For most of the last decade Chris Williams has been dissecting the machinery of the UK property market and helping industry understand how it can be rebuilt piece by piece.

As founder and managing partner of Novus Strategy he has positioned himself at the forefront of what he calls the “age of connection”, a period when the homebuying process must move beyond piecemeal digitisation toward full-scale transformation.

Williams’s core argument is simple: the UK property market has been stuck in a loop of incremental change for too long.

“Change,” he says, “is building a better version of the past.” True transformation, by contrast, “is fundamentally reimagining how things get done.”

That distinction lies at the heart of his mission. While many sectors have seen transaction times collapse through digitisation, the time it takes to buy, sell or remortgage a home in Britain has gone up over the past decade.

“That tells us incremental change isn’t impacting the consumer experience to the level it should,” Williams explains. “If the UK is to remain competitive, housing needs to transform – not just change.”

FROM VERTICAL TO HORIZONTAL

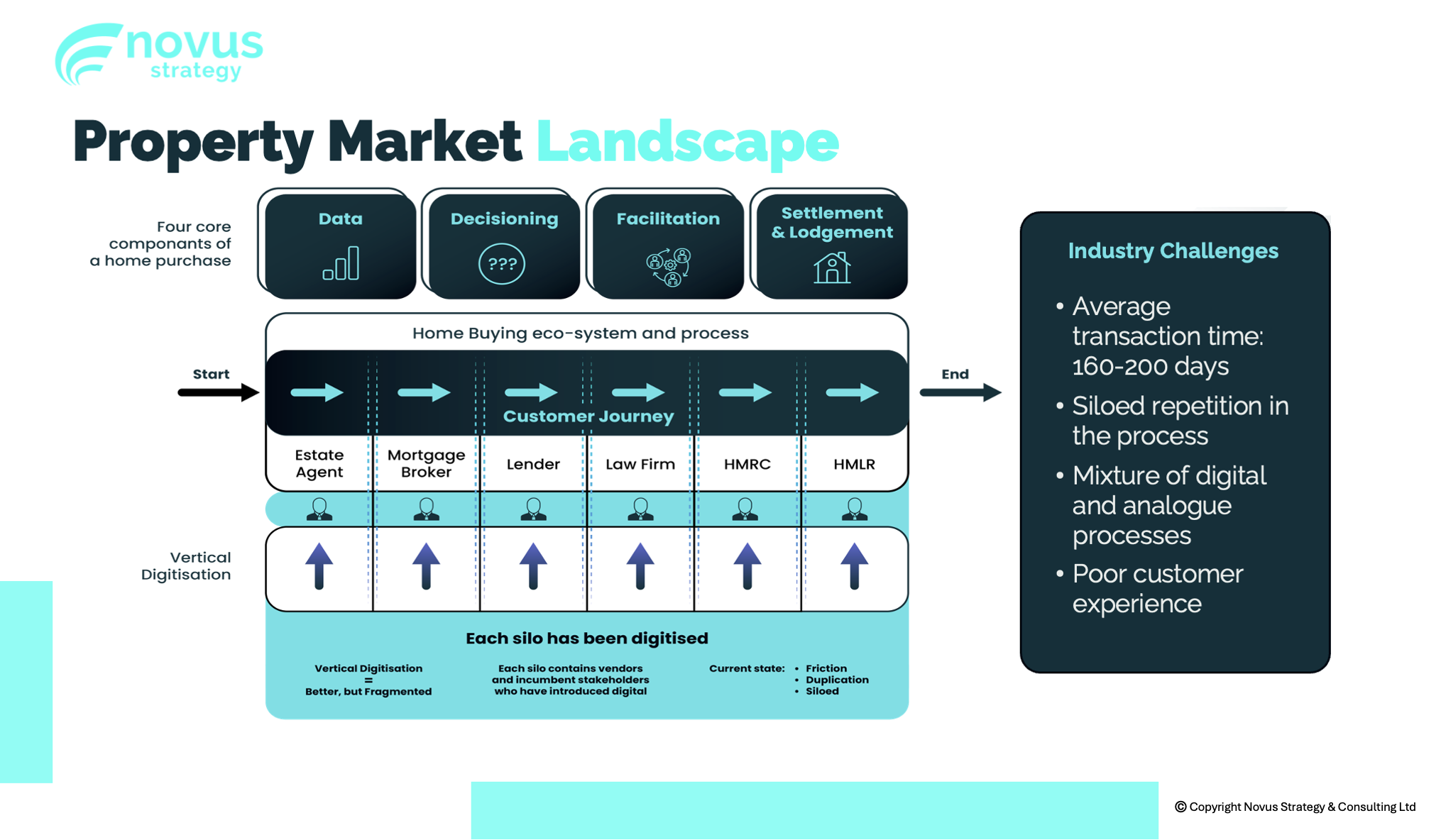

The property market, Williams argues, has so far experienced only the first phase of digital modernisation: what he terms “vertical digitisation.”

Each participant – lenders, brokers, estate agents, law firms and public bodies such as HM Land Registry and HMRC – have modernised in isolation, building their own digital systems and consumer journeys.

That approach has delivered improvements at a local level, but zooming out tells a different story.

“At the micro level, each area has improved,” Williams says. “But if you zoom out and look end-to-end, transaction times have gone up, not down.”

For him, this vertical approach has reached maturity.

“It’s built the industry’s digital capabilities to the point where transformation is now possible,” he says.

The next step, he believes, is horizontal digital integration – a term that has become the organising principle of Novus Strategy.

Horizontal digital integration, Williams explains (this really does make sense, see the graph below – ed), is the connective tissue that links each actor in the property chain – from lender to conveyancer to broker – through shared data and agreed standards.

“There are loads of technology providers,” he says. “But what the industry needs is a framework. Data standards, interoperability and shared understanding are what will take us to the next stage.”

MOMENT OF CLARITY

Novus Strategy was born out of two converging moments. The first came when a major UK lender asked Williams to assess the mortgage ecosystem’s readiness for digital transformation.

The second arrived during the pandemic, when Covid-19 accelerated digital adoption across the homebuying chain.

“The lender wanted to know how mature the market really was,” he recalls. “They’d seen rapid digital progress in other areas of the bank, but this side was moving much slower.

