A new report has revealed a stark and growing gap between people’s expectations around caring responsibilities and the financial reality they face later in life, with unpaid carers emerging as one of the most financially vulnerable groups in the UK.

According to research from Phoenix Insights, the longevity think tank of Phoenix Group, only 27% of people believe they will have caring responsibilities by the time they reach the state pension age of 67. In reality, half of all people will become carers by the age of 50. This disconnect may be leading many to underprepare for the long-term economic implications of stepping away from paid work to care for others.

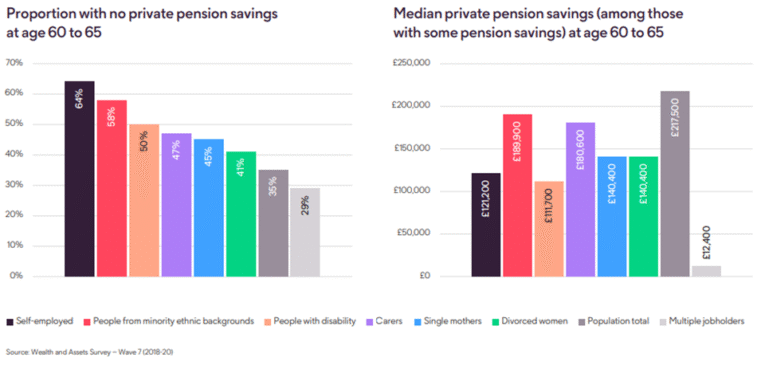

The impact on private pension wealth is particularly acute. The report shows that nearly half (47%) of people who are carers have no private pension savings at all by the time they reach the age of 60 to 65. Even among those who do have pension provision, carers have on average 17% less in private pension savings than the national median – a shortfall of almost £37,000.

Patrick Thomson, head of research analysis and policy at Phoenix Insights, said the findings should raise alarm among policymakers and employers alike. “Over the last 30 years we’ve seen major changes in the labour market, with higher overall employment rates, particularly for women,” he said. “Despite this there are still large number of people economically inactive who are not in work for caring, health or other reasons – hampering their ability to save for their retirement.”

He warned that an ageing population and rising demand for unpaid care risk compounding the problem. “A rapidly growing number are, often unexpectedly and earlier than they anticipated, caring for loved ones across multiple generations,” he said. “This can put them at particular risk of falling out of paid work and becoming financially vulnerable in later life.”

The report follows earlier research by Phoenix showing that 45% of unpaid carers struggle to meet even their day-to-day living costs, driven largely by their exclusion from the workforce.

BARRIER TO LONG-TERM PLANNING

In addition to financial pressures, uncertainty about the future may also be discouraging long-term planning. Phoenix Insights found that while 44% of people felt able to imagine their lives over the next five years, only 31% said the same about the next 15 years.

Sara Thompson, chief people officer at Phoenix Group, said employers must play a greater role in helping carers remain in the workforce. “People shouldn’t have to choose between caring for a loved one or going to work,” she said. “But many have to do so, with an estimated 2.6 million people leaving the workplace to care for a relative or loved one – which is having a negative impact on their ability to save for their private pension.”

She urged businesses to consider measures such as flexible working and paid carers leave. “It’s important for businesses to retain valuable employees and do what they can to support colleagues with caring responsibilities to stay in work for as long as they need or want to,” she said. “Giving workers the ability to care for a loved one but not at the expense of their own financial futures.”

The findings come as the state pension age is set to rise to 67 in April next year, intensifying pressure on people to remain economically active for longer despite growing caring responsibilities.