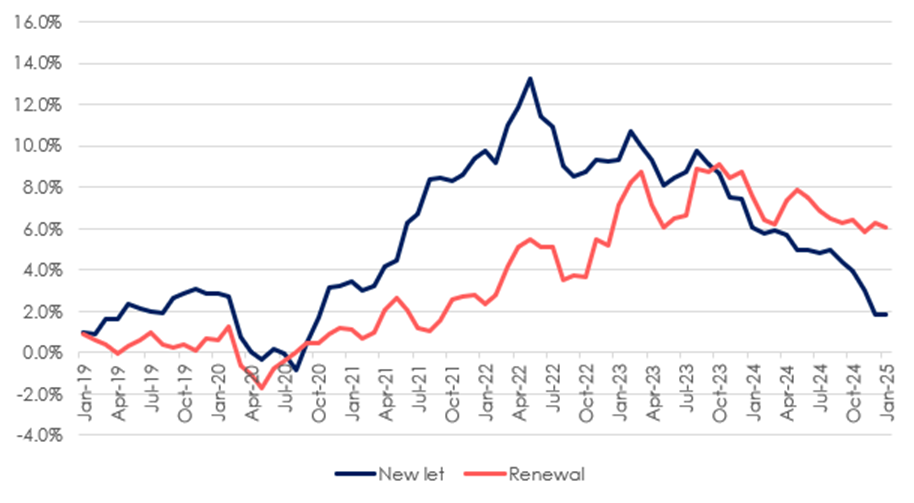

Latest data from Hamptons reveals a continued slowdown in rental growth for new lets across Great Britain — a trend that could reshape lending strategies and investor appetite.

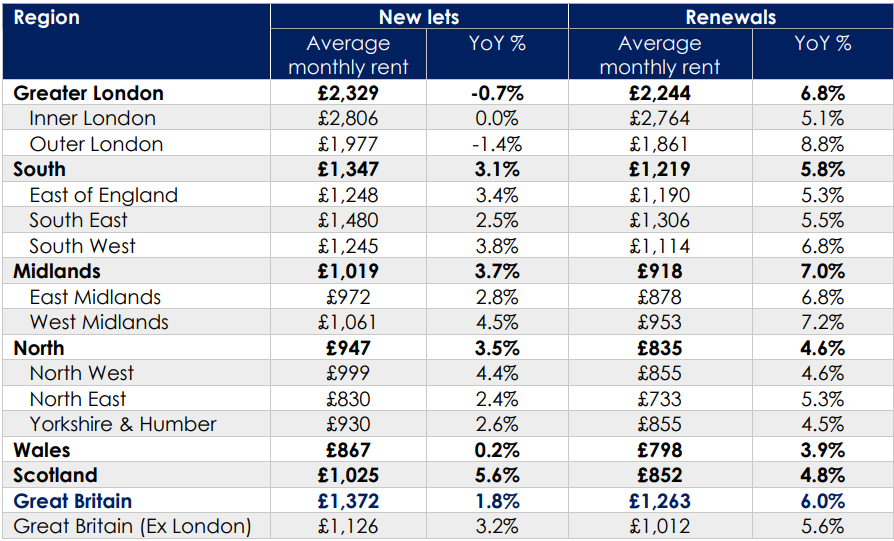

Rental growth for new lets eased to just 1.8% year-on-year in January 2025, with the average tenant moving home now paying £1,372 a month. This marks the 18th consecutive month of slowing growth, signalling that the once red-hot rental market is losing momentum.

Source: Hamptons

However, it’s a different story for tenants renewing contracts. Rents for renewals rose 6.0% over the past year – more than three times the pace of new lets – bringing the average renewal rent to £1,263 per month, still £109 lower than signing a new contract.

For brokers, this growing gap highlights a critical point: landlords are pushing up rents for existing tenants to bridge the shortfall between renewal prices and new lets, especially in regions without rent caps, like England and Wales.

OPPORTUNITIES AND RISKS

The regional divide also presents both opportunities and risks for buy-to-let investors.

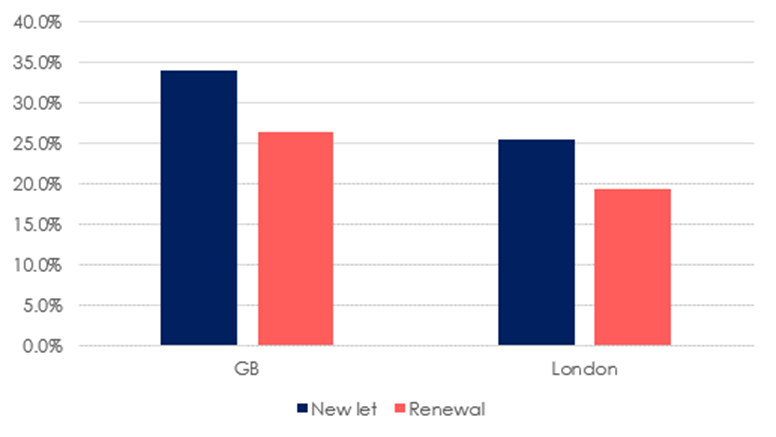

London saw a striking contrast, with rents for new lets falling by 0.7% while renewals surged by 6.8%. This is the second month of rental decline for newly let properties in the capital – a clear signal that the London market is cooling faster than expected.

Source: Hamptons

Northern England (North East, North West, and Yorkshire & Humber) experienced rental growth of just 3.5%, a sharp drop from 8.4% a year ago. Meanwhile, the South East, South West, and East of England posted a combined 3.1% growth, down from 6.2%.

SHRINKING POOL

Adding to the pressure, landlord activity has hit a record low. In January, landlords accounted for just 9.6% of property purchases in Great Britain – the lowest since records began in 2009. London saw an even steeper drop, with only 7.0% of purchases made by landlords.

In Scotland, where the Additional Dwelling Supplement increased from 6% to 8% in December 2024, landlord purchases slumped to just 4.6%.

Source: Hamptons

With rental stock levels stabilising and fewer homes available to rent – London alone has seen a 25% fall in rental stock since last year – competition for quality buy-to-let properties is set to heat up.

BOTTOMED OUT

Aneisha Beveridge (main picture), Head of Research at Hamptons, said: “The pace of rental growth nationally has likely bottomed out. There are some signs that growth outside London is slowly picking up again, but we’re unlikely to see it run at the same rate as it has over the last few years. Rather, a squeeze in the number of rental homes on the market has made securing a property more competitive than it has been in recent months.

“What happens to rents on newly let homes tends to play out in the renewal market around 18 months later. So we expect tenants renewing their contracts to face smaller increases in 2025 than they did in 2024.”

STAMP DUTY IMPACT

“Over the past five years, the lag between the two markets has saved sitting tenants an average of £6,641 each year, a saving which would have been wiped out had increases in renewal rents tightly tracked new lets.

“New purchases by landlords have been depressed by increases in stamp duty rates towards the end of last year and the prospect of tighter regulation in the form of the Renters’ Rights Bill. While purchases by landlords haven’t completely dried up, it’s looking like higher stamp duty rates have reduced the share of homes sold to landlords by between 10% and 20%.”