“Then Covid hit, and we saw how quickly digital adoption could accelerate. Those two things together – plus the fact that there wasn’t an independent specialist consultancy to help the sector transform – made it clear there was a role for us to play.”

THE AGE OF CONNECTION

Williams believes the conditions for transformation have finally aligned.

“Historically, the market lacked digital maturity across its core components – data, decisioning, facilitation and settlement,” he says.

“But by 2023, that maturity reached a peak. We now have the foundation to move from vertical to horizontal.”

He credits both the industry and consumers for this shift. “We’ve now got digitally native consumers and an industry that understands collaboration is required. The appetite and maturity are both there.”

The result, he says, is that the UK housing ecosystem has entered a new phase – one defined by connection, collaboration and standardisation.

BEATING THE SCEPTICS

For all its potential, the mortgage and conveyancing community remains cautious after years of unmet promises.

“There’s fatigue,” Williams concedes. “This industry has heard a lot of people claim they’ve got the silver bullet that will transform it.”

Rather than sell a product, Novus positions itself as a guide.

“We don’t have a platform to sell,” he says. “We’re not a vendor. We help the industry understand where it is, where it’s going and how to get there.”

He insists resistance is rare once scepticism turns to understanding.

“The industry is desperate to deliver better consumer experiences. When we show the data and demonstrate that digital maturity is there, that scepticism turns into excitement. It’s about showing people the role they can play in the transformation journey.”

REDESIGNING THE JOURNEY

Much of Williams’s workday revolves around helping major actor groups – lenders, law firms and broker and estate agency networks – redesign the homebuying journey.

“My day-to-day is about translating strategy into an actionable pathway,” he says. “Helping them sequence what needs to happen next and supporting them in execution.”

He points out that every group in the chain faces similar pressures: shrinking margins, tight capacity and rising expectations.

“Conveyancers, for example, get the rough end of the stick. They do the bulk of the work, yet they’re constantly squeezed. But by redesigning the customer journey and reconfiguring their business models, they can unlock new efficiencies.”

INDUSTRY ALIGNMENT

When the government announced plans to modernise the homebuying process, Novus Strategy was already working with major organisations to shape the agenda.

Williams welcomed the move. “The government’s role will be policy,” he says. “But what informs policy are real-world innovations already happening. The private sector will ultimately deliver this.”

