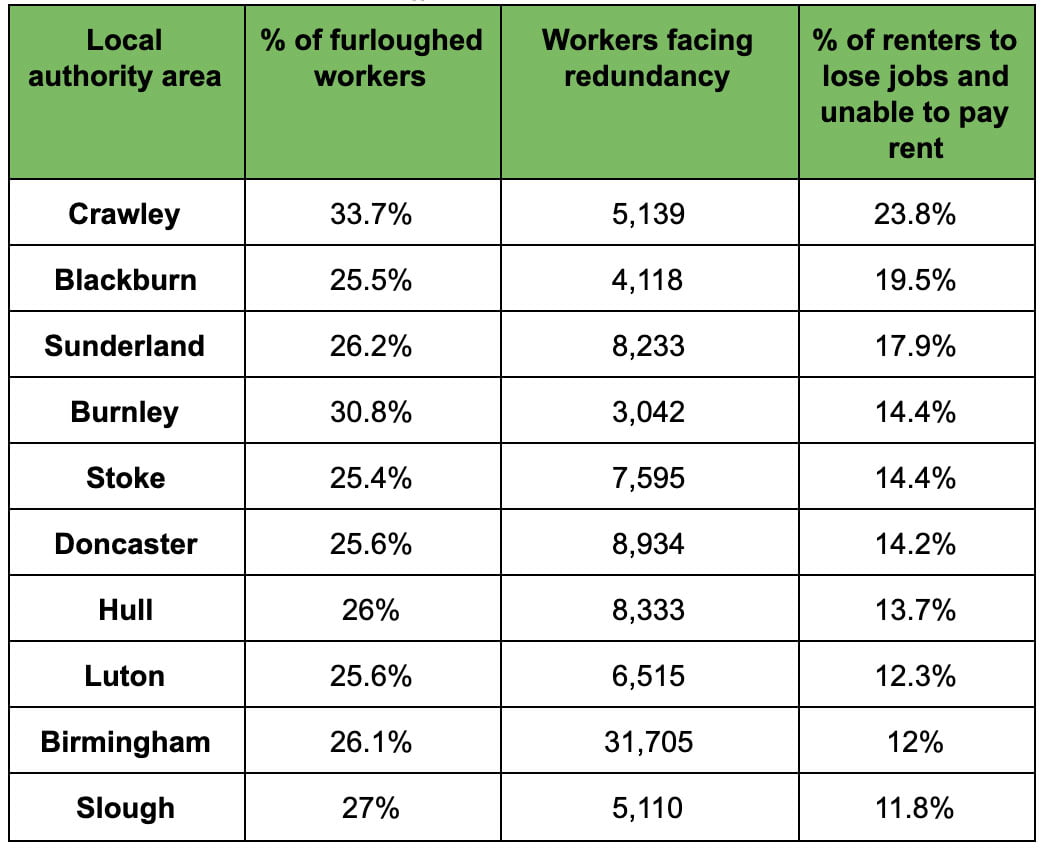

New research suggest that up to a quarter of private renters could fall into arrears in towns and cities most impacted by coronavirus.

The research, from rental technology firm Flatfair, found towns like Crawley, which has high numbers of both private renters and furloughed workers, are set to be hit the hardest by redundancies.

Flatfair’s analysis has revealed that as many as 23.8% of the West Sussex town’s private renters could be out of a job soon, leaving them unable to pay rent.

Blackburn, in Lancashire, could see 19.5% potentially fall into rent arrears after losing their jobs.

Renters in Sunderland may also be badly affected, with around 17.9% expected to be made redundant.

Franz Doerr, CEO of Flatfair, said: “While the government’s job retention scheme has ensured many thousands of workers have avoided unemployment, not every job is salvageable.

“Thousands of out-of-work renters face the very real possibility of also losing their homes if they are unable to keep up on rent payments. It is, therefore, up to both landlords and their tenants to be proactive and work together to find a solution.

“Flatfair’s free-to-use Resolve solution is an online portal which allows landlords to quickly and transparently negotiate and agree on a rent repayment plan in the event of any current or expected rent arrears.

“Landlords looking to further safeguard their income can also take advantage of Boost, which provides an additional six weeks of damage protection on top of the maximum of five allowed through a traditional rental deposit.”