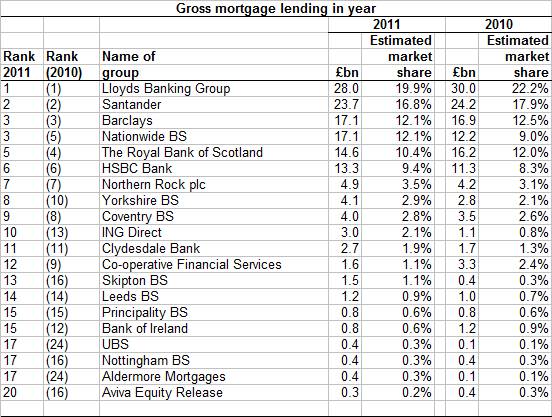

The Council of Mortgage Lenders (CML) has published its table of the top 20 largest mortgage lenders in 2011.

The trade body said the data show that, although lending remains heavily concentrated in the hands of the six largest lenders (an overall pattern that has been reinforced by the credit crunch), the next tier of medium-sized lenders increased their market share last year.

The six largest lenders advanced mortgages worth £113.8 billion in 2011, compared to £110.8 billion in the preceding year. However, despite increasing their amount of lending in absolute terms, their share of the total advanced showed a modest decline in 2011 (from 81.9% in 2010 to 80.7% last year).

The data show an expansion of lending activity by those lenders in the tier just below the largest six firms. The next five largest lenders on the list saw their market share increase from 9.9% in 2010 to 13.2% last year. In absolute terms, the amount they advanced increased to £18.7 billion from £13.3 billion in the preceding year.

The figures also show a pattern of increased market share in 2011 for larger mutual lenders. The Nationwide, Yorkshire, Coventry, Skipton and Leeds building societies all increased their market, as, among the banks, did HSBC, Barclays and some of the medium sized firms (Northern Rock and Clydesdale). Among this group, ING Direct has been, by some distance, the fastest-growing lender in relative terms over the last two years. Now ranked the 10th largest lender, ING Direct advanced mortgages worth £3 billion last year, compared with £1.1 billion in 2010 and £0.1 billion in 2009.

As in previous years, the lending totals in the CML’s tables are rounded to the nearest £100 million. Below the largest 20 lenders, this rounding effect produces a significant clustering of firms, with nominal lending totals of either £0.2 billion or £0.1 billion (this year’s list would have contained more than 20 lenders with these rounded totals).