He believes official recognition validates the industry’s progress. “It’s good for everyone,” he says. “It gives conveyancers, lenders and brokers a chance to contribute to consultations and shape the customer journey redesign. It’s an opportunity to evolve their businesses, not get squeezed by them.”

SLASHING TRANSACTION TIMES

Asked what single change could most quickly reduce the average transaction time, Williams cites one clear priority: upfront information.

“Pilots in the industry have already shown what’s possible,” he says, referencing a trial run by LMS and Connells that used reusable ID and upfront data to reduce cancellations and shorten transaction times.

“The next step is doing that at scale and bringing in other parts of the process, such as lenders. That’s starting to happen.”

CLIENT READY

Williams can usually tell when a lender is serious about transformation.

“It’s usually them coming to us,” he says. “They know what they want to achieve – shorter transaction times, better customer experience, reduced cancellations, and margin growth. Those are the indicators they’re ready.”

The more advanced organisations, he says, are already embedding HDI – horizontal digital integration – into their long-term strategies.

“They’re thinking 18 to 48 months ahead, laying the foundations to continue the trajectory of transformation that’s now upon us.”

THE NEW BATTLEGROUND

For Williams, transformation is an ongoing process, not a finish line.

“Standing still is tantamount to extinction,” he says. “Right now we’re in the early phases of HDI adoption but that will unlock new opportunities and growth.”

He predicts the next major frontier will be “the new battleground”: the period after a mortgage offer is issued.

“That’s where lenders can differentiate – improving in-life experiences, developing new products, and using technology to retain customers.”

Artificial intelligence will also play a growing role. “We’ll start to see it in the next 18 to 24 months,” Williams says. “The technology already exists. We don’t have a technology problem – we have a configuration problem.”

THE CONFIGURATION PROBLEM

By configuration, Williams means the way each event in the homebuying process is triggered and connected.

“The technology already exists to enable a full end-to-end digital homebuying experience,” he says. “What isn’t embedded yet is how those events trigger and at what points. That’s the customer journey redesign.”

Getting that right, he argues, will allow the sector to move from change to transformation.

“Once organisations configure correctly, they’re no longer just building a better version of the past. They’re fundamentally redesigning how they operate.”

DOT-COM BUST

Williams’s views are informed by long experience across multiple technology cycles. Having started his career during the dot-com boom, he witnessed first-hand how industries evolved through web, mobile and now AI revolutions.

“I’ve seen businesses go from 60 to 600 people in 18 months, scale to IPO and then face the reality of reconfiguration,” he says. “What that taught me is to be agile – to build resilience and leverage technology to deliver better customer experiences.”

Those lessons underpin his conviction that the property market is now ready.

“Every industry transforms eventually,” he says. “The key is knowing when the digital maturity and frameworks are in place. That’s where we are now.”

THE AI BUBBLE

Williams also sees echoes of past cycles in today’s AI investment boom. “The market is overinflated,” he says. “We’ll probably see a correction – but a correction doesn’t mean the technology’s gone. The capabilities still exist.”

For him, the coming adjustment will be healthy.

“It will strip away the hype and make adoption more focused. We saw the same with mobile – everyone rushed to build apps, most of which failed. What remains is the real value.”

LEADERSHIP LEGACY

Asked what legacy he hopes Novus Strategy will leave, Williams is clear: “That we helped organisations truly transform how property is bought and sold in the UK. That we helped steer the industry toward HDI and the connected ecosystem it needs.”

Outside work, Williams recharges through family, travel and aviation – a lifelong passion that led him to earn a pilot’s licence.

“Aviation is interesting because you can translate a lot from it into business,” he says. “In aviation, pilots configure the flight, but humans stay in the loop. It’s all about collaboration and communication – the same principles that underpin transformation.”

He compares aviation’s crew resource management – the discipline of teams working together in complex environments – to the property sector’s challenge.

“Most aviation disasters happen because people didn’t collaborate or configure systems correctly,” he says. “This industry is no different. Transformation won’t happen without people working together toward a common outcome.”

This industry has many doubters and for some the Novus Strategy vision might appear to be a plane crash waiting to happen.

But for Williams, the outcome is clear: a property market that’s faster, fairer and fully connected – an ecosystem configured for the 21st century.