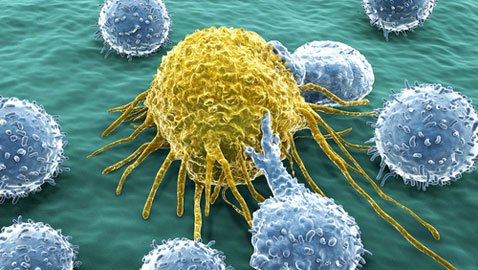

Bright Grey has made changes to its critical illness cover across both business and personal menu plans, by adding three new additional conditions relating to the early detection of cancer.

It has also extended the definition of major organ transplant to ABI+.

Bright Grey’s critical illness menu products now provide cover for 48 illness definitions, with 41 paying the full amount of cover and seven paying out a smaller lump sum in addition to the full cover. 12 definitions are classed as ABI+ by exceeding the ABI’s standard definitions.

The three new additional conditions which pay 20% of the sum assured, over and above the original sum assured, up to a maximum of £15,000 are:

· Carcinoma in situ of the oesophagus – treated surgically by removal of all or part of the oesophagus

· Carcinoma in situ of the testicle – treated surgically by complete removal of the testicle

· Carcinoma in situ of the urinary bladder – definite diagnosis supported by histological evidence

The major organ transplant definition has been extended to provide cover for the transplant of the whole lobe of the lung or liver.

Jennifer Gilchrist, senior product development manager, Bright Grey, said: “Cancer is a word that none of us want to hear but it is by far the biggest critical illness risk people face. Fortunately with diagnosis and treatment now taking place much earlier and often before the cancer becomes severe, more and more people are surviving the disease. This is why it is important to ensure the critical illness policy recommended to clients pays out, not only for more advanced stages, but for early forms of cancer too.

“Successful claims for additional covered conditions have the added value of not reducing the original amount of the critical illness covered. Therefore, introducing three more additional early stage cancer conditions will give customers greater protection.

“We also recognise that while a financial payout is essential to help people to continue to have some financial security, anyone diagnosed and being treated for cancer faces difficulties that money alone can’t overcome. That is why we include our Helping Hand service, providing practical and emotional support, with all menu protection plans.”