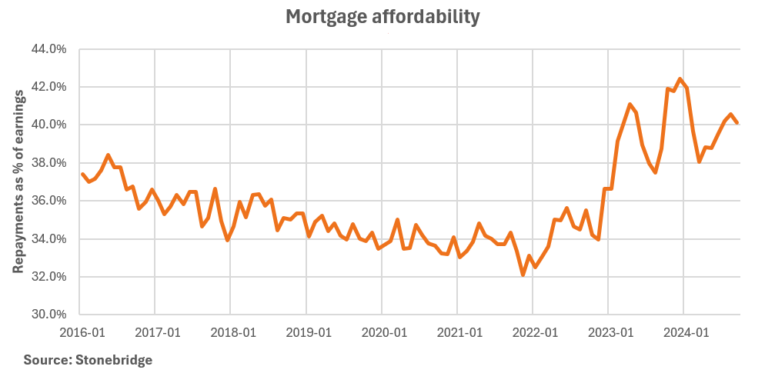

Borrowers are spending over two-fifths of their salary on mortgage repayments, according to new data from Stonebridge.

The network’s first Mortgage Affordability Index reveals that mortgage payments accounted for 40.1% of the average borrower’s salary in September, the third month in a row this figure exceeded 40%.

It means the proportion of borrowers’ income taken up by mortgage payments is currently near its highest level in a year, due largely to a combination of rising house prices and higher borrowing costs.

MIXED FORTUNES

While affordability did improve slightly in September (from 40.6% in August), mortgage repayments continue to take up a far larger proportion of borrowers’ salaries than they have done historically.

For example, in November 2021, the month before the Bank of England (BoE) started hiking rates, mortgage payments accounted for just 32.1% of the average borrower’s salary – 8.5 percentage points less than today. The long-running average is 35.9%

CANCELLING OUT

Stonebridge’s Mortgage Affordability Index found that rising house prices were effectively cancelling out any benefits gained from the gradual reduction in mortgage rates witnessed over the past few months.

The average rate on newly drawn mortgages fell from 4.86% to 4.78% between August and September, according to the Bank of England. However, Stonebridge’s internal data shows the average loan size rose to a 27-month high of £198,383 the same month – due to rising house prices – resulting in only a marginal affordability boost for borrowers.

“it’s clear from the data that most borrowers are yet to see the benefits from reduced borrowing costs”

Stonebridge’s Mortgage Affordability Index marries official wage and mortgage rate statistics with its own loan data to determine the relative affordability of mortgage finance in proportion to earnings.

Rob Clifford, chief executive at Stonebridge, said: “While the Bank of England has started to cut interest rates again, it’s clear from the data that most borrowers are yet to see the benefits from reduced borrowing costs.

“With house prices still rising and mortgage rates elevated, homeowners are now spending more than two-fifths of their salary on mortgage payments – well above the historical average. This highlights that the cost-of-living squeeze is far from over for millions of households.

“With more than 1.8 million fixed rates due to end in 2025, now is the time for brokers to re-engage with their clients”

“The good news is that we’re likely past the worst, with the Bank of England likely to continue cutting interest rates throughout 2025. As we go into 2025, we expect that to filter through to borrowers in the form of lower mortgage rates, which will provide relief for millions of households.

“With more than 1.8 million fixed rates due to end in 2025, now is the time for brokers to re-engage with their clients, many of whom will be concerned about how much they are going to have to pay going forward. If anything, this is a perfect opportunity for brokers to remind borrowers of the importance of good quality, independent advice